| [ | Summary: Bullion Direct filed for bankruptcy in July 2015, not having $30M of customers' metal and cash | ] |

| [ | Upcoming Dates: n/a | ] |

| [ | Also see: forums, mailing list (below), anonymous tips, documents, Bullion Dealer Data | ] |

| [ | Contact:

| ] |

Sentence Reduction Explanation

May 17, 2024 7:30AM ESTSpecial thanks go to someone who contacted victim services.

The First Step Act of 2018 has a "Time Credits" provision (18 USC 3632 (d)(4)), that allows most prisoners to earn 10-15 days of credit per month in prison.

The media and government portrayals of the law are unfortunately vague. From the best I can tell, there is no maximum credit that can be earned... but the sentence can be reduced by a maximum of 1 year (with any extra credit letting the person transition to an RRC (halfway house) sooner).

So from the best I can tell, Charles' sentence will end in November, 2028. However, he may transition to a halfway house (or home confinement) earlier than that (perhaps sometime in 2026).

More Sentence Reductions

May 16, 2023 8:00AM ESTTABLE UPDATED May 17, 2023 7:20AM EST

Again, in both the Bullion Direct and NWTM cases, there have been sentence reductions, applied to all 3 felons at the same time.

From my understanding, once the judge sets the prison sentence, and the Bureau of Prisons is expected to keep the prisoner detained according to federal law (with no exceptions). With federal prison sentences, there is no parole, but offenders get about 15% "good conduct time" reduced from their sentence (unless forfeited). It's up to 54 days per year of the sentence. However, that does not explain what is going on here; for example, Charles McAllister had a 10 year prison sentence, but it now expected to be released after about 7 years and 7 months. The "good conduct time" of 54 days per year of the sentence works out to about 8.5 years. There is nothing in the court records explaining this, and with it happening with 2 unrelated cases, it is clearly widespread... but I cannot find anything online explaining this.

The Bureau of Prisons states that the release date "reflects the inmate's projected release date based on BOP calculations", which implies that it factors in good time. But that would mean that it should not change.

I've added a chart showing the changes, which are always in multiples of 5 days.

| Date | Charles McAllister | Ross Hansen | Diane Edrmann |

|---|---|---|---|

| 15 May 2021 | In prison (10 year sentenece) | --- | --- |

| 18 May 2021 | 18 Nov 2029 | --- | --- |

| 10 May 2022 | 18 Nov 2029 | In prison (11 years) | In prison (5 years) |

| 18 Jul 2022 | 18 Nov 2029 | 22 Sep 2031 | --- |

| 25 Oct 2022 | 20 Aug 2029 (-90) | 02 Sep 2031 (-20) | 11 Aug 2026 |

| 20 Feb 2023 | 22 Apr 2029 (-120) | 14 Jul 2031 (-50) | 02 Jul 2026 (-40) |

| 31 Mar 2023 | 22 Jan 2029 (-90) | 24 Jun 2031 (-20) | 22 Jun 2026 (-10) |

| 09 May 2023 | 23 Dec 2028 (-30) | 09 Jun 2031 (-15) | 28 May 2026 (-25) |

| 07 Jul 2023 | 08 Dec 2028 (-15) | 10 May 2031 (-30) | 13 May 2026 (-15) |

| 17 May 2024 | 18 Nov 2028 (-20) | 26 Dec 2030 (-135) | 29 Nov 2025 (-165) |

More Massive Sentence Reductions

March 31, 2023 2:45PM ESTThe Bureau of Prisons is now showing Charles McAllister's release date as January 22, 2029 (about 3 months earlier than the last change).

Although the Department of Justice has alerted victims of this, no explanation was given. This is the third time in about 6 months that multiple felons have received sentence reductions in unrelated cases at about the same time. I have no idea if this is a normal occurrence, fixing widespread errors, massive federal sentence reductions, or something else.

The release date can be found at https://www.bop.gov/inmateloc/ (entering "Charles McAllister" and looking for Register #00222-480).

Massive Sentence Reductions?

February 20, 2023 3:30PM ESTThe Bureau of Prisons is now showing Charles McAllister's release date as April 22, 2029 (about 4 months earlier than the last change).

Although the Department of Justice has alerted victims of this, no explanation was given. This is the second time in about 4 months that multiple felons have received sentence reductions in unrelated cases at about the same time. I have no idea if this is a normal occurrence, fixing widespread errors, massive federal sentence reductions, or something else.

The release date can be found at https://www.bop.gov/inmateloc/ (entering "Charles McAllister" and looking for Register #00222-480).

Release Date Changed to August 20, 2029

October 25, 2022 12:50PM ESTFor reasons unknown, the release date for Charles McAllister has changed from November 18, 2029 to August 20, 2029, according to information the Department of Justice has sent to victims.

This is about 3 months less than his original sentence.

Victims of Northwest Territorial Mint's bankruptcy (NWTM) received a similar letter about a week earlier, saying that the expected release date for owner Ross Hansen was moved up by several weeks. So there may be some re-calculation going on or something.

There is no real news regarding Charles' appeal. Appeals in cases like this are common, but rarely change anything.

Charles Requested Sentence to be Vacated

April 21, 2022 1:45PM ESTLast month, Charles McAllister filed a motion to vacate his sentence, arguing ineffective counsel.

Among other things, he alleges that several of his employees may have stolen from the company, and that the government's estimate of $16M of misappropriated funds was flawed.

These were filed on March 9, 2022, with no filings since, suggesting this is not being treated by the court as an urgent issue.

One thing that I find interesting is his determination to get the $16M value of misappropriated funds reduced, while at the same time blaming the loss on others. Lowering the value of the loss would have no benefit to Charles McAllister if he was not indeed responsible for the losses.

He also points to a "celebrity net worth" website that in 2012 estimated a former manager's net worth at $15M (which Charles referred to as "newfound wealth"), which being so close to the government's $16M figure, I assume is supposed to imply that he stole all the money.

He also does not attempt to explain how one or two employees could have stolen $15M from the company in 2012 without being detected (or, if it was detected, why he didn't speak up until now -- I'm assuming he hasn't filed a police report).

Charles Expected to be Released 11/18/2029

May 18, 2021 10:15AM ESTThe Bureau of Prisons is showing Charles McAllister's expected release date as 11/18/2029.

This is in line with the expectations, as federal prison sentences are not subject to parole, but prisoners are usually awarded days off for "good behavior", that works out to approximately 15% of the original sentence (the actual calculation is a bit convoluted). In other words, the 8.5 years is expected.

Charles in Prison

May 15, 2021 8:40AM ESTAccording to the Bureau of Prisons, Charles McAllister self-reported yesterday by 3PM EST to Montgomery FPC.

He may try filing the second appeal he told the judge he was planning, but he is now in prison.

Charles Now Due in Prison May 14, 2021 at 3PM EST

April 15, 2021 2:25PM ESTAbout 45 minutes before Charles McAllister was scheduled to report to prison today, he received a partial "Hail Mary" -- Judge Yeakel ordered McAllister to remain released on bail for 1 month.

My guess is that this was designed by the judge to allow McAllister time to finish preparing and to file his appeal, at which point Judge Yeakel would consider the merits of the appeal.

Charles Due in Prison Today at 3PM EST - Hoping for Hail Mary

April 15, 2021 11:45AM ESTYesteday evening, Charles McAllister received notice that he is to report to the Montgomery FPC federal prison today at 2:00PM CDT (3PM EST). He has filed an emergency motion requesting that he continue to be released on bail pending appeal.

Specifically, he has thrown his attorney under the bus, claiming that his attorney provided "such poor representation as to amount in ineffective assistance of counsel." McAllister is planning to file another appeal, pro se (without an attorney).

To me, this appears to be a last "hail mary" attempt to stay out of prison, from someone who was convicted of fraud but believed in hindsight that he was just a poor businessman, and is still deluded as to what has and will happen.

From what I understand, if in the next 3 hours and 15 minutes he is neither in prison nor granted an emergency order, he will be considered an escaped convict. Needless to say, I will be updating this later today!

UPDATE April 15, 2020 12:45PM EST: It appears that McAllister wrote (or had someone write) this over a year ago! He states, for example, that the BOP reports "at least 14 positive cases of COVID-19" from a site last visited March 28, 2020 (it now shows over 300 cases, with 0 active inmate cases at Montgomery FPC). On the one hand, having just hours to present an emergency order poses massive problems and errors are likely; on the other hand, a big part of his argument is based on very old information (which he could have updated over the past few months, knowing he would be getting this notice).

UPDATE April 15, 2020 1:05PM EST: Charles McAllister now appears on Judge Yeakel's calendar for today at 12:00PM (1:00PM EST), as a telephone conference. This will be 2 hours before McAllister is due in prison.

Charles McAllister's Appeal Fails

February 4, 2021 2:35PM ESTCharles McAllister's appeal of the judgment against him failed, with the appeals court affirming the decision of the district court.

This should mean that he will be going to prison very soon, as his release on bond was "pending appeal", and the appeal has been decided.

Charles McAllister Files for Bankruptcy

July 23, 2020 1:20PM ESTLast month, Charles McAllister and his wife filed for Chapter 7 bankruptcy (see the voluntary petition). It looks like they owe over $100,000 in credit card debt (as well as some other debts). And the elephant in the room: $16M of restitution from the criminal lawsuit. Interestingly, it shows that they owe state income tax from 2016-2019.

Creditors in the Bullion Direct case will likely not have any way to be (or benefit from being) a creditor in this personal bankruptcy (as it is Bullion Direct that owed you money, not Charles himself). From my understanding, the law does not discharge restitution debts in Chapter 7 bankrupty, meaning that Charles will still owe $16M in restitution. In other words, if in the future Charles is able to pay some of the restitution, you would still be able to get it, regardless of this bankruptcy.

What this says to me is that unfortunately (but not surprisingly) Charles used up any money that he did end up receiving from Bullion Direct (e.g. the large salary and severance pay).

McAllister Not in Prison

July 16, 2020 3:15PM ESTSeveral days before McAllister was required to report to prison, the judge allowed him to delay the beginning of his prison sentence until after his appeal is processed. If he succeeds with his appeal, he will presumably not spend a single day in prison.

However, if he is not successful with his appeal, his prison sentence should remain the same (just delayed).

I am hoping to get more information on the appeal, and when a decision may be made, but I do not know at this time.

McAllister to Report to Prison July 1, 2020

April 2, 2020 1:10PM ESTDue to the way the court system works, the date Charles McAllister was supposed to report to prison was not in the public record. Many people have wondered when he will report to prison.

This information came out today, as the government requested that the unknown date be extended to July 1, 2020 (since they received a letter from the Bureau of Prisons requesting the delay, due to "the ongoing coronavirus situation"). The judge filed an order that McAllister report to the Bureau of Prisons no later than July 1, 2020.

10 Years in Prison

February 13, 2020 8:35PM ESTCharles McAllister was sentenced today to 10 years in prison.

UPDATE February 29, 2020 9:40AM EST: Charles McAllister has been assigned federal inmate #00222-480. As of today, he is not yet in custody of the Bureau of Prisons (which likely means he will be voluntarily surrendering).

.

Sentencing Delay, Part 2

January 3, 2020 3:25PM ESTDue to a scheduling conflict with a potential government witness, the sentencing hearing has been continued to February 13, 2020 at 2:00PM.

Sentencing Delay

December 16, 2019 6:55PM ESTCharles McAllister requested a delay in the sentencing hearing to January or February, 2020. The goverment did not object, so the judge allowed the delay.

The sentencing hearing will now be on February 6, 2020 at 2:00PM.

Pre-Sentencing Notes

December 6, 2019 9:05AM ESTThe government has filed its pre-sentencing report ("PSR"), which is sealed (so we cannot view it). Charles McAllister, however, has filed objections to it, which provide some insight as to what is in there. The PSR is essentially a "blueprint" for how the government would like to see Charles sentenced; the judge makes the ultimate decision based on sentencing guidelines and weighing in factors from both sides.

The main takeaway is that Charles is trying to claim a loss of only $4.7M, not the $16.1M the government claims (or the $24M+ listed in the bankruptcy creditor list). Both the government and Charles calculate based on the amount of money received and the expected amount of profit, rather than the amount customers actually lost.

Charles also mentions that the PSR included information about at least 11 victims, 7 of whom ended up with a severe financial hardship as a result of the losses. He objects to this because of a lack of information.

Charles also objects to the fact that the PSR claims that the scheme used "sophisticated means"; from my limited understanding of the legal term, that makes sense. Bullion Direct appears to have been, if it not for the losses, a legitimate business (albeit with a "wild west" attitude, such as trying to buy a $16M gold mine in 2011, with massive losses already on the books).

If the judge were to accept the changes, the guidelines would recommend an offense level of 27 points, which would result in a 70-80 month sentence. The objection isn't clear, but it appears that the PSR suggested 35 points (35 points translates in this case to a recommended 168-210 month sentence). As a reminder, the level/points in the guidelines are just that: guidelines. In about 2 weeks (December 19) we should find out the official sentence.

Freedom Denied

October 30, 2019 12:15PM ESTJudge Yeakel denied McAllister's request for an acquittal and new trial.

With that out of the way, we are now awaiting sentencing on December 19, 2019.

McAllister Wants Freedom

October 21, 2019 9:30AM ESTCharles McAllister filed 2 documents with the court on Friday, hoping to change the results of the trial.

In the first, he moves for an acquittal, arguing that the government did not prove specific intent, based on McAllister's belief that he was honoring the contract with customers.

In the second, he makes a motion for a new trial, because the government stated that McAllister could have, but did not, call on Bullion Direct's corporate counsel to testify. That, according to the filing, may have led jurors to believe that McAllister had the duty to prove his innocence (rather than the government proving his guilt).

GUILTY

October 4, 2019 9:40PM ESTCharles McAllister today was convicted on 2 counts of wire fraud and 1 count of engaging in a monetary transaction with criminally derived property. Thanks to KVUE for breaking the news.

Sentencing is scheduled for December 19, 2019. It looks like the maximum possible sentence would be 50 years in prison.

UPDATE October 7, 2019 12:25PM EST: I now have the jury's special verdict form showing that McAllister is guilty, and the instructions they were given.

TRIAL: Day 1 Summary

October 1, 2019 8:15AM ESTYesterday was the first day of the criminal trial of Charles McAllister.

I have heard from one source that Charles is arguing that the government can't prove there were 6,000 victims who lost $16M-$25M because they didn't interview everyone. He is also arguing that a "use" clause that he added to the terms of service ("BullionDirect may use such [stored] Products") clears him of any wrongdoing (I'm not clear how this would work, since an attorney reportedly advised against that, it doesn't address issues before 2012, doesn't address customer orders (as opposed to stored), and doesn't address IRA accounts).

An article in the Austin American-Statesman says that Charles' attorney chalked up the losses to "bad business decisions and bad business judgment", but not criminal behavior. The article also states that a federal agent subpoenaed Charles' email account, and found the folders for all email empty.

I will update as I hear more throughout the trial.

Trial Underway

September 30, 2019 8:40AM ESTThe trial in the criminal case against Charles McAllister begins at 9:00AM CDT.

It is expected to last about 2 weeks, with 200 exhibits (some reserved), and 23 witnesses (including 5 customers and about 8 former employees; 5 of the witnesses are on my list of people who "knew or should have known" about the fraud over 5 years ago).

If anyone has any information on what goes on at the trial, please let me know (see "Contact:" above, or go to the anonymous tips page).

Unexpected Hearing Today

September 9, 2019 6:15PM ESTToday, the court docket showed an entry: "Minute Entry for proceedings held before Judge Lee Yeakel:Telephone Conference as to Charles McAllister held on 9/9/2019".

I was not expecting a hearing today, and double-checked, and do not see any reference to a hearing today. The trial is not scheduled to start on September 30, 2019. No further information was given, and the minute entry documents have their access restricted, preventing me from finding out what was discussed (and whether this was a normal pre-trial hearing, or something more important like discussing a plea agreement).

UPDATE September 10, 2019 7:10PM EST: A filing today shows this was benign: a likely Government witness is married to a member of the court's staff. This will not cause any issues.

Trial Update

August 26, 2019 12:25PM ESTThere have been a flurry of court filings in preparation for the upcoming trial starting on September 30, 2019 at 9:00AM.

This has included things like the government filung proposed jury instructions, as well as suggested questions to ask jury members.

Bankruptcy Officially Closed

August 3, 2019 12:40PM ESTThe judge has signed an order with a final decree, stating that the bankruptcy case is closed.

Chapter 11 to Close

July 3, 2019 9:35PM ESTThe Trustee has filed a motion with the court to close out the Chapter 11 bankruptcy, as nearly all the funds were distributed, and there are no other assets left. The remaining funds would be use to pay remaining expenses (e.g. U.S. Trustee fees).

Trial Delayed Until September 30

May 8, 2019 9:00AM ESTJudge Yeakel allowed the trial to be delayed. It is now scheduled to start September 30, 2019 at 9:00AM. If a plea agreement is made, it will need to be on or before August 6, 2019.

McAllister Trial May be Delayed

March 5, 2019 2:45PM ESTCharles McAllister is requesting a 60+ day delay for the trial, mainly due to the amount of time it will take to review documents. The prosecution is OK with the delay, so I imagine it will likely be approved.

Bullion Direct Checks Bouncing

February 9, 2019 11:15AM ESTI have heard from two people now that the checks Bullion Direct were rejected by their bank.

I am guessing that the checks have the incorrect routing number or account number.

It may be worth waiting to deposit the check until this has been cleared up.

Bullion Direct Distribution and Taxes

February 4, 2019 12:55PM ESTI've had a few people asking me about taxes. I do not have legal or tax training, but have researched this a fair bit.

I originally put up a page about how to take a tax loss. I have gone ahead and added a section "2019 Update" with further details (the rest of the page is unchanged).

It outlines 5 different scenarios, depending on whether you already took the loss, and if so, whether it was taken as a theft loss or capital loss.

Checks Arriving

February 3, 2019 11:15AM ESTA number of people have reported that they have received checks from Bullion Direct.

It looks like the checks are for about 2.75% of what creditors are owed (so if you are owed $1,000, you would get a check for about $27.50). The reason for this is that Bullion Direct owed creditors around $30M, but only had assets of roughly $1M. Without having any other money, there was no way for them to provide a larger distribution.

Checks (To Be) Sent

January 25, 2019 8:30AM ESTYesterday, the Trustee filed the latest post-confirmation report.

It shows that Bullion Direct sent a check for $633,437.93 to North American Credit Services, which is presumably the company that will or has handled sending out payments to creditors. The report further states that "Final Distribtion to be made in January, 2019". Once the checks have been deposited, or enough time passes by that the money gets sent to the court, they plan to close the case. I have not heard from anyone who has received a check yet, but people should be receiving them soon.

As a reminder, the latest status on the Charles McAllister criminal case is that the jury selection and trial is scheduled for May 13, 2019 at 9:00AM.

Equity Trust Letter

January 25, 2019 8:25AM ESTI heard yesterday that Equity Trust, the company that handled the Bullion Direct IRAs, has sent out a letter to some of their customers.

The letter discusses arbitration. It informs customers that they have the option of opting out of arbitration by March 31, 2019; otherwise, they will be bound by arbitration. "Bound by arbitration" means that if you want to sue them, you have to instead go to an arbitrator (the American Arbitration Association), who gets to decide without the failsafe of the appeal process in the legal system. Arbitration tends to be cheaper, but with more concerns of bias.

For Bullion Direct customers, this likely is not going to matter much: I can only see it being an issue if you wanted to sue Equity Trust, or join a class action lawsuit against Equity Trust (I am not aware of any regarding Bullion Direct, and it may well be too late to do so). However, if someone were to file a class action lawsuit against Equity Trust, you would not be able to particpate unless you opt out. Therefore, if it were me (remember, I do not have legal training), I would opt out.

Distribution Approved

December 14, 2018 7:55AM ESTYesterday, Judge Tony Davis signed an order approving the distribution of remaining funds, estimated to be 2.5-3.5 cents for every dollar owed. So if you are listed as having a General Unsecured Claim of $1,000, you could expect a check for $25-$35.

While that amount is very small, it is at least better than the Tulving Company or the Northwest Territorial Mint bankruptcies (where creditors either will get or are expected to get nothing).

Motion for a Small Distribution

November 9, 2018 1:10PM ESTThe Trustee has filed a motion to distribute about $700K to Bullion Direct creditors.

The motion states that the Trustee expects that creditors will receive about 2.5% to 3.5% of what they are owed.

Criminal Case Status

September 20, 2018 1:00PM ESTI have had a few people asking about the criminal case against Charles McAllister, who faces up to 50 years in prison if found guilty of the 3 felonly counts of fraud from the indictment.

The latest status is that the jury selection and trial is scheduled for May 13, 2019 at 9:00AM. Any plea bargain or plea agreement needs to be entered by April 26, 2019. These dates were extended due to a request by McAllister, due to the volume of documents.

'Proposed Amounts'

September 6, 2018 3:40PM ESTCreditors whose claims are being objected to should have received a letter from the Trustee.

Please note that it may state "Proposed Allowed Claim Amount." Note that this is the proposed amount of your claim, not the amount that you will actually receive from the bankruptcy estate. Right now, there is only about $700,000 of cash in the bankruptcy estate, and $24M of claims, or about $.03 for every dollar owed.

Objection to Claims

September 6, 2018 3:20PM ESTThe Trustee has filed an omnibus objection to claims (this was in July; sorry, I've fallen behind!).

This is being done to make sure claims are equal. For example, if one person valued their silver at $15/oz and another valued theirs at $16/oz, it wouldn't be fair. Some people reported that their claims were secured or priority claims (it wouldn't be fair for one creditor to be paid while another similarly situation creditors didn't get anything). It also handles duplicate claims, and claims that were filed after the deadline. Finally, it handles claims where no dollar amount was listed ("unliquidated" claims).

For the most part, these seem fair, and get all creditors on even footing. However, for people who filed late or did not list a dollar amount, it could be a problem (in other words, your claim could be denied if you take no action).

CFTC Complaint Filed

July 24, 2018 8:20PM ESTI just found out today that the CFTC quietly filed a civil complaint against Charles McAllister on April 26, 2018.

The case is a typical CFTC case against bullion dealers, basically requesting an injunction banning McAllister from doing various commodity transactions in the future, and repayment of the amount owed customers (which would likely be impossible, given the amount customers are owed) and a penalty.

A default judgment was issued (as McAllister did not respond within the timeframe required), but was reversed, as the non-response was due to a miscommunication between attorneys.

Case to be Closed, ~2% Payout

July 18, 2018 5:45PM ESTThe Trustee filed the latest quarterly post-confirmation report.

In it, he says "The Liquidating Trustee is currently reviewing and objecting to claims in preparation for making a final distribution to all allowed creditors, then closing the case."

So it sounds like he is expecting to close the case fairly soon, paying roughly 2% of what creditors are owed ($700K of cash is in the bank, versus an expected $33M customers are owed).

What is not discussed is what Charles' Mom did with Bullion Universe. It appears to have crashed and burned, with no evidence of a single sale. Perhaps when Charles' Mom realized her son is facing prison time, she couldn't quite focus on being a bullion dealer. I wonder if she will be required to prove that she spent the $100K that she promised the court she would to start the business?

Some Claims to be Disputed

July 18, 2018 5:10PM ESTThe Trustee of the BullionDirect Litigation Trust, Gregory S. Milligan, has filed a motion to dispute various claims.

From what I can tell, these disputes are legitimate: for example, duplicate claims, claims in the wrong amount (e.g. someone basing a claim on the spot price on some date other than the one that Bullion Direct is using), secured claims (which only applies when there are assets that the claim is secured by, which does not apply here). The only controversial dispute I see is that the Trustee is taking the position that 507(a)(7) priority does not apply (claims arising from the deposit, before the commencement of the case, of money in connection with the purchase, lease, or rental of property, or the purchase of services, for the personal, family, or household use of such individuals, that were not delivered or provided. ).

The "deposit" priority, if allowed, would essentially allow all the people who filed a Proof of Claim that way to get money (up to a certain dollar amount, such as $2,850) before any other creditors. If disallowed, everyone gets treated the same (paid a percentage of what they are owed). If allowed for everyone (an option that would likely require a motion from a creditor to allow), everyone would get up to that certain dollar amount before anyone got paid beyond that (which would benefit people with small claims, some of whom might get paid 100% of what they are owed, at the expense of creditors who are owed more money).

If your claim is being disputed, you should get a letter about it in the mail.

Trial Date Set for September 10, 2018

March 20, 2018 7:50AM ESTJudge Yeakel has set a date of August 27, 2018 9:00AM for the Docket Call, and Jury Selection / Trial are set for September 10, 2018 at 9:00AM.

McAllister Allowed to Bullion Universe Town

March 1, 2018 4:10PM ESTToday, Judge Andrew W. Austin signed an order allowing McAllister's request to travel to The Woodlands, TX (and Houston, TX) for purposes of meeting with his Houston based attorney.

As I previously reported, the law firm that McAllister's attorney works for has a law office in The Woodlands, which is just about next door to the building that Charles McAllister's mother (who bought the Bullion Direct assets and is running them as Bullion Universe) works. The mailing address for Bullion Universe is farther away in The Woodlands, TX.

More on Restrictions

February 22, 2018 9:15AM ESTCharles McAllister filed a motion yesterday to change the restrictions imposed on him for travelling.

It clarified that it is indeed Alabama, not Texas, that he is restricted to (which the court documents had neglected to specify). He also wants to change "Lee County, AL and surrounding counties" to "Middle District Alabama". This would allow him to travel to 23 different counties, as opposed to the current 5 (or perhaps a few more if travel into Georgia is allowed). He is also requesting clarification that he is also allowed to travel to Houston, TX and apparently The Woodlands, TX "for the purpose of meeting with his counsel."

The motion is unopposed, mainly because the Judge had stated at a hearing that Charles McAllister could travel to Houston, TX for purposes of meeting with his counsel (but it did not get reflected on the written order).

The catch is that while his attorney has an office in Houston (at 811 Main Street, per the law firm's website), McAllister states that his attorney also has an office in The Woodlands, TX, about 30 miles from Houston, and McAllister wishes to go "to the Houston area (Harris and Montgomery Counties) for the purpose of meeting with his counsel", which would of course allow him to go to The Woodlands to meet with his attorney at a different office. That would be fine, except Bullion Universe -- the company that can't seem to start up, that was based on the remains of Bullion Direct -- is located in The Woodlands. And Charles' mother, who started that company, works as a lawyer 2 blocks away from the law firm's The Woodlands office. And she lives in The Woodlands. And the CFTC believed that as of May, 2016, Charles was living in The Woodlands.

A Few Clarifications

February 5, 2018 8:40AM ESTA reader mentioned to me that Lee County (where Charles is restricted to) refers to Lee County, AL rather than Lee County, TX. This helps clear things up: Lee County, TX is very, very small. However, the documents are vague: the conditions of release do not mention a state, which one usually infers to mean the only state mentioned in the documents (Texas). Also, the last official report of Charles' location was that he was living with or very close to his mother in Texas (from the CFTC's documents). But Lee County, AL is where Auburn, AL is located, which is where Charles originally went after shutting down Bullion Direct. Also, the conditions of release part 7 secion d does not have the box checked for "surrender any passport to:" -- but it does list "PRETRIAL SERVICES" there, making it unclear if he was required to turn in his passport.

Hearing March 1, 2018 - Trial March 18, 2018

January 31, 2018 7:00AM ESTYesterday, U.S. District Judge Lee Yeakel filed an order, which sets a March 1, 2018 9:00AM "Hearing on all Pending Pretrial Motions and Docket Call." He also stated that the case is set March 12, 2018 9:00AM for "Jury Selection and Trial."

Investigation Report

January 28, 2018 1:05PM ESTOn January 26, the Trustee filed an Investigation Report discussing the results of the investigation that the estate of Bullion Direct conducted.

There is not a lot of new information, except:

"BullionDirect was advised in 2012 by legal counsel against continuing to use customer metals under a use clause in non-IRA customer agreements without adequate disclosure to customers. BullionDirect ignored this advice, and instead threatened legal action against insiders who favored such disclosure, and who resigned in 2012 after learning that BullionDirect would not follow this advice. BullionDirect ultimately did not disclose its true financial status to customers in 2012, and instead continued using customer metals to fund operations, including paying McAllister and other insiders."

and:

"As for lawyers, BullionDirect appeared to employ a rotating cast of law firms, and it appears that each separate firm was only provided limited information about BullionDirect. For example, the law firm that provided legal advice against the use of customer metals apparently did not know the extent to which BullionDirect s operations were in fact funded by those metals, and a different law firm that may have had a fuller picture of BullionDirect s overall financial situation did not advise BullionDirect on its customer-facing operations, and also ceased performing services for BullionDirect after becoming aware of its overall financial services."

Charles McAllister Indicted

January 24, 2018 3:20PM ESTUPDATED January 28, 2018 12:05PM EST

Bullion Direct owner Charles (Chad) McAllister was arrested on Tuesday January 23, 2018, indicted with 2 counts of wire fraud and 1 count of money laundering, facing 50 years in prison. He pleaded not guilty, and was released on bail. The conditions of release require him not to leave Lee County, TX or surrounding counties (except to travel to Austin, TX for court purposes). The Government is also seeking forfeiture of up to $16,186,212.56.

I imagine most of my readers have a very clear picture in their mind of whether Chad is guilty or not. The indictment, however, does not mean that he is guilty: the Justice Department states "It is important to note that an indictment is merely a charge and should not be considered as evidence of guilt. The defendant is presumed innocent until proven guilty in a court of law."

I had planned on writing a lot about the arrest and indictment, but there just isn't much to say. The indictment and Charles McAllister's arrest warrant do not provide much in the way of details I wasn't already aware of.

The one question in my mind is where the government came up with the $16.1M figure. There are $24.2M in claims from customers, broken down into $17.2M of Regular claims and $6.8M of IRA claims. The $16.1M figure may refer to claims that date back no farther than January, 2009 (the latest date that the Government believes the "scheme" may have started).

As reference, Hannes Tulving, Jr. (owner of The Tulving Company) was charged with 1 count of wire fraud (with a maximum 20 years of jailtime). He was sentenced to 2.5 years in prison (reduced mainly for cooperation and his health). In the Tulving case, the accounting records reportedly showed assets roughly equal to liabilities (the asset valuations were heavily exaggerated, but apparently prepared without input from Hannes), whereas in Bullion Direct the accounting records showed the massive liability (e.g. at one point around 2010 showing $20M of customer obligations and only $8.3M of assets, with total equity of $-14.3M). In the Tulving case, money from customer orders was used to pay for expenses, but in the Bullion Direct case there was also the issue of metal apparently owned by customers (storage) being sold without their permission.

You can look at the official Justice Department press release, or the article from the Stateman that broke the news.

Dillon Gage to Help Platform Universe

October 26, 2017 12:35PM ESTYesterday, the Bullion Direct litigation trust filed a proposed settlement agreement with Dillon Gage. Dillon Gage had received $775K from Bullion Direct in the 90 days before its demise, which appears to have been in the normal course of business. Dillon Gage representatives "have consistently testified under oath that Dillon Gage believed that BDI was an ordinary retailer of precious metals and was unaware that BDI offering purported depository services as well."

With the Settlement Agreement, Dillon Gage would pay the Bullion Direct litigation trust $324,500. Dillon Gage would also be obligated to provide support to Platform Universe (the company that started up earlier this year from the ashes of Bullion Direct). Dillon Gage can get up to half their money back, if Platform Universe becomes profitable (half the profits would go to Dillon Gage until the full $162,250 is returned).

It is interesting to note that an anonymous group of investors bought large online bullion dealer Provident Metals recently, and they have a management agreement in place with Dillon Gage.

Other information gleaned from the motion are that Cheryl Huseman (Charles McAllister's mother) is President of Platform Universe, C. Jack Murph (her husband) is Vice President, and that they have been providing financial reports to the Trustee.

Update: Some Progress

October 19, 2017 5:05PM ESTOn October 10, 2017, Gregory S. Milligan (the Trustee for the BullionDirect Litigation Trust) filed a motion that would allow the filing of certain court documents without having to send copies to creditors. This makes sense, as it is costly to send copies to creditors, and the Trustee gets dozens of unrelated calls/E-mails after each one.

However, what the motion also does is supply us with some new information:

"Along with reviewing the books and records of BDI itself, the Trustee and his team have obtained document production from third-parties such as the Debtor s business partners, lawyers, and accountants. Both informal interviews and depositions under oath pursuant to Bankruptcy Rule 2004 have been conducted. Tolling agreements to preserve claims for future prosecution have been entered as appropriate. Negotiations over potential settlements have been commenced."

That said, it appears that Bullion Universe a/k/a Platform Universe never got anywhere. Specifically, there still are no prices listed on any products after it has been "live" for about 6 months. So it appears that any litigation is the best source of recovery at this point.

E-mail re: Bullion Direct, Bullion Universe

June 20, 2017 12:35PM ESTThe Trustee of the BDI Litigation Trust sent out an E-mail today to Bullion Direct creditors, to clarify a few things.

Basically, he is pointing out that [1] Bullion Universe (the name being used by Platform Direct, the new company that is offering customer-to-customer metals trading) is not in any way involved with claims against Bullion Direct, and [2] Bullion Direct creditors will benefit if Bullion Universe is profitable.

Platform Universe is the company that was formed to buy some of the Bullion Direct assets. It is doing business as Bullion Universe. You should contact Bullion Universe with any questions about the new company (such as how to do business with them). The BDI Litigation Trust is responsible for creditor claims (e.g. sending any payments or handling a change of address).

The E-mail also points out how the principals of Platform Universe will put an extra $100,000 into Platform Universe if it reaches 3,000 transactions within 6 months or 5,000 transactions within 1 year. Therefore, the Trustee states "it is in the best interest of the Trust and the former customers and other creditors of BDI that Platform Universe is both successful and profitable."

No Criminal Charges Yet

June 16, 2017 8:30AM ESTSo far, it appears that no criminal charges have been filed related to Bullion Direct.

Given that a man in an Austin suburb was recently charged with theft over not delivering a single $9.7K silver order, one would think that not delivering thousands of orders and stored metal totalling $25M would be thoroughly investigated.

Nobody has suggested that what happened was not fraud. Bullion Direct even stated "Many [employees, officers, lawyers, accountants, and vendors] knew or should have known that the Debtor was acting in a massively fraudulent matter." Wow. That's a $25M theft from thousands of people (there are 7,500-or-so entries in the creditor list, although that does include some duplicates).

We're not talking about some hit-and-run type of robbery, with no evidence and long-gone suspects. The suspects are known, and have not fled. There is beyond ample evidence. Nobody claims that the $25M bankruptcy filing is imaginary; it is proof that $25M is owed customers who had placed orders with the company or stored metal there. The owner of The Tulving Company went to prison for a similar scheme. Bullion Direct even went much farther: beyond its unshipped catalog orders (the "Tulving" scheme), it also had $21M of metal it claimed to be storing for customers (including at least $6M in metal for IRA customers!), and even $220K of cash it was supposedly holding for IRA customers.

It has been 2 years since I contacted Bullion Direct asking about the situation, and nearly that long since the bankruptcy filing. It does take a long time to investigate large crimes, so it may not be unusual that nothing has happened yet. The problem is that in most cases, investigators refuse to say when they have closed an investigation. So you have to keep open the possibility that the investigation died out a long time ago.

This leads us to 3 possibilities. [1] The case is still open. This is the most obvious possibility. [2] The case was closed because they couldn't crack it (they couldn't figure out who was behind the fraud, couldn't find evidence, didn't have the resources, etc.). For a $25M crime, this is a massive strech. [3] The case was closed because they determined no crime occurred. This, too, is a massive stretch (just one of several pieces is nearly identical to the Tulving case). My analysis is simplistic (e.g. it doesn't distinguish between the investigators and prosecutors, or the multiple investigators), but it should get the point across.

Ultimately, I imagine the case must still be open, barring extreme incompetence.

Bullion Universe Live

April 25, 2017 1:35PM ESTBullion Universe has sent an E-mail to Bullion Direct creditors letting them know that the website is now live.

Good luck, Bullion Universe! Let's spread the word.

Bullion Universe Preview Ready

April 19, 2017 3:00PM ESTThe Bullion Universe website was turned on this morning, and Bullion Direct creditors have been invited to preview it.

The E-mail that creditors received says that final testing and product configurations are underway, and they expect to announce a soft launch soon.

Bullion Universe to Start Soon

April 6, 2017 1:50PM ESTThis morning, I checked again to see if there was any news about Platform Universe, and didn't find anything. Just a couple hours later, they sent out an E-mail to what appears to be all Bullion Direct creditors, implying that they are starting up as Bullion Universe (although there is no site available there right now). The E-mail was worded as though it was intended for a larger audience.

The Bullion Universe domain name was one of the assets transferred to Platform Universe. Platform Universe registered Bullion Universe as an assumed name, signed by Cheryl Huseman as President of Platform Universe. So the business name was chosen roughly a decade ago.

The site is described as "A website for self-directed bullion transactions," and presumably will be similar to what Nucleo was (trading with other individuals, coordinated by Bullion Universe). It makes it clear that customer funds cannot be used for any other reason than fulfilling customer orders (and will be held in a separate bank account), that precious metals will be held by Brinks, and that there will be annual audits be independent auditors. The E-mail also had a (cryptic to me) message: "Your participation and support will help regain the participation of all 60,000 customers that accounted for over $1.5 Billion in successfully completed transactions during fifteen years of Bullion Direct, Inc. operation."

Having to trust the Mom of the person most creditors are accusing of stealing their money is not going to be easy (and harder for me, as she hasn't responded to my queries; that's not the best way of being transparent). However, creditors have two things going for them here: [1] the company will be under a lot of scrutiny, and [2] should there be any fraud with the new company (which I doubt), claiming ignorance would be hard (e.g. due to the clearer claims from the beginning, and the fact that it is starting from the ashes of a bankrupt fraudulent company).

Platform Universe to Start Soon

March 10, 2017 8:55AM ESTA long time has gone by since the Chapter 11 reorganization plan was approved by the court. And a lot of people have started asking me if Platform Universe is really going to start up, or if it was all just a sham.

The Bullion Direct assets were bought by Cheryl Huseman (the mother of Bullion Direct founder/owner Charles McAllister) and her husband C. Jack Murph. I E-mailed Ms. Huseman on Monday (at the E-mail address she uses to receive legal E-mails regarding the asset sale), and as of this morning I have received no response. Hopefully the customer service for Platform Universe, when it starts up, will be better. Creditors need this company to succeed as it is likely their best chance of getting paid.

Despite the lack of response there, however, I have heard that they are indeed working on the company, are in final stages of testing, and expect to start within the next few weeks.

Trustee To Pursue Litigation Claims

January 19, 2017 3:45PM ESTBullion Direct has filed a motion, which the court allowed, to extend the time for objecting to claims from January 20, 2017 to January 22, 2018.

Among the reasons for doing this are that the Trustee of the BullionDirect, Inc. Litigation Trust is "currently focused on overseeing an investigation of potential litigation claims that could be asserted to attempt to recover further funds for the victims of [Bullion Direct]." It further says that they have hired litigation counsel to do a preliminary investigation.

This is encouraging, given how quiet it has been lately. I really haven't heard much of anything lately, especially regarding Platform Universe (the company that Charles' parents set up to hopefully bring in money to creditors).

Information From Expense Reports

September 1, 2016 1:30PM ESTI have spent quite a bit of time going through the Bullion Direct expense reports, getting what information I can from them.

The most important information, which I stumbled upon accidentally, was some details of a CFTC investigation into what happened at Bullion Direct (see the Application to Show Cause and the Suggestions in Support (large; 375pg, 9MB), which I have written about in an earlier post. In a nutshell, the CFTC started investigating Bullion Direct before it shut down, subpoenaed Charles in December, Charles through his lawyer tried to use his Fifth Amendment rights to not testify or produce documents he has, and he has 'bigger fish to fry' (FBI involvement and criminal implications).

It also shows some sort of arrangement between Dillon Gage (the bullion wholesaler than supplied Bullion Direct with metal, that also owns the IDS vault where metal was stored at the end). It mentions a compromise and settlement, but it is unclear what that is in regards to. It appears that Dillon Gage tried to put in a bid for the platform.

It also shows that the Missouri Attorney General and Business Consumer Alliance were receiving information from Bullion Direct as of the beginning of this year. It also shows that in August, Bullion Direct mailed "attorney files" to the CFTC (which appear to have been obtained from attorneys that Bullion Direct had used in the past).

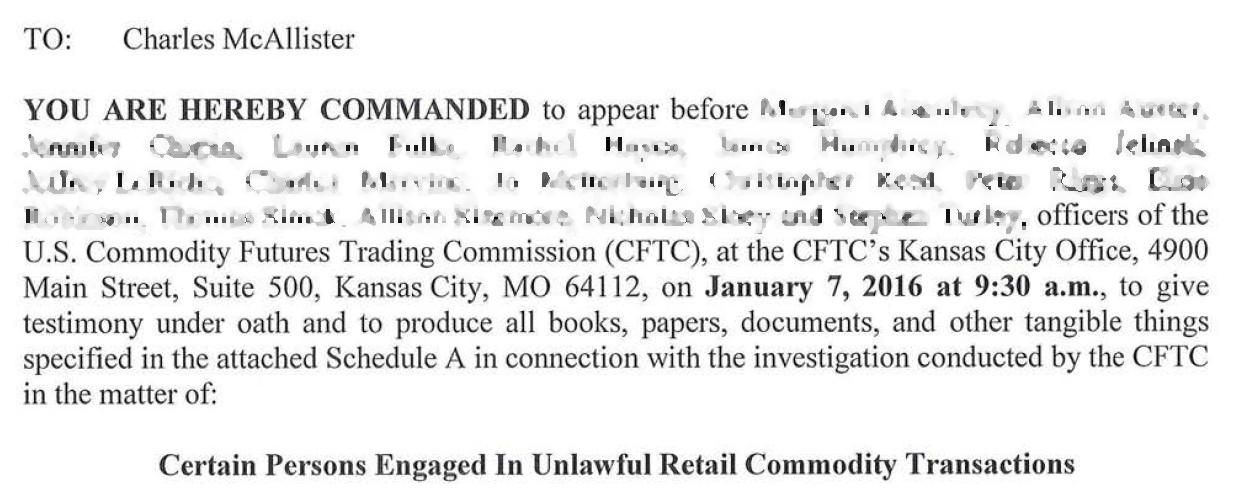

CFTC Opened Investigation Before Charles Shut Down

August 31, 2016 4:15PM ESTAccording to court documents I found, the CFTC (U.S. Commodity Futures Trading Commission) started investigating Bullion Direct no later than May, 2015 -- over a month before Charles shut down operations. It is investigating "actions and omissions" (perhaps among other things).

The CFTC has uncovered evidence that Bullion Direct and Charles McAllister may have violated the Commodity Exchange Act.

Charles is aware of the investigation, and was subpoenaed in December, 2015. Charles did not produce the documents, and instead plead asserted his Fifth Amendment rights against self-incrimination.

Charles Living With His Mom?

August 31, 2016 3:40PM ESTThe CFTC believes that at least as of May, 2016, Charles was living at an unknown address in the same planned community that his mother lives in, and that the new Bullion Direct ("Platform Universe") uses as its mailing address. This conflicts with the information we currently had, which was when Joe Martinec stated in August, 2015 under oath that Charles abruptly moved to Auburn, AL, where his daughter is in school, and that his wife had a teaching job there.

What is really concerning is that [1] presumably Joe Martinec knew Charles was living in the same ZIP code as his mother, and [2] this was not disclosed before the sale of Bullion Direct assets to his mother. Remember, in June I discovered that Charles had been working on starting a business called "Austin Platforms," suggesting that he was working on a use for the Bullion Direct assets. Between that, and him living at his mother's house (or very close by), suggests that at the very least he intends to have a very strong role (formal or not) in the new company.

BD Final Expenses: Blaming Costs on Me

August 31, 2016 1:40PM ESTDan Bensimon (Bullion Direct CRO) and Joe Martinec (Bullion Direct's attorney) have filed their final fee applications. Their first fee applications were in November, 2015 (Joe with Exhibits and Dan). You can also see the new ones for Joe and Dan. I put together a page with issues I had with the expenses from the first fee application here.

Joe never answered any E-mails I sent him, and Dan just responded to my introductory E-mail, but nothing after that. They did, however, act on E-mails that I had sent. For example, after sending them an E-mail politely explaining that the 2010 tax return did exist, Dan and Joe had a meeting, and the next day wrote a check to the IRS to get a copy of the return. The only way they have chosen to communicate back to me is through public documents. I only knew of that meeting and their request for the 2010 tax return through expense reports.

In this case, their communication to me was through their current fee application. It stated "Many [of the 5,000 claimants] relied instead on facts posted at websites, message boards and on blogs [instead of paying for legal representation]" The fact (pun intended) that Joe used quote marks around the word "fact" (note my non-sarcastic use of quotes) is an obvious insult to me: the quotation marks change the sentence from benign (creditors relying on my information) to an implication that I was posting erroneous statements as facts, and creditors had to contact Dan as a result of these errors (which I am sure is untrue -- perhaps I should hire an attorney and sue him for defamation?).

Joe then writes "In some instances, it appears that a blog post would suggest a certain email message to Debtor s counsel, resulting in large numbers of nearly identical inquiries." In this case, Joe had filed a creditor list with the court showing every claim as disputed. That means that either [1] Bullion Direct would need to update the creditor list with the court, or [2] all creditors would need to file a Proof of Claim (which is highly undesirable, for privacy reasons, and to reduce expenses). I made a post on August 17 telling customers they would have to contact Joe to find out if he planned to file an amended creditor list. Why? Because I E-mailed Dan and Joe on August 13, and they refused to respond. I E-mailed them again on August 15, this time Cc:'ing the U.S. Trustee (so there is proof I sent the E-mail), explaining that having them communicate with me would help preserve the assets of the estate, and that if they did not respond, I would need to let creditors know they would need to contact Joe directly. So the large expense of responding to nearly identical inquiries was their choosing. Should they really get paid for that?

Next, Joe writes "One blogger, not an attorney, made multiple demands that he be treated as the legal representative of a group of claimants he was advising." Obviously, he is referring to me. However I never in any way suggested that I wanted to be a legal representative to anyone, nor provide legal advice to anyone. My communications with Joe and Dan were simply [1] asking questions, or [2] giving them information that I felt would be useful to them, with one exception. On September 10, 2015, I wrote to them (Cc:'ing the U.S. Trustee), making what could be seen as a demand to either communicate with me or acknowledge that they refuse to. I just asked for the same level of information that he would be required to give me if I had been a creditor (for example, if I had bought an ounce of silver for $15 before the bankruptcy), and even added that information be limited "to the extent the law allows" (so his suggestion that I was demanding something illegal only would be possible if Joe chose to violate the law against my desires). It is a shame that Joe will give financial information to a creditor, but not me. Who knows what I might have uncovered, given how much I was able to uncover without this level of information?

What should come from all this? If anyone wants to have an attorney object to the final fee applications, I would be more than happy to provide as much information as needed. I find the behavior of Joe and Dan to be deplorable, using information I provided to fix massive errors but refusing to even give me information the media had access to, and taking tens of thousands of dollars to do so (money that belongs to Bullion Direct creditors, not them), just because they can get away with it. Note, too, that Joe's firm is billing $433/hr to respond to these duplicate queries, something that if a legal assistance could do, the bankruptcy court feels $50/hr is appropriate (or $100/hr using Joe's personal paralegal).

Joe & Dan's Final Fee Applications

August 26, 2016 5:45PM ESTJoe Bensimon of Unique Strategies Group is requesting $75,732.00 for fees and expenses from 01 Nov 2015 through 20 Aug 2016 (in addition to the $81,201.90 of approved fees/expenses before that, of which about $60K was already paid). That totals $156,933.90 of compensation since the case started.

Joe Martinec of Martinec, Winn & Vickers, P.C. is requesting $113,480.00 for fees and $2,679.20 for expenses from 16 Nov 2015 through 19 Aug 2016 (in addition to the $124,183.26 of approved fees/expenses before that, of which about $95K was already paid). That totals $240,342.46 of compensation since the case started.

I expect to make another post within a few days with information gleaned from the expense reports.

Dan's $1.8M Typo

August 11, 2016 10:15AM ESTThe bank account balance at Bullion Direct, as of July 31, 2016, was almost certainly $189,578.67.

However, in the latest Monthly Operating Report that Dan Bensimon filed, the "Cash Account Reconciliation" page shows $1,895,768.67 in 4 places on the page. While someone familiar with the case (like myself) can figure out which numbers are in error, and someone unfamiliar with the case could make a good guess as to which numbers were in error (by looking at other pages), it is another example of Dan's sloppy work.

But while we're at it, for the record, I should point out that every Monthly Operating Report that Dan has filed is very fuzzy, almost as if it has been saved using very high compression (very "lossy"). For example (from the top right of page 7):

| Dan's Fuzzy Text (Original Size) | Court text (Original Size) | Dan's Fuzzy Text (PDF Zoom) | Dan's Fuzzy Text (Paint Zoom) |

|---|---|---|---|

|

|

|

|

For those born with human eyes, and not those of an eagle, that says "FILING TO DATE" and "$181,216.62". I think. I have no idea why he uses this fuzzy text, whether it is simply more sloppiness (he once saved a picture with very high compression, and the software defaults to that setting, and he didn't notice it was so fuzzy), or whether it is intentional (e.g. to keep people like me from finding out what he is up to). But all his monthly operating reports are like this (minus the $1.8M error).

Reorganization Plan Approved

July 29, 2016 11:20AM ESTJudge Tony M. Davis ordered the approval of the Chapter 11 Plan of Reorganization, allowing Bullion Direct founder Charles McAllister's mother and step-father to buy the assets of the company, and start a new business to hopefully pay back creditors much of what they are owed.

This means that the deal that Bullion Direct has hoped for, and the Unsecured Creditors' Committee also felt was the best option, will go through as intended.

As I get more information about the new company, I will be sure to provide updates.

Did Charles Try to Buy Bullion Direct Assets?

June 22, 2016 2:20PM ESTEither Charles, or someone impersonating him, spent at least a bit of time and energy late last year working on creating at least a skeleton of a company, called Austin Platforms. It was listed at AngelList (a website for startups to get funding and employees), with Charles listed as the founder. It also has an (unused) website, austinplatforms.com, which was originally registered late last year to a mysterious "C McAllister" and then later switched to anonymous ownership.

Oddly, there is no sign of the company in the usual sources. For example, it does not appear in the records of Texas Secretary of State or as a Travis County DBA.

The name -- including "Platforms", very similar to his Mom's "Platform Universe" -- strongly suggests that he was creating his new company in an attempt to buy the assets of Bullion Direct.

Interestingly, someone registered a domain "platformuniverse.com" about 2 months later, using the same anonymous service that Charles used. Presumably, this is going to be used with the Platform Universe company that Charles' mother is forming.

Ballot to be Sent to Creditors

June 15, 2016 1:05PM ESTJudge Davis signed an order approving Bullion Direct's Disclosure Statement, and setting the times for filing acceptances or rejections of the plan.

Creditors should be receiving the ballots soon. Acceptances and/or rejections need to be filed by July 13, 2016, sent to Bullion Direct's attorney (Joe Martinec). The same date is fixed as the last day for filing written objections, with a hearing on July 25, 2016 at 9:30AM on the confirmation of the plan.

Charles Vacationing

June 13, 2016 7:00AM ESTI have heard a report that seems to confirm my suspicions that Charles and his family are continuing to take vacations. This includes a beach town about a 4 hours' drive from where Charles and family are supposedly living. I have also heard that Charles traveled to a quaint Italian town within walking distance of Switzerland.

On an unrelated note, there is a new article at the Statesmen, With millions in precious metals missing in Austin, a mother steps up (new link 26 Nov 2019).

Joe & Dan to be Paid

June 6, 2016 12:25PM ESTDocket 180 was just filed, an order by Judge Davis allowing Joe Martinec's firm to receive $44,836 of the $124,183.26 they requested last November for work done through November 15, and allowing Dan Bensimon's firm to receive $40,050 of the $81,241.90 it requested (for work through October 31).

My understanding is that this is not a determination of how much they can be paid for those time periods, but rather that the Unsecured Creditors' Committee has agreed to disbursing those amounts now, and that the court may later approve further payment.

Objectionable Claims

May 31, 2016 6:40PM ESTBullionDirect has filed a lengthy document related to the asset purchase.

It includes a list of objectionable claims. Specifically, it lists claims that were filed in the Debtor's name (all those people who said their name is "BullionDirect", likely due to the bankruptcy court's 'impulse claim' system), duplicate claims, those that said their claim was secured but was not, those that claimed priority claims but did not have one, unliquidated claims, ones that have been paid already, late filed claims, and claims that exceed the amount in Bullion Direct's records.

Bullion Direct Assets Sold to Charles McAllister's Mom

May 26, 2016 1:40PM ESTOn Monday, the judge approved the sale of the Bullion Direct assets to Cheryl Huseman (Charles McAllister's mother) and Jack Murph. You can find the actual Asset Purchase Agreement here (note that it was subject to change; e.g. the asset allocation was to be added).

Here is my understanding of what they are paying: [1] The purchase price is $100,000 (which goes to the Bullion Direct estate, and to creditors after expenses), [2] they will provide a $100,000 "additional capitalization" on the closing date (cash the new company will use), and within 12 months will give the company another $100,000 (loan or equity investment) if warranted.

It also provides for Contingent Payments, in the amount of 80% of net profits for the first year, 60% of net profits for years 2-3, and 50% of net profits for years 4-7.

It appears that the closing has either already occurred, or is scheduled for sometime today.

This is exactly what we thought was going to happen, with the exception of the hope that another buyer might come in to increase the value to creditors.

E-mail re: Disclosure Hearing

May 2, 2016 4:50PM ESTSeveral people have reported getting the following E-mail:

PROCESS NOTE: The Bankruptcy Court must approve a Disclosure Statement before it can be sent to creditors, along with a proposed Plan of Reorganization or Liquidation. The Plan will establish the terms for payment of creditors' claims. Creditors will have an opportunity to vote on the Plan after the Disclosure Statement has been approved. You may view the Notice of Hearing by clicking the following link:

I expect to add a link shortly for those that did not get the E-mail.

Disclosures

April 19, 2016 8:20PM ESTBullion Direct has filed a Disclosure Statement. Some information I found interesting includes:

However, it is also possible that BullionDirect suffered additional losses due to outright theft by McAllister and other insiders. While current management has not uncovered evidence of theft, McAllister and other insiders had ample opportunity to embezzle assets and conceal this embezzlement in subsequent years.

During 2007 ... management hired additional staff and hired consultants to assist the accounting staff in producing accurate financial information. Those efforts failed, and during Fiscal Year ending June 30, 2009, BDI management hired Randy Russell, a consultant, to help BDI create an accurate financial information system. After spending upwards of two million dollars on a new, comprehensive accounting software, the company still could not integrate the data contained in the website database system with the accounting system.

Footnote: Mayfield had served as BDI s controller until 2009, but left and joined Randy Russell in a tax consulting firm. (I add this as interesting because she was on the payroll as late as about May, 2012 -- footnotes are usually considered even more reliable than the rest of the text).

The returns showed that by June 30, 2002, the end of BullionDirect, Inc. s third fiscal year, the company had amassed $829,000 of operating losses on only $4.5 million in trades. Unfulfilled orders had already amounted to $722,000.

From the beginning of the company, the various terms of service agreements posted to the website were interpreted by BDI management as allowing BDI to act as owner of the stored metals and to book, but not complete, transactions. The unfulfilled transactions were referred to as obligations .

Equity Trust Company, a precious metals IRA account manager, sent quarterly reports to BDI customers with precious metal funded IRAs, which tended to reinforce the belief of the customer that the purchased precious metals were being held in the vault used by BDI, but, had the vault contents been inspected by Equity Trust, the much smaller amount of inventory would presumably have been noted. It does not appear that Equity Trust ever examined, audited or inspected the vault. Equity Trust has denied any liability resulting from its erroneous and misleading reports.

Management appeared to realize that not enough individuals wanted to sell its precious metals on-line, thus the company increased its volume of sales of bullion it did not own. The company monitored the current price of bullion and offered sales of that bullion on its website at prices slightly discounted from the current market price, the policy being that they would immediately purchase the item to be sold at current market price. BullionDirect continued to lose money throughout this period.

Realizing the magnitude of its problem from the 2010 tax return, management tried to make BDI a possible merger partner or target for acquisition.

BDI hired consultants, primarily, Randy Russell, to create an accounting system that would integrate the website database. This $4,000,000+ effort was not successful. In addition, Randy Russell advised BDI management to invest in other transactions, including one for over $400,000 in one of Russell s own companies, NBFog, Inc. That company has yet to generate any return and is the target of litigation by other investors. BDI s claims against NBFog, Russell and others are under investigation.

bank statements stopped being reconciled as of September 30, 2011.

In addition the CRO and counsel have cooperated with every state, local and federal agency that has been examining the operations of BullionDirect, including several state attorneys-general.

Administrative Expenses (taking priority over everything else) through April 19, 2016 include:

Unique Strategies Group (Bensimon) $221,500 (including $100K success fee reduced to $50K) Martinec Winn & Vickers, PC $184,800 Dykema Cox & Smith $ 60,000 TOTAL: $466,300Debtor does not believe that any amount would be available to pay unsecured creditors under a Chapter 7 liquidation. ($695K estimated at fire-sale prices).

On or after the petition date, the Debtor was the subject of inquiries or investigations by multiple attorneys general, the Travis County District Attorney and the Austin Police Department. In addition, investigations were begun by the Federal Bureau of Investigation, the Internal Revenue Service, and the Commodities Futures Trading Commission.

Given the state of BDI s records and the legal burden of individuals asserting title to specific items, it would be virtually impossible to track or trace the ownership of the coins and bars in the vault.

Reorganization Plan

April 19, 2016 6:40PM ESTBullion Direct has filed a Plan of Reorganization.

It is strongly recommended that creditors at least look through it.

It lists 6 classes of creditors:

| Class 1 | Administrative Claims - Payable from available funds after reservation of $50,000 for BDI Litigation Trust, any balance to be paid from BDI Litigation Trust |

| Class 2 | Secured Claims of Governmental Units - Payable over 5 years at 12% interest |

| Class 3 | Priority Unsecured Claims of Governmental Units - Payable over 5 years at 3% interest |

| Class 4 | Priority Unsecured Claims [11 U.S.C. 507(a)(7)] (up to $2,775 per claimant) - Pro rata payments from BDI Litigation Trust until paid in full |

| Class 5 | General Unsecured Claims - Payment on pro rata basis from BDI Litigation Trust after payment of Classes 1 through 4 |

| Class 6 | Equity Cancellation of stock No payment |

It is unclear who would be entitled to be in Class 4, as some of the people who chose to file a Proof of Claim form checked that box while others did not, and the Bullion Direct creditor list does not specify which creditors would qualify to be in Class 4.

CFTC Investigation

April 19, 2016 7:25AM ESTI have heard reports that some CFTC attorneys have called some Bullion Direct creditors.

It is not at all surprising that the CFTC is pursuing this. Hopefully, however, they will conduct a full investigation, and restore the damage they did to their reputation with their poor investigation of The Tulving Company. This phone call is certainly a good step. With The Tulving Company, I am not aware of them talking with customers, who certainly would have let them know that The Tulving Company had indeed been around for about 20 year and was not a fly-by-night operation.

Asset Sale/Auction Hearing

March 29, 2016 12:05PM ESTThere was a hearing yesterday, regarding the sale and auction of the intellectual property.

Bullion Direct's motion to sell/auction the intellectual property was approved. The auction will take place on May 23, 2016 at 9:30AM (however, bids must be in by May 16, 2016). Hopefully word will get out to anyone who may consider bidding.

Tax Information

March 15, 2016 8:50AM ESTI have finally put together a page on tax information.

Basically, it looks like you can probably take a theft loss (which is normally better than taking a capital loss, which you could do instead if you wanted). It may be possible to deduct part of the loss in 2015 (the amount that cannot reasonably be expected to be recovered), but it does not need to be deducted in 2015.Mo< For full details, click on the link above. If you have questions, please let me know.

Upcoming Asset Sale and Auction

March 11, 2016 1:35PM ESTBullion Direct filed a motion on Tuesday to enter a sale agreement (referred to as a 'stalking horse' bid) and auction.

Specifically, Cheryl Huseman and C. Jack Murph (Charles McAllister's mother and stepfather) have put in a bid where they would get most of the assets of the company (including the website and software), putting $100,000 into the company, and conditionally another $100K-$200K. They would try to revive the business, using a 3% commission rather than a 2% commission. They would also get a release of liability. Part of the profits would go to a creditor trust.

So what does the "stalking horse" bid mean? It means that they will be bound to make purchase the purchase, but there will also be an auction, and they can be outbid (but if they get outbid, $25,000 of the winning bid would go to them, to help cover their costs of making the purchase agreement).

$50,000 of cash will go to a Creditor Trust, along with the ~$700K of metal in the vault. All creditors will be beneficiaries of the trust. 80% of the profits from the first year would go to the trust, along with 60% of profits in years 2-3, and 50% of the profits from years 4-7.

Ultimately, what creditors want here is for people to bid on buying these assets and restarting Bullion Direct. If you would rather have, say, an existing bullion dealer running Bullion Direct than Charles' parents, let people know about the auction. It sounds like there may only be a couple weeks for bidders to prepare.

Notices from Bullion Direct

March 11, 2016 1:35PM ESTSubject: BullionDirect, Inc. - Chapter 11 No. 15-10940-tmd - Notice of Hearing

Date: March 10

Title: Notice of Expedited Hearing on Sale Procedures Motion - March 28, 2016, at 1:30 p.m. (Judge Davis Courtroom)

Today BullionDirect, Inc. filed Notice to Creditors and Parties in Interest of Expedited Hearing on Debtor's Motion for Order (a) Authorizing Debtor to Enter Into an Agreement for the Sale of Assets Free and Clear of Claims, Interests, Liens and Encumbrances, (b) Approving Procedures and Notice with Respect to Sale, (c) Scheduling an Auction and Hearing for Approval of Sale, and (d) Granting Related Relief (Doc#148). The hearing has been set for March 28, 2016, at 1:30 p.m. in Judge Davis' Courtroom No. 1, Third Floor, Homer Thornberry Judicial Building, 903 San Jacinto Blvd., Austin, Texas (Click Notice of Expedited Hearing to see the document).

We will keep informed.

Subject: BullionDirect, Inc. - Chapter 11 - Sale Procedures Motion

Date: March 8, 2016

Title: Sale of Assets Free and Clear of Claims, Interests, Liens and Encumbrances and Related Relief

Today BullionDirect, Inc. filed Debtor's Motion for Order (a) Authorizing Debtor to Enter Into an Agreement for the Sale of Assets Free and Clear of Claims, Interests, Liens and Encumbrances, (b) Approving Procedures and Notice with Respect to Sale, (c) Scheduling an Auction and Hearing for Approval of Sale, and (d) Granting Related Relief (Doc#143). (Click Sale Procedures Motion to see the document) and a Motion for Expedited Hearing (Doc#144) requesting that the hearing be set for March 28, 2016, at 1:30 p.m. (Click Motion to Expedite to see the document).

We will send updates when they are available.

No News Yet On Hearing

March 1, 2016 2:35PM ESTSo far, I have not heard any news on the hearing that was supposed to have been held yesterday (regarding the motion for conversion to Chapter 7), or even seen confirmation that it did indeed take place.

As soon as I have any information, I will post it here.

I have heard (but cannot confirm) that Bullion Direct may be planning to get a 'stalking horse' bid, an asset purchase agreement to buy the website platform and possibly all of Bullion Direct's intellectual property, subject to an auction.

Hearing Continued Again

February 7, 2016 8:45AM ESTThe hearing for the court to decide on the motion to convert to Chapter 7, as well as payment of professional fees, has been postponed again from February 3 to February 29.

Again, there is no information as to why these delays are occurring. However, delays like this usually only occur if both sides are willing to accept the delay, which suggests that Bullion Direct is working on something that could be beneficial to creditors.

Website Back Online

February 5, 2016 6:25AM ESTThe Bullion Direct website is back online, and appears to have all customer data intact. No explanation is known for why it was down.

Website Dark

January 27, 2016 10:25AM ESTYesterday between about 11:20 and 11:30, the Bullion Direct website went dark.

It appears that Bullion Direct (Dan Bensimon and Joe Martinec) shut down the website. However, there are other possibilities (e.g. they forgot to pay the bill, hackers, massive failure at the hosting location, a simple error that nobody noticed, etc.).

The fact that people cannot see Bullion Direct's website doesn't sound unusual, until you realize that is where people are checking their account information. The fact that the site is down yet Bullion Direct has not informed creditors is quite disturbing, as many may assume that Dan Bensimon (who is working on a deal with Charles McAllister's Mom) has skipped town like Charles. At the very least, it adds to the already adversarial relationship between Bullion Direct and creditors.

UPDATE 9:30PM: They may have shut it down on January 26 because the Proof of Claim deadline was January 25, and they figure that nobody needs to access their account information anymore. But the problem with that is that if the case is converted to Chapter 7, everyone needs to file a Proof of Claim, and would then need that information.

Quiet

January 19, 2016 1:45PM ESTThere has been nearly no activity recently in the bankruptcy and/or investigations visible from outside the 'inner circle' (Bullion Direct, investigating government agencies, and whoever they are dealing with).

The latest court document was filed 11 days ago, and simply a "We're still alive" filing -- a document stating that Bullion Direct's Master Service List has not changed.

Right before that, on January 4, a document was filed by Joe Martinec stating that the hearing on conversion to Chapter 7 (scheduled for January 6) was postponed ("will be continued to a later date as necessary"). It mentioned that there would be a status hearing on January 6, but no information is available about that hearing.

A number of people have asked about the Bar Date (Proof of Claim deadline) of January 25, 2016. I'm not allowed to give legal advice (but isn't saying "You should ask an attorney" -- what I would advise if pushed -- legal advice?). That said, my understanding is that in a Chapter 11 bankruptcy, there is no need to file a Proof of Claim form if you are properly listed in the list of creditors (see http://about.ag/pics/bk/bd/101.pdf), or the court tells you otherwise. That said, if the bankruptcy does convert to Chapter 7, you almost certainly will be required to fill out a Proof of Claim (but should be notified by the court). However, that (from a moral and logistical perspective) would have to involve a new deadline.

Objection to Professional Fees

December 8, 2015 4:40PM ESTToday the Unsecured Creditors' Committee filed a limited objection to the professional fee applications.