| [ | Summary: In Chapter 11 bankruptcy (reorganization) after reports of 6+ month delays, $55.8M owed creditors | ] |

| [ | Related Pages: court documents, mailing list, tips, Bullion Dealer Data, 341 Meeting | ] |

| [ | Contact:

| ] |

Ross and Diane's Appeal

May 17, 2024 9:30AM ESTOn May 9, there was a hearing regarding Ross and Diane's appeals. The hearing may be viewed here (backup on YouTube).

There are 2 main parts to their argument. The first is that the judge had a duty to question a juror who may have felt they would take an indictment by the government as evidence of fraud (the US attorney pointed out that the defense also had a duty to question this). The second is that the shipping delays may not have been an "essential" part of the bargain that customers made (which is relevant due to a decision that was made about a month ago in another case).

The majority of criminal appeals do not succeed, so this sounds like a long shot.

Sentence Reduction Explanation

May 17, 2024 9:30AM ESTThe First Step Act of 2018 has a "Time Credits" provision (18 USC 3632 (d)(4)), that allows most prisoners to earn 10-15 days of credit per month in prison.

The media and government portrayals of the law are unfortunately vague. From the best I can tell, there is no maximum credit that can be earned... but the sentence can be reduced by a maximum of 1 year (with any extra credit letting the person transition to an RRC (halfway house) sooner).

So it sounds like Ross and Diane will be finish their sentences about a year early, and may be able to transition to a halfway house earlier than they otherwise would.

Ross Now at FCI Sheridan in Oregon

July 21, 2023 8:00AM ESTI should have waited 24 hours before my post about Ross (or written in weeks earlier).

The Bureau of Prisons is now reporting that Ross Hansen is at FCI Sheridan (enter "Bernard" as the first name, "Hansen" as the last name).

Ross' Whereabouts Unknown

July 20, 2023 8:00AM ESTFor about a month now, the Bureau of Prisons has been reporting the location of Ross Hansen as "NOT IN BOP CUSTODY".

From my understanding, this means that the prisoner is not in a BoP facility, and usually means that they are either in transit to another facility or in a non-BoP facility (such as a county jail). There are many reports from people whose loved ones are in this status, and cannot be found even by their attorneys.

This definitely does not mean that he has escaped; the BoP has a special status for that. As for why they are showing this and where he may be, that is something I do not know

Also, I have updated the table in the post below this with the latest changes in sentencing.

More Sentence Reductions

May 16, 2023 8:00AM ESTTable udpated July 20, 2023 8:00AM EST

Again, in both the Bullion Direct and NWTM cases, there have been sentence reductions, applied to all 3 felons at the same time.

From my understanding, once the judge sets the prison sentence, and the Bureau of Prisons is expected to keep the prisoner detained according to federal law (with no exceptions). With federal prison sentences, there is no parole, but offenders get about 15% "good conduct time" reduced from their sentence (unless forfeited). It's up to 54 days per year of the sentence. However, that does not explain what is going on here; for example, Charles McAllister had a 10 year prison sentence, but it now expected to be released after about 7 years and 7 months. The "good conduct time" of 54 days per year of the sentence works out to about 8.5 years. There is nothing in the court records explaining this, and with it happening with 2 unrelated cases, it is clearly widespread... but I cannot find anything online explaining this.

The Bureau of Prisons states that the release date "reflects the inmate's projected release date based on BOP calculations", which implies that it factors in good time. But that would mean that it should not change.

I've added a chart showing the changes, which are always in multiples of 5 days.

| Date | Charles McAllister | Ross Hansen | Diane Edrmann |

|---|---|---|---|

| 15 May 2021 | In prison (10 year sentenece) | --- | --- |

| 18 May 2021 | 18 Nov 2029 | --- | --- |

| 10 May 2022 | 18 Nov 2029 | In prison (11 years) | In prison (5 years) |

| 18 Jul 2022 | 18 Nov 2029 | 22 Sep 2031 | --- |

| 25 Oct 2022 | 20 Aug 2029 (-90) | 02 Sep 2031 (-20) | 11 Aug 2026 |

| 20 Feb 2023 | 22 Apr 2029 (-120) | 14 Jul 2031 (-50) | 02 Jul 2026 (-40) |

| 31 Mar 2023 | 22 Jan 2029 (-90) | 24 Jun 2031 (-20) | 22 Jun 2026 (-10) |

| 09 May 2023 | 23 Dec 2028 (-30) | 09 Jun 2031 (-15) | 28 May 2026 (-25) |

| 07 Jul 2023 | 08 Dec 2028 (-15) | 10 May 2031 (-30) | 13 May 2026 (-15) |

Another Massive Sentence Reduction

March 31, 2023 2:45PM ESTThe Bureau of Prisons is now showing Ross Hansen's release date as June 24, 2031 (about a month earlier than the last change), and Diane Erdmann's release date as June 22, 2026 (about a week earlier).

Although the Department of Justice has alerted victims of this, no explanation was given. This is the third time in about 6 months that multiple felons in unrelated cases have received sentence reductions at about the same time. I have no idea if this is a normal occurrence, fixing widespread errors, massive federal sentence reductions, or something else.

The release dates can be found at https://www.bop.gov/inmateloc/ (entering "Bernard Hansen" or "Diane Erdmann").

Massive Sentence Reductions?

February 20, 2023 3:10PM ESTThe Bureau of Prisons is now showing Ross Hansen's release date as July 14, 2031 (more than 3 months earlier than the last change), and Diane Erdmann's release date as July 2, 2026 (about a month early).

Although the Department of Justice has alerted victims of this, no explanation was given. This is the second time in about 4 months that multiple felons have received sentence reductions in unrelated cases at about the same time. I have no idea if this is a normal occurrence, fixing widespread errors, massive federal sentence reductions, or something else.

The release dates can be found at https://www.bop.gov/inmateloc/ (entering "Bernard Hansen" or "Diane Erdmann").

Ross to be Released September 2, 2031

October 25, 2022 1:00PM ESTSeveral victims have told me that the received an email from the Department of Justice informing them that Ross Hansen's release date has been changed to September 2, 2031, which the Bureau of Prisons has confirmed. This is 20 days earlier than he was originally scheduled to be released. No information is known as to why this change was made; however, a similar change was made to the owner of Bullion Direct (who was in prison for a similar fraud scheme), whose release date was moved up by several months. So I am guessing that there was a re-calculation of release dates for many prisoners.

Diane at Pekin FCI (IL)

Release Date: 08/11/2026

October 25, 2022 12:55PM ESTThe Bureau of Prisons finally updated Diane's whereabouts, after several months of keeping people in the dark. She is now at Pekin FCI in Illinois, presumably at their minimum security satellite camp. Her release date is scheduled for August 11, 2026.

Ross now at Terminal Island FCI (CA)

Release Date: 09/22/2031

July 18, 2022 9:15PM ESTI was checking to see if Diane had been placed yet, and she has not (nor has her release date appeared at the BOP Inmate Locator page.

However, when I checked up on Ross (no webcams there yet, though), it shows that he is now at Terminal Island FCI, and it shows a release date of 09/22/2031. I have no idea why he was moved so quickly. I was a bit concerned when I read that Terminal Island FCI has a metal factory that makes "high-quality metal products" -- and pictured Ross in a black-and-white striped jumpsuit leading a gang of medal-making inmates. But no, they make metal products like desks (and perhaps the metal prison toilets, I imagine, as Home Depot doesn't usually have them in stock).

Ross at Victorville Medium II FCI (CA)

June 22, 2022 9:15PM ESTThe Bureau of Prisons is now showing that they have Ross in a nice comfy bunk in a prison cell at Victorville Medium II FCI (in California).

To look him up on that page, you need to enter "Bernard" as the first name, and "Hansen" as the last name.

As a medium security prison, my understanding is that he will be in a prison cell with a cellmate, and that it will be locked at night.

Ross is Appealing

June 16, 2022 6:50PM ESTSorry if the headline was misleading. Ross is appealing the final judgment and sentence.

Today his attorneys filed a simple notice of appeal, saying just "Notice of hereby given that Defendant Bernard Ross Hansen (Defendant Hansen) appeals to the United States Court of Appeals for the Ninth Circuit from the final judgment and sentence entered in this action on June 6, 2022."

Restitution

June 7, 2022 9:45PM ESTI forgot to mention about restitution.

Judge Jones ordered $32,163,327.52 of restitution for Diane, and $33,744,166.92 for Ross. The media in at least one case got this wrong, and thought it was $65M of restitution; it is not. It is marked with $32,163,327.52 as "joint and several". That means that Ross and Diane are both responsible for the first ~$32M, and only Ross is responsible for the rest. So if Diane won a $100M lottery ticket, she would have to pay the ~$32.1M -- leaving Ross responsible for the ~$1.6M. If Ross won a $100M lottery ticket, he would have to pay the full ~$33.7M, and Diane would owe nothing.

In theory, they should pay this money, and victims would get it. In reality, the chances are they aren't going to pay enough money to make any type of meaningful payout. Even if they came up with $300,000, that's a penny for every dollar owed.

How Were the Sentences Determined?

June 7, 2022 12:00PM ESTSomething that struck me about the hearing yesterday is that there was virtually no rationale given for the sentences that were imposed on Ross and Diane.

In the Tulving Company case, the judge started with the total offense level of 28 (78-97 months in prison), and then lowered it based on the various mitigating factors: 5 levels for cooperation and 4 for serious health issues, bringing the offense level to 19. The guidelines for a level 19 offense are to sentence 30-37 months in prison, and the judge went with 30 months.

Judge Jones did come up with the total offense levels: 43 for Ross (guidelines are for a life sentence), and 39 for Diane (guidelines are for a 262-327 month prison sentence). While he talked about what he read for sentencing (the various reports and memos), the reasons variances might be given (e.g. health), he never outlined his thought process, and just came up with 5 years for Diane and 11 for Ross. By my calculations, that works out to 11-12 levels variance for Ross, and 14-15 levels for Diane. But whether he mental calculated those new levels, or just picked numbers, one can only guess.

My hunch is that he played it safe, and just went with what the probation office recommended (5 years for Diane, 10 for Ross), and gave Ross an extra year so as to [1] not give the exact sentence the probation office recommended, and [2] slap his wrist for having masterminded the escape from justice. But, that's just speculation on my part.

UPDATE June 8, 2022 10:20AM EST: To be clear, I am not suggesting that the judge did anything wrong here. I would have liked for him to have provided more details about how he came up with his numbers. But it is up to the judge to decide the sentence, and there is nothing about the sentencing that seems out of the ordinary to me. If Diane were sentenced to 30 years in prison, or if Ross had been sentenced to 12 months of home confinement, it would be a different story.

Court Documents

June 6, 2022 7:20PM ESTThe court has filed the sentencing documents for Ross and Diane.

I should also point out that Diane asked to be placed at FCI Dublin, and the court agreed (although the Bureau of Prisons has the final say). Ross did not make a request for placement, nor did the judge make a recommendation, so the Bureau of Prisons will choose what they think best for him.

DoJ Press Release

June 6, 2022 7:10PM ESTThe Department of Justice has issued a press release, which covers some of the information from the sentencing (as well as some old news).

5 Years for Diane, 11 Years for Ross

June 6, 2022 3:25PM ESTI haven't gotten official confirmation from the court (PACER) yet, but several people have confirmed 60 months for Diane (5 years), and 11 years for Ross.

The hearing lasted about 2 hours and 40 minutes. It followed the typical sentencing formula, with each side giving their input, as well as 3 victims that spoke. The judge seemed to be judging them very harshly, but not letting that judgment interfere with a just sentence given the all the various "pushes" and "pulls" (upward/downward departures) from the sentencing guidelines. He could have given Diane up to 27.5 years in prison, and life for Ross.

As probably the only expert on fraud at established bullion companies in recent history, I was disappointed that the government allowed Hansen's attorney to claim that Hannes Tulving (owner of The Tulving Company) led a flashy lifestyle, "driving around in a Ferrari" (which happened for less than a year, and before the fraud began) and a living in a $30K/month condo (which was actually $5K/month, and going to someone who was involved in the downfall of the company). He lived very much like Ross, just in a nice area of town: Hannes Tulving worked nearly 24x7 (he would literally take orders in the middle of the night), never taking a vacation. But I doubt that had much, if any, influence on the outcome.

If anyone has any specific questions, please let me know (email is right above the posts), as I listened to the whole thing.

Slight clarification: it is 5 years and 11 years per count, to run consecutively. A distinction lawyers would notice, but does not (to my knowledge) have any effect on the amount of time they spend in prison: 5 years for Diane, and 11 for Ross.

UPDATE June 6, 2022 5:10PM EST: Another clarification: Given the way that federal prison sentences work, they must serve at least 85% of their sentence (assuming no successful appeals, pardons, etc.), and usually get out at that point for "good behavior". So Diane will likely serve a bit more than 4.25 years in prison, and Ross will likely serve a bit more than 9.35 years in prison.

Also, I did not mention, the judge assigned Diane a "offense level" of 39 for Diane, and 45 for Ross (which the government pointed out gets reduced to 43, which is the maximum level).

More Arrest Details

June 1, 2022 11:15AM ESTThe sentencing filings provide a bit more detail on what happened.

Oddly, the FBI seems to think that Ross and Diane traded one of their cars for the 2005 minivan they were driving. However, the minivan was theirs (Diane got to keep it in her bankruptcy, since the trustee felt it was worth less than the costs of selling it).

After the sentencing hearing, the FBI went to Ross and Diane's rented house. The FBI "observed individuals moving belongings out of the residence." This is strange. While there was a good chance that they would have been detained at the sentencing hearing, it was not certain, so they would not have made plans to have someone remove their belongings that night.

They also stayed at Bremerton, WA, which was previously unknown.

After surveillance, Ross was arrested while walking their dog, and Diane was arrested in the hotel office. They had 3 loaded firearms in their car, but apparently none on them or in their hotel room. They also had a "burner" Tracfone and some ammunition, along with a Walmart receipt and reading glasses. They apparently had less than $1,000 cash with them.

Sentencing On Track

June 1, 2022 11:00AM ESTThe government has filed a new sentencing recommendation, asking for just an extra year for Ross and 6 months for Diane (16 years and 8 years, respectively). They seem to be using the fleeing more to justify their reasons for the original sentences, rather than to be "greedy" and ask for a lot more prison time. The government points out that while Ross and Diane feel they should have lower sentences for health issues, if they were healthy enough to flee, they are healthy enough for prison. The Probation Office feels 2-3 extra years should be added to their sentences.

Ross believes the fleeing should not impact their sentences. His attorney made it sound like what it was: a very foolish, poorly planned last-minute decision. His attorney points out that Ross was surprised that the FBI took so long to find them. And finishes by saying that fleeing "should not significantly alter [the Court's] approach to sentencing in this case."

Diane, however, had her attorney request a slightly longer sentence (3 years, instead of the 2 she initially requested), which was likely a smart move, as it shows her taking some responsibility for her actions.

The government probably made a very wise move by only asking for a small addition to the sentence for fleeing: it helps prevent the government from looking greedy, and helps solidify their case for 8 years for Diane and 16 years for Ross.

This leaves Judge Jones in the difficult position of determining a sentence. He probably had something in mind before, and the fleeing likely isn't going to reduce what he was initially thinking. The fleeing ultimately makes the judge look bad, as he was the one that allowed them to be free for the past nearly 4 years since they were originally arrested. He also needs to take "general deterrence" into account: he needs to let people thinking of fleeing know that it isn't in their best interest.

The final nearly unspoken factor in sentencing is where they will go. The judge cannot decide this (the Bureau of Prisons does), but the judge can make recommendations. In my mind, fleeing makes it unlikely that the judge will recommend them for a minimum security "camp".

Diane: BOP #49005-086, Ross #16745-086

May 12, 2022 7:45AM ESTThe Bureau of Prisons has now released information on both of them. They are both, as I suspected, staying at SeaTac FDC while awaiting their sentencing on June 6 at 9AM. You can confirm this information at https://www.bop.gov/inmateloc/ (using "Diane Erdmann" and

UPDATE June 14, 2022 9:00AM EST: The Bureau of Prisons has surprisingly updated Ross Hansen's name in their system. Previously, using "Ross" as the first name and "Hansen" as the last name would find him; now, it does not (I believe they had him listed as "Ross Bernard Hansen"; he has been listed in court cases, and was registered to vote, as "Bernhard Ross Hansen" (with a "h" in Bernhard)).

Sentencing Hearing June 6 at 9:00AM

May 11, 2022 8:10PM ESTThe court's notes for today's hearing confirm what I had heard:

MINUTE ENTRY for proceedings held before Judge Richard A. Jones - CRD: Victoria Ericksen; AUSA: Brian Werner, Benjamin Diggs; Def Cnsl: Benjamin Byers; PTS: Michael Munsterman; Court Reporter: Nancy Bauer; BOND REVOCATION HEARING as to Diane Renee Erdmann held on 5/11/2022. Defendant advised of Allegations 1 and 2 as set forth in the 5/10/2022 Petition. Defendant DENIES the allegations. For the reasons set forth on the record, the Court GRANTS the government's motion to remand Defendant pending sentencing and REVOKES Defendant's appearance bond. SENTENCING set for 6/6/2022 at 9:00 AM in Courtroom 13106 before Judge Richard A. Jones. Supplemental sentencing materials due by 5/31/2022. Defendant remanded to custody. (VE) (Entered: 05/11/2022)

"Nugget"

May 11, 2022 6:35PM ESTAnother piece of information has come out about the mastermind plan behind how Ross and Diane were able to get 11 extra days of freedom (in exchange for perhaps a few extra years in prison). They called their dog Stewie "Nugget" to help avoid detection.

They also parked their car in the back of the motel, away from the street, and told employees they were doing so so that "family members" wouldn't be able to find them. Ross apparently was talking a lot to people, doing his typical conning-even-when-there-is-nothing-to-gain, saying how he was working for the government and just quit.

Note to self: the next time I become a fugitive, tell people the truth, but use codewords. "FBI" becomes "family members", and "being sought by" becomes "working for".

Ross and Diane Staying In Custody

May 11, 2022 4:30PM ESTA reader with knowledge of the hearing today says that Ross and Diane did show up this time, in prison jumpsuits. Ross' attorney could not think of a credible argument to that Ross should not remain in custody, while Diane's attorney suggested home monitoring would be sufficient. However, Judge Jones not surprisingly kept both in custody. The new sentencing hearing will be on June 6 at 9:00AM, allowing time for new sentencing recommendations.

I have not been able to confirm this with the court (and will provide an update when I do), but was able to confirm the June 6 date with another source. A big "Thank You" to the people who updated me (without people providing information like this, I don't have as much to write about, or it takes a lot longer to update people).

Stewie Safe

May 11, 2022 1:15PM ESTIt has been reported that Stewie, Ross and Diane's dog, is safe and unharmed, and has been placed with a family member.

Ben and Kat Alexander

May 11, 2022 12:50PM ESTAccording to a media report, part of the intricate plan to avoid capture involved using aliases. They apparently did not use their real names when checking into the motel they were captured at, but instead used the names "Ben Alexander" and "Kat Alexander". I have to wonder if they were pretending to be married, or pretending to be siblings.

Ross Hansen: at SeaTac FDC

May 11, 2022 12:30PM ESTIt loos like Ross Hansen spent the night at SeaTac FDC, and has has an inmate number (Bureau of Prisons Register Number) of 16745-086. I believe that is the same one he was using back around 1994.

Although Diane is almost certainly also at SeaTac FDC, I cannot find any trace of her whereabouts yet, for a number of possible reasons (the BOP system may not have processed her yet, the website may not be updated yet, or they may have her name wrong).

Thank You

May 11, 2022 10:50AM ESTI wanted to say "Thank You" to a number of people:

- The person who spotted Ross and Diane and reported it, leading to their capture

- The FBI and others involved in their capture, who risk their lives to protect the public

- Everyone who provided tips

Hearing Tomorrow

May 10, 2022 8:50PM ESTRoss and Diane will be in court tomorrow (Wednesday) at noon, in front of Judge Jones, who has overseen their case since the beginning.

Court documents show that they had firearms with them, in further violation of their bond.

I expect that the hearing tomorrow will just cover the bond, a technicality to keep them in custody, and that a new sentencing date will be announced soon.

CAPTURED

May 10, 2022 5:27PM ESTIt is official, the FBI has confirmed that they have been captured. More details as soon as I get them.

UPDATE May 10, 2022 6:10PM EST:

They were caught at the Hadlock Motel in Port Hadlock, WA, about halfway between their home and the Canadian border. They were smart enough to switch license plates, but the FBI agents investigating a tip were smart enough not to walk away when they saw the wrong plates on a 2005 Chevy Astro.

Captured?

May 10, 2022 5:25PM ESTI've just heard from a realiable source that the FBI has captured Ross and Diane. No further details are available. I have not been able to confirm this, but will update as soon as I have.

Media, Investigators...

May 10, 2022 8:40AM ESTI wanted to welcome any media and investigators (or other like-minded individuals) to this site, as news of Ross Hansen and Diane Erdmann's fugitive status grows. I have been following this case since January, 2016 (about 3 months before the scheme was shut down), and have thousands of documents (I am a firm believer in provable facts). I assist victims at no cost, mostly through this site and an email list. No media source reported it until 3 days later, after the FBI Most Wanted poster was released.

I am happy to discuss this with you (contact information above), answer any questions, or help lead you to the information you seek.

Normally, I try to let justice run its course on its own, trying not to do anything to alter the outcome of a criminal trial or sentencing. However, now that Ross Hansen and Diane Erdmann have been convicted, and are clearly fleeing, I am happy to do anything I can to help them be apprehended.

FBI MOST WANTED

May 2, 2022 5:30PM EST

The FBI has issued a "WANTED" poster for Ross Hansen and Diane Erdmann.

(thank you to the person who submitted the file at the anonymous tips page).

Tips Wanted

May 2, 2022 3:10PM ESTThere are 3 possibilities at this point: [1] Ross and/or Diane have been apprehended, [2] They have intentionally fled to evade prison, or [3] They have a valid excuse for not showing up at the sentencing.

At this point, more than 72 hours after the sentencing hearing began, #3 seems less and less likely. If they had been delayed due to a car accident, that would be resolved by now. If their house caught on fire, that would be known by now. Sure, it's possible they got into an accident and are unconscious or have amensia (but I would think those responsible for apprehending them would have checked hospitals near the route from their house to the court). But the odds of those valid reasons go down as each hour passes. Of course, it would take some time to find out about a valid explanation.

So given that #2 -- fleeing -- is a very strong probability at this point, if anyone has information on their possible whereabouts, feel free to leave me a note on the anonymous tips page (or email me directly, which would be necessary for a response; my gmail address is on the "Contact:" line above). Knowing Ross, he likely would have talked about this before the sentencing hearing, but is not bold enough to have talked to people afterwards. But my guess is that someone knows something.

Page on Their Arrest Status

April 30, 2022 8:35AM ESTI have added a page at about.ag/RossDiane_ArrestStatus.htm where I will provide any updates on the status of their arrest.

NO SHOW

April 29, 2022 5:15PM ESTThe sentencing hearing started at about 1:45PT. Neither Diane Erdmann nor Ross Hansen was present. The judge asked the attorneys, and one had emailed with Ross (or Diane?) last night. The judge asked if their could have been any confusion about the timing of the hearing, and it did not sound like that was the case.

The government then requested a warrant for their immediate arrest, and the judge said he had no alternative but to grant the request. He also pointed out that the court has a low toleratnce for not being on time for a sentencing. He issued a recess until 2:00, and shortly afterwards he announced that he had issued the warrant for their arrest, and terminated the hearing.

So there are two possibilities here:

- Ross and Diane intentionally skipped town. If this is the case, the warrant has been issued, and if found, they will likely be in prison until the sentencing, at which point their prison term at sentencing will be increased, or

- They had a lame excuse: a flat tire, emergency, or something like that, in which case the sentencing will get delayed. But that does not explain why neither called their attorneys.

Pre-sentencing Documents

April 23, 2022 11:30AM ESTA lot of documents have been filed in the past 2 days, getting ready for the sentencing on Friday, April 29, 2022 at 1:30PM.

The Probation Office has recommended a 3-year sentence for Diane, and a 7-year sentence for Ross. The Government wants a 7.5 year sentence for Diane, and a 15 year sentence for Ross. Diane is requesting a 2 year sentence, Ross wants a sentence of undetermined length that is significantly less than 7 years.

Sentencing guidelines provide a fairly narrow range for a recommended sentence, after calculating a "level" (based on factors such as the amount of loss) and criminal history (which I believe is not considered in this case, since Ross' criminal history was too long ago). The largest factor by far is the amount of the loss, which the Government pegs at over $25M. That adds 22 levels to the guidelines, versus just 8 for a loss under $150K.

Ross is claiming the loss "cannot reasonably be determined", and therefore the gain to him should be used. He believes the loss to be incalculable in part because of the poor accounting system that NWTM used and because of Calvert's mishandling of the Chapter 11 bankruptcy. He then tries to show that his gain was just $97,030 (the owner's draws from July 2015 until bankruptcy). This would have the potential of reducing his sentence as much as about 10 years.

I'm sure common sense will prevail as to whether $97,030 or $33M is a more reasonabe representation of the amount of loss to NWTM customers.

Sentencing Continued to April 29, 2022 1:30PM

March 16, 2022 6:45PM ESTThe judge just allowed another motion to continue sentencing to April 29, 2022 at 1:30PM.

This was due to a delay in Diane getting the second hip replacement surgery.

Sentencing Continued to April 1

January 3, 2022 5:25PM ESTThe judge just allowed a motion to continue sentencing to April 1, 2022, at 1:30 p.m.

For Diane, this was to allow her time to get a hip replacement, and for Ross, the ability to assist Diane during the recovery time.

The government argued that the sentencing should go on as expected (with any prison sentence to start after Diane's recovery). It was pointed out, however, that the Bureau of Prisons ultimately decides when the prison sentence starts (with input from the judge), so the only way to assure that she would be able to get recovery time was for the sentencing to be continued. Of course, other factors were taken into consideration as well (including the increase in COVID cases).

Victim Impact Statements Due Dec. 3

October 18, 2021 12:45PM ESTThe government has sent out an email to victims a couple of days ago, alerting them to the change in date for the sentencing.

One important piece of information is that the deadline for Victim Impact Statements has been extended, to December 3, 2021.

As it stands, the government has received somewhere in the vicinity of 600 such statements (as of October 5, they had processed 400, with several hundred more in the works). Unlike most court documents, these statements are not public. Ross Hansen, Diane Erdmann, the government, and their attorneys can access them, but lowly people like myself cannot (for good reason; most people would not want these details shared).

The victim impact statement serves a number of purposes. The most obvious is that it helps the judge determine a sentence (the judge has guidelines for prison sentence length, but needs to decide where in the range is apporpriate, or if there are reasons to go above/below the guidelines). There's a big difference between "I paid for a $20 silver eagle and didn't get it, I am so mad!" and "I lost my life savings, but working after retirement isn't so bad" and "My wife still won't forgive me for trusting Ross". It can also help provide a sense of closure for victims.

As far as convicted felons awaiting sentencing are concerned, the most damning potential of the victim impact statements is if they show a "substantial financial hardship." If one or more victims meet this criteria, 2 levels are added to the sentencing guidelines. If there are 5 or more victims meeting that criteria, 4 levels are added. If it hits 25 victims meeting that criteria, 6 levels are added. The difference between 0 or 25 victims meeting that criteria could result in an 8-10 year difference in the length of the sentence.

Sentencing Now January 7, 2022

October 12, 2021 8:20PM ESTJudge Jones has ordered that the sentencing be continued until January 7, 2022 at 1:30PM.

Ross's attorneys argued that they needed more time, given their other commitments, the 500+ pages of victim impact statements, and the large spreadsheet used to calculate losses. Diane's attorneys argued that she needs to complete 2 months of psychological testing in order for the judge to properly determine her sentence.

Calvert Loses, Yet Again

August 8, 2021 8:45AM ESTIn October, 2019, in an 85 page ruling, Judge Alston denied Calvert nearly all his fees as Trustee. Calvert was understandably mad, and appealed -- but lost his appeal.

Recently, Calvert asked for $40,000.00 to cover estimated expenses in closing the bankruptcy case (100 hours at $400/hr). At a hearing, Judge Alston asked for an explanation. Calvert responded by reducing his request to $19,000.

Judge Alston ruled that Calvert get none of those estimated expenses. Among other things, Judge Alston stated that "the Trustee is asking the Court for an award of compensation for services he has not provided in this case", "the Trustee s failure to even attempt to justify his initial $40,000 estimate ... equates to a tacit acknowledgement that he grossly overstated his initial request for compensation.", and "the Trustee knowingly and intentionally sought compensation for services that he knows will be provided by another professional."

More Details

August 2, 2021 3:40PM ESTA few more things about the guilty verdict:

Ross and Diane are still out on bond (but without their passports). My guess is that they will be required to self-report to prison sometime shortly after the sentencing (the Bureau of Prisons will choose the date and the prison, likely with a recommendation by the judge).

Before the sentencing, a "Presentence Report" (PSR) will be made. This will not be available to the public, but the defendant usually can see it (with names in victim statements redacted). It contains various details that may be relevant to sentencing. In this case, one of the most important pieces will be the Victim Impact Statements. These are written (and/or oral, in person) statements from victims that "describe the emotional, physical, and financial impact [they] have suffered as a direct result of the crime." One way these affect the sentence is that if the crime resulted in "substantial financial hardship" to 5 or more victims, 2 levels are added (or 4 levels if there were 25 or more 25 victims with substantial financial hardship). A difference of 2 levels can affect the sentence by about 2-4 years in this case.

It is very hard to predict the length of their prison sentences. According to the 600+ page 2018 Guidelines Manual, I estimate that they will end up at roughly level 35," which work out to a guideline of 14 to 17.5 years in prison. However, many other factors are taken into consideration, and the sentence could be much less than that (even just probation), or possibly higher. Wire/mail fraud carries a maximum 20 year sentence (which the judge should not exceed) per count. Normally all counts would be treated the same ("grouped"), with the sentences running concurrently (a single sentence), which the guidelines seem to explicitly suggest (see example #3 in Note 6 on page 370 of the Guidelines Manual). However, if the judge felt it necessary to treat unfulfilled orders, storage and/or lease metals differently (which I doubt would happen), I believe it would result in well over Level 43 where a life sentence is recommended.

If I had to guess, I would go with somewhere around 14-16 years. However, as I suggest in the previous paragraph, I could be way off. The judge could be very lenient or very harsh, there could be factors that I am not accounting for (such as health issues), or I could simply be misinterpreting the complex guidelines.

As reference, in the Tulving Company case, the owner was at Level 28. The judge reduced that 5 levels for cooperation with the investigation, and another 4 points for medical issues. That led to a guideline of 30-37 months, and the judge went with 30 months (2.5 years). With Bullion Direct, the owner was sentenced to 10 years in prison (details on points are not known).

Jury Verdict Form

August 2, 2021 1:20PM ESTFor those that are curious, the Jury Verdict Form was just released.

It is a 7 page form that goes through each count, and shows whether Ross Hansen and/or Diane Erdmann were found guilty on each count.

GUILTY

July 30, 2021 8:10PM ESTThe court just released the information that Ross Hansen (mis-spelled in the minutes as Hanson) is guilty on 14 counts, not guilty on 1 count. Diane Erdmann is guilty on 13 counts, not guilty on 2 counts.

MINUTE ENTRY for proceedings held before Judge Richard A. Jones - CRD: Victoria Ericksen; AUSA: Brian Werner, Benjamin Diggs; Def Cnsl: Angelo Calfo, Anna Cavnar and Henry Phillips for Defendant Hansen; Russell Aoki, Steven Fogg, Isham Reavis and Benjamin Byers for Defendant Erdmann; Court Reporter: Debbie Zurn; JURY TRIAL Day 16 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/30/2021. At 9:05 a.m., the jury returns and resumes deliberations. At 3:36 p.m., the jury returns to open court with the following verdicts: As to Defendant Bernard Ross Hanson, GUILTY as to Counts 1, 3, 4, 5, 6, 8, 11, 12, 13, 14, 15, 16, 19 and 20; NOT GUILTY as to Count 9. As to Defendant Diane Renee Erdmann, GUILTY as to Counts 1, 3, 4, 5, 6, 8, 11, 12, 13, 14, 16, 19 and 20; NOT GUILTY as to Counts 9 and 15. For the reasons set forth on the record, the Government's motion to remand Defendant Hansen is DENIED. Sentencing set for 10/29/2021 at 9:00 AM in Courtroom 13106 before Judge Richard A. Jones. Defendants remain on bond. (VE) (Entered: 07/30/2021)

Trial, Thu July 29

July 29, 2021 8:10PM ESTJURY TRIAL Day 15 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/29/2021. At 9:02 a.m., the jury returns and resumes deliberations. At 4:30 p.m., the jury is excused to return on 7/30/2021 at 9:00 AM to resume deliberations.

Trial, Wed July 28

Deliberations Begin

July 28, 2021 8:35PM ESTJURY TRIAL Day 14 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/28/2021. Counsel present closing arguments. The alternate jurors are selected and excused. At 3:50 p.m., the jury commences deliberations. After inspection and approval by counsel, all admitted exhibits are provided to the jury. At 4:32 p.m., the jury is excused to return on 7/29/2021 at 9:00 AM to resume deliberations.

Jury Instructions

July 28, 2021 3:25PM ESTThe judge has filed the 32 page jury instructions, which instruct the jury on exactly how what they are supposed to determine and how they are supposed to determine it. For example, it defines "reasonable doubt" and the elements of fraud that must be met for a guilty verdict.

Trial, Tue July 27

July 27, 2021 8:50PM ESTNote: It looks like we are nearing the end of the trial; yesterday, the government rested, and today both defendants did.

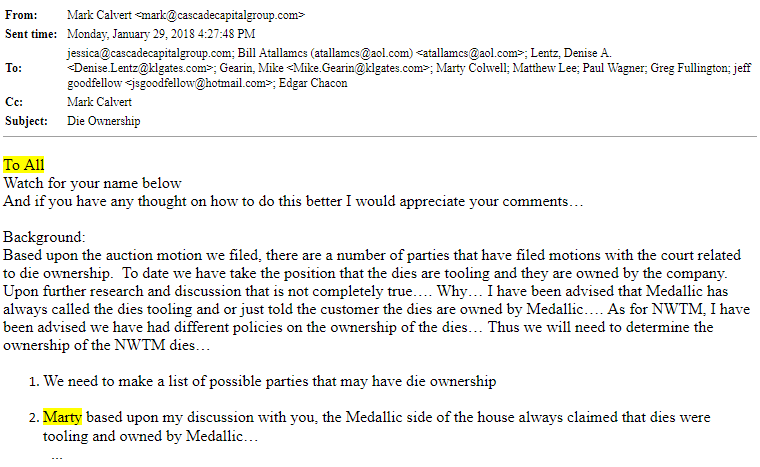

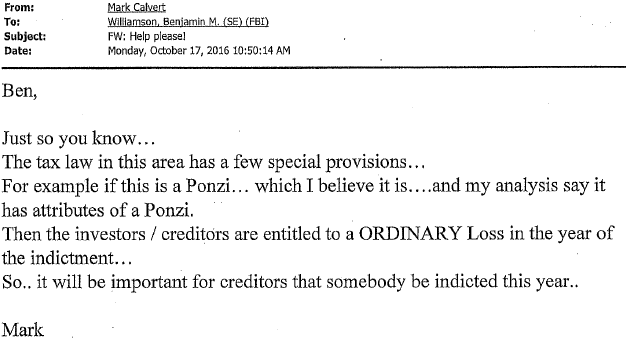

JURY TRIAL Day 13 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/27/2021. The testimony of Mark Calvert resumes and concludes. Anne Layne is sworn and testifies. Exhibits Admitted: 581a, 1044, 1046, 1446, 1458, 1473, 1474, 1475 and 2001. Defendant Hansen rests. Defendant Erdmann rests. Objections and exceptions to the Court's proposed jury instructions are noted for the record. The Court instructs the jury. Jury trial to resume on 7/28/2021 at 9:00 AM, before Judge Richard A. Jones.

Trial, Mon July 26

July 27, 2021 7:55AM ESTJURY TRIAL Day 12 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/26/2021. The testimony of Special Agent Andrew Cropcho resumes and concludes. Government rests. Defendant Hansen's motion for judgment of acquittal pursuant to Federal Rule of Criminal Procedure 29 is DENIED. Defendant Erdmann's motion for judgment of acquittal pursuant to Federal Rule of Criminal Procedure 29 is DENIED. Special Agent Ben Williamson and Mark Calvert are sworn and testify. Exhibits Admitted: 574, 581 (excluding page 3), 1022, 1028, 1034, 1035, 1385, 1459, 1476 and 1786. Exhibits Refused: 1011 and 1465. Jury trial to resume on 7/27/2021 at 9:00 AM, before Judge Richard A. Jones

Trial, Thu July 22

July 22, 2021 10:30PM ESTJURY TRIAL Day 11 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/22/2021. The testimony of John (Jack) Szczerban resumes and concludes. Jose (Dino) Vasquez, Samantha Blizard and Special Agent Andrew Cropcho are sworn and testify. Exhibits Admitted: 400d, 404a, 405a, 499, 532, 538, 542, 545, 546, 547, 548, 550, 552, 553, 1756, 1757, 1758 and 1759. Jury trial to resume on 7/26/2021 at 9:00 AM, before Judge Richard A. Jones.

Trial, Wed July 21

July 21, 2021 8:30PM ESTJURY TRIAL Day 10 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/21/2021. Diane Hopkins is sworn and testifies. The testimony of Greg Fullington resumes and concludes. The testimony of Paul Wagner resumes and concludes. Richard (Russ) Wilson and John (Jack) Szczerban are sworn and testify. Exhibits Admitted: 11, 12, 20, 115, 146, 147, 487, 529, 530, 1110, 1390, 1747, 1755 and 1760. Exhibits Refused: 1115 and 1385 (pages 3-10 only). Jury trial to resume on 7/21/2021 at 9:00 AM, before Judge Richard A. Jones.

Trial, Tue July 20

July 20, 2021 9:50PM ESTJURY TRIAL Day 9 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/20/2021. Patricia Williams, David Carver, John Young, Jason Calhoun, and Greg Fullington are sworn and testify. Exhibits Admitted: 132, 139, 167, 168, 169, 170, 171, 172, 173, 174, 175, 176, 177, 178, 179, 180, 181, 533, 1315, 1720, 1721, 1725, 1726, 1727, 1728, 1730, 1731, 1732, 1733, 1734, 1735, 1738 and 1742. Exhibits Refused: 534 and 1717. Defendant Hansen's oral motion for a mistrial is DENIED. Jury trial to resume on 7/20/2021 at 9:00 AM, before Judge Richard A. Jones.

Trial, Mon July 19

July 19, 2021 8:50PM ESTJURY TRIAL Day 8 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/19/2021. Testimony of Alea Guerra resumes and concludes. Sam Furuness, John Drummey, Steven Campau, John Jankowski and Paul Wagner are sworn and testify. Exhibits Admitted: 60, 61, 63, 78, 380, 381, 383, 384, 385, 386, 387, 388, 391, 405d, 496 and 1350. Exhibits Refused: 1064 (reoffered and refused) and 1329. Jury trial to resume on 7/20/2021 at 9:00 AM, before Judge Richard A. Jones.

Trial, Thu July 15

JURY TRIAL Day 6 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/15/2021. Raymond (Ken) Farrell, Edward (John) Rickey, John (Mike) Orms, Norman Hauptman, William Hanson, Julie Howe and Alea Guerra are sworn and testify. Exhibits Admitted: 116, 117, 119, 121, 123, 124, 125, 126, 127, 129, 130, 148, 150, 151, 152, 153, 182, 183, 184, 185, 186, 187, 267, 268, 488, 490, 526, 527, 1278, 1291, 1704 and 1711. Exhibit Refused: 1285. The Court hears from counsel for Defendant Hansen ex parte in closed proceedings as set forth in the sealed record. The Court hears argument on Defendants' 307 Joint MOTION to Preclude Government from Calling Belatedly Disclosed Witnesses. For the reasons stated on the record, the Court denies the motion as to Dino Vasquez and Patty Williams, and reserves ruling as to Jack Szczerban. The motion is moot as to Reed Thayer, as the Government indicates it does not intend to call Mr. Thayer as a witness. Jury trial to resume on 7/19/2021 at 9:00 AM, before Judge Richard A. Jones.Trial, Wed July 14

JURY TRIAL Day 6 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/14/2021. Testimony of Bud Jameson resumes and concludes. Kyle Markley, Debbra Fillo, Peg Morris, Kim Neff and Jeff Goodfellow are sworn and testify. Exhibits Admitted: 37, 101, 103, 104, 140, 142, 143, 144, 145, 199, 200, 201, 202, 203, 204, 205, 206, 207, 208, 209, 210, 211, 212, 213, 261, 263, 272, 273, 278, 319, 322, 400a, 405c, 405e, 521, 522, 523, 524 and 525. Jury trial to resume on 7/15/2021 at 9:00 AM, before Judge Richard A. Jones.

Probation Violations

July 14, 2021 8:40 AMRoss Hansen has now been caught violating his probation 4 times by talking to witnesses. Yesterday he reportedly stated to a witness "By the way, this is prison for the rest of my life."

Trial, Tue July 13

JURY TRIAL Day 5 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/13/2021. Testimony of Derrin Tallman resumes and concludes. David James, Diane Wong, Annette Trunkett and Bud Jameson are sworn and testify. Exhibits Admitted: 50, 51, 52, 53, 54, 55, 56, 57, 84, 86, 194, 195, 196, 198, 298, 299, 300, 301, 302, 303, 310, 315, 316, 403a, 486 and 1231. After hearing from Defendant Erdmann and her counsel ex parte in closed proceedings, for the reasons stated on the record, the Court DENIES Defendant Erdmann's motion to discharge her attorneys and for appointment of new counsel. Jury trial to resume on 7/14/2021 at 9:00 AM, before Judge Richard A. Jones.Trial, Mon July 12

JURY TRIAL Day 4 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/12/2021. Testimony of Catherine Hopkins resumes and concludes. Christopher Welch, Shawn Boelens, Brent Bassett and Derrin Tallman are sworn and testify. Exhibits Admitted: 4, 6, 160, 161, 162, 163, 164, 165, 166, 304, 305, 306, 307, 308, 309, 513, 1068, 1150, 1151, 1153, 1157, 1165, 1218, 1684, 1690, 1691 and 1693. After hearing argument of counsel, for the reasons stated on the record, Defendant Erdmann's 304 MOTION for Mistrial is DENIED. Jury trial to resume on 7/13/2021 at 9:00 AM, before Judge Richard A. Jones.Trial, Thu July 8

July 8, 2021 9:25PM ESTThe judge denied the defendant's motion to exclude from evidence the $700,000 of precious metals that Diane Erdmann sold after the bankruptcy, which she states was hers. The minute entry states (I removed the names of customers):

JURY TRIAL Day 3 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/8/2021. Testimony of Erin Robinson resumes and concludes. [Bullion Customer], [Bullion Customer] and Catherine Hopkins [general counsel for NWTM ~2010] are sworn and testify. Exhibits Admitted: 14, 138, 188, 189, 191, 192, 193, 224, 225, 461, 493, 1078, 1155, 1508 and 1509. Exhibits Refused: 13 and 1064. Jury trial to resume on 7/12/2021 at 9:00 AM, before Judge Richard A. Jones.

Trial, Wed July 7

July 7, 2021 8:35PM ESTNothing really to report. The minute entry states:

JURY TRIAL Day 2 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/7/2021. The Court preliminarily instructs the jury. Counsel present opening statements. Erin Robinson is sworn and testifies. Exhibits Admitted: 26, 27, 28, 29, 31, 33, 34, 46, 251, 256, 258, 259, 260, 262, 264, 265, 266, 269, 270, 271, 274, 275, 279, 280, 286, 287, 288, 289, 294, 295, 296, 297, 410, 411, 414, 416, 418, 419, 420, 421, 422, 423, 425, 426, 427, 428, 429, 430, 483, 484, 485 (illustrative only) and 491. Jury trial to resume on 7/8/2021 at 9:00 AM, before Judge Richard A. Jones.

Trial Underway

July 7, 2021 10:10AM ESTThe criminal trial against Ross Hansen and Diane Erdmann started yesterday. The court's "minute entry" for yesterday was "JURY TRIAL Day 1 as to Bernard Ross Hansen and Diane Renee Erdmann held on 7/6/2021. Voir dire commences. The jury is sworn and empaneled. Jury trial to resume on 7/7/2021 at 9:00 AM, before Judge Richard A. Jones."

From my understanding, that simply means that the jury has been selected. I do not have any other updates (if you do, feel free to contact me -- you can use the anonymous tips page if you like).

One outstanding issue is that the defendant's attorneys filed an "in limine" motion (one that the jury is not supposed to see) July 2, the last business day before the trial started, asking for certain evidence to be excluded from the trial (items that Hansen and/or Erdmann sold to fund legal expenses; I won't go into more details unless the judge denies the motion). The government responded pointing out that the motion was filed very late, well after the normal deadline, and pointing out what they believe to be flaws in the legal argument to exclude the evidence.

The good news is that the trial has finally started. That is what I know at this point, and I will continue to update this page as I get further details.

UPDATE July 8, 2021 10:40AM EST: The judge has ruled that the evidence mentioned in the "in limine" motion may be used. It specifically refers to the $700K of precious metals that Ms. Erdmann sold. The defendants did not want the evidence of those sales included, but the judge ordered that the government may include that evidence.

Trial Starting Tuesday

July 1, 2021 3:15PM ESTThe criminal trial again Ross Hansen and Diane Erdmann is on track to (finally!) start on Tuesday, July 1, 2021.

There is zero doubt that a crime occured: while millions of dollars of unfulfilled customer orders could conceivably not be a crime, millions of dollars of missing storage metal can only be lost or stolen. Millions of dollars of "lost" precious metals is a story only a child could believe, and stolen is a crime. The question, of course, is whether Hansen and/or Erdmann are responsible: the government says yes, they say no. That's why there is a trial.

The government presents a compelling case: that NWTM, after delayed orders in 2008 resulted in a Consent Decree with the Attrorney General, kept losing money, and Ross Hansen and Diane Erdmann kept the company afloat by delaying orders further, and enticing customers to place orders. Rather than enriching themselves, the government says they used the money to turn NWTM into the largest privately owned mint. The government points out that somewhere around 95% of large (over $1,000) bullion orders were too late (not adhering to the 2008 Consent Decree) or never delivered, and they state that Erdmann would give priority to orders where people said they would complain to outside organizations. They plan to back up their position with 484 exhibits and 56 witnesses.

Hansen and Erdmann, on the other hand, explain this as just "going out of business" and say "poor business practices are not fraud, and bankruptcy is not a crime." Their trial brief states that "Under Mr. Calvert s direction, thousands of NWTM customers lost funds sent for orders which had not been fulfilled at the time of bankruptcy or failed to recover stored metal after Mr. Calvert s firm, Cascade Capital Group, took control of the assets of the company. But these losses were sustained after the defendants left."

Tax Loss Information

June 23, 2021 1:00PM ESTI have just added a webpage that covers information on how to deduct this as a tax loss on your tax return.

The basics: I believe it should be fine to deduct the amount you paid NWTM (or the price you originally paid for metal stored at NWTM) as a capital loss, most likely on your 2021 tax return (although 2018-2020 would likely be OK as well).

Ross told in 2011: "Criminal charges could result"

April 20, 2021 2:50PM ESTIn the criminal trial, Ross Hansen is hoping to get the judge to exclude as evidence a letter written in 2011 by an in-house attorney that stated "I advised [Ross Hansen] that both civil liability and criminal charges could result..."

He is also hoping to exclude a letter written by a different in-house attorney in September, 2015 that included: "It is my belief that these business practices expose NWTM and Ross Hansen to criminal and civil liability" and "NWTM has used some of the [storage bullion] to fulfill... orders", "NWTM is using customer payments to fulfill other customer's orders, pay debts of NWTM...", "these actions are keeping NWTM in business", "akin to a Ponzi scheme", "... this has been NWTM's business model from its earliest days of operation."

The last statement I included is sounds eerily familiar: Bullion Direct was in operation for about 15 years, and has a failed business plan from the beginning, spending $15M+ of customer stored metal to keep the business afloat. The owner is due in federal prison in less than a month for a 10-year prison sentence (which he already appealed once unsucessfully, and plans to re-appeal).

Calvert Loses Appeal

January 29, 2021 12:45PM ESTAs I mentioned in February, NWTM Chapter 11 Trustee Mark Calvert appealed the judge's decision to deny much of his fees.

The appeals court affirmed the bankruptcy court's decision (meaning that his appeal was denied).

Hansen/Erdmann Trial July 6, 2021

January 1, 2021 10:00AM ESTThe judge in the criminal trial against Ross Hansen and Diane Erdmann has filed an order that sets the criminal trial to start on 7/6/2021 (time/location TBD).

Hansen/Erdmann Trial February 22, 2021

December 5, 2020 1:40PM ESTSee updated trial date in update above.

Hansen/Erdmann Trial January 11, 2021

March 24, 2020 2:00PM ESTSee updated trial date in update above.

Calvert Appealing Denial of Expenses

February 23, 2020 6:25PM ESTThis happened a while back, but Chapter 11 Trustee Mark Calvert has filed an appeal (case #2:20-cv-00079-MJP), believing that he should receive payment for his work as Trustee in this case. The fees directly to him as Trustee were denied, as I previously reported.

I am watching this, and will report as I hear more information.

Calvert's Attorney Avenatti In Jail

January 17, 2020 9:35AM ESTAs I have reported, in the Meridian case Calvert used the services of attorney Michael Avenatti.

Avenatti has now been accused of wrongdoing by quite a few people, has several lawsuits against him, and facing 3 indictments. Avenatti vigorously denies any wrongdoing.

However, Avenatti took $1M in legal fees he received in April, 2019 and attempted to keep it from his creditors. His attorney claims that he did so legally, paying debts in an order he chooses. The prosecutors say he defrauded and concealed money from creditors, by sending $700K to his ex-wife and buying cashier's checks to drain the bank account (re-depositing them when he needed money). They also say he structured financial transactions to avoid reporting requirements.

The New York Times states that if convicted, he could face up to 300 years in prison.

Calvert to Get Nothing

... Gearin gets 35%, Cascade 55%, Northrup 97%

October 11, 2019 8:25PM ESTI haven't had a chance to read the entire 85-page ruling, but it looks like Judge Alston's ruling on compensation awards Northrup nearly every penny he requested, Cascade most of the money it billed for (except amounts billed by Calvert for work that should have been done as the trustee). K&L Gates (the law firm Gearin works for) was chastised and ended up with about 35% of what they billed for (which was generous: Judge Alston made it clear they could have received nothing). Calvert was awarded just $14K for expenses, and nothing for the $1M in fees he billed for.

I will likely be adding more as I digest the entire ruling.

UPDATE: Those percentages are based on what was billed. However, where the estate has cash equal to only about 40% of the billed expenses, that seriously affects the outcome. It looks like Northrup is going to get more than twice what he would have if all expenses were allowed, Cascade will get about 50% more, and K&L Gates will get about 80% of what they would have received if all expenses were allowed. So this seems like a 'slap on the wrist' for Gearin and a windfall for Northrup. While severe for Calvert, with Cascade getting about 50% more than it would have otherwise, Calvert will likely be getting a decent amount.

Diane's Seized Metal to be Sold

October 2, 2019 6:50PM ESTBoth Calvert and the trustee in Diane's bankruptcy have filed motions requesting approval of a settlement between Calvert, Diane's trustee, and Bradley Cohen (who caused the metal to be seized originally).

Calvert valued the metal at $149K in May, 2016, and has received an offer from Bellevue Rare Coins for $142K (which is reportedly 4% below the spot value of the metal).

However, it is very difficult to determine the true value and verify the prices, since there is no breakdown of how many ounces of silver and how many ounces of gold there are. Also, one document implies that the price of silver/gold went down since Calvert prepared the original inventory (implying that that caused the value of the coins to go down). That is not true; the price of gold and silver are both higher. However, the document also refers to the price of gold as being $1,004 -- a level it has not been down to in nearly 10 years.

Of the proceeds, $25K would go to Cohen, and the rest split evenly between Diane's trustee and Calvert (for the two estates).

Asset Sale Approved

August 26, 2019 1:20PM ESTThe judge approved the sale of most of the remaining assets to Ranger Industries.

Trial Delayed Until April 13, 2020

August 26, 2019 12:00PM ESTBecause Diane changed attorneys, the court has the trial to be continued until April 13, 2020 at 9:00AM.

Court Found Ross to be in Violation of Bail

August 4, 2019 12:30PM ESTOn July 29, 2019, there was a hearing to determine if Ross Hansen violated the terms of his bond, which the government alleged, but Ross denied.

The court found that Ross "committed the violation. Court admonishes defendant for violating conditions of the bond but does not revoke the bond at this time."

NWTM Assets to be Sold for $115K

July 22, 2019 1:35PM ESTChapter 11 Trustee Mark Calvert has filed a motion to sell most of the remaining NWTM assets for $115,000 to Ranger Industries. Ranger Industries makes custom challenge coins and related items.

The assets to be transffered include the NWTM domain name and website, NWTM customer list, certain NWTM copyrights/trademarks, social media accounts, the Amazon storefront, art, design work, imagery, photography, and the store inventory (100,000s of medals).

Ross Hansen Hearing Tomorrow

July 18, 2019 10:00AM ESTRoss Hansen's probation officer has caused a hearing tomorrow at 10:30AM, as a result of "Mr. Hansen violated a special condition requiring him not to have direct contact or indirect contact with any existing and/or future witness in this case by having contact with a witness on or about June 19, 2019."

As soon as I find something out, I will post about it here.

UPDATE July 19, 2019 8:40PM EST: A hearing will be held on July 29 at 1:30PM: "INITIAL APPEARANCE RE: BOND REVOCATION HEARING as to Bernard Ross Hansen held on 7/19/2019. Defendant present on summons. Defendant advised of allegation 1 in the 7/1/19 petition. Defendant DENIES allegation. Hearing set. Defendant remains on bond pending the revocation hearing. Bond Revocation Hearing set for 7/29/2019 at 01:30 PM in Courtroom 12B before Hon. Mary Alice Theiler. (KMP) (Entered: 07/19/2019)"

Attorney Hijacked NWTM Mailings

June 19, 2019 8:10AM ESTIt was a mistake, as far as I can tell. But if so, one he won't admit to.

About a year ago, an attorney named Norman K. Short filed a very simple 1-page document, docket 1605. I'm guessing he doesn't do much with bankruptcies, so when a client of his was changing their address, Norman somehow thought she was the debtor (rather than a creditor) -- something people outside bankruptcies often confuse.

When he filed the form, it caused the court to: [1] change the attorney for NWTM from "Pro Se" to Norman Short and his GSJones Law Group PS, and [2] change the address of NWTM to that of a client of Short's (causing documents to get sent to his customer, rather than NWTM). Short signed the document "Norman K. Short, Attorney for Debtor." And so he became NWTM's attorney of record, and his client is getting important bankruptcy documents meant for NWTM (although not a problem in this case, as Calvert gets a copy straight from Gearin).

I informed Short of this in March, but he never responded (which I took to mean that I misunderstood, and there was no error). But this past week, I looked closer. It turns out that there is a creditor in the NWTM case owed $3,026 for an order for silver who used Short's services. She asked him to change *her* address, and instead he must have thought his client was not a $3,000 creditor but instead the company owing $75M. Oops!

It's really a moot point, but accidentally inserting yourself as the attorney in a $75M bankruptcy? Wow. Not even caring enough to fix it? Bigger wow.

UPDATE September 18, 2019 3:50PM EST: It sure took a while, but today Mr. Short finally caused an entry to be made in the docket: "Withdrawal of Document. Filed by Norman K. Short on behalf of Northwest Territorial Mint LLC. (Related document(s)1605 Change of Address). (Short, Norman) (Entered: 09/18/2019)".

Diane's Bankruptcy Now Chapter 7

June 14, 2019 2:40PM ESTThe judge has ordered Diane Erdmann's bankruptcy to be converted to Chapter 7. The new 341 Meeting of Creditors will be on 7/15/2019 at 09:30 AM at Courtroom J, Union Station (Diane did not appear at the Chapter 13 341 meeting).

I also did not point out that at the hearing on Tuesday, Diane did not show up. Ross Hansen appeared, claiming that he had authority to speak for her, as he had a signed power of attorney. However, no such document had been filed with the court, and it does not seem that such a document would have even allowed for him to speak on her behalf.

The Interim Chapter 7 Trustee assigned to the case is Kathryn A Ellis.

Diane: $300K/year Income

June 13, 2019 10:30AM ESTThings just blew up for Diane Erdmann at the her bankruptcy hearing on Tuesday, from the way I read it.

First, Calvert was successful in converting the bankruptcy to Chapter 7, rather than having it dismissed (speculation was that Diane was planning to dismiss it all along, using the bankruptcy as a temporary tool to delay Calvert). I believe the conversion forces her to be subjected to things like 2004 exams and subpoenas.

Second, the bombshell: the IRS filed a claim, stating that Diane owes $127K for taxes for 2016, and $41K for taxes in 2017 (with no returns filed for 2013-2015). Those numbers imply a minimum of $630,000 of income in 2016-2017. My guess is that it was collectible capital gains for bullion sold during that time (as we know of $500K-$700K or so of bullion she sold during that time).

The reason I call that a 'bombshell' is that Diane stated (p30) under penalty of perjury in her bankruptcy schedules that she had no income in 2017. How can you report no income if the IRS shows that you did? Hmmmm...

Diane Wants her Bankruptcy Dismissed

June 12, 2019 8:15AM ESTLast night, Diane Erdmann filed a motion to dismiss her bankruptcy case. It was short and to the point: "I, Diane Erdmann, hereby request that my Chapter 13 bankruptcy filing be dismissed."

I wonder what the judge will think of someone filing for bankruptcy the night before a motion to sell what she claims to be her property, delaying filing of paperwork for mysterious reasons, asking for her schedules to be sealed (they were eventually filed unsealed, but I did not post them for privacy reasons), having a creditor request to force the bankruptcy into Chapter 7, not showing up to court for her creditors' meeting, and then asking to dismiss her case with no reason given.

UPDATE June 13, 2019 10:35AM EST: I was originally not going to post her bankruptcy schedules, but given that she stated she had $1,691.23 of income since the beginning of 2017 (p30), and the IRS shows an income tax return implying over $180K of income in 2017 alone, this is a necessary document for people to see: it is a massive red flag; if she did not commit perjury, posting these may help people understand that (and if she did commit perjury and chose to submit public documents to support it, well, um, that was her choice).

Diane's Bankruptcy Meeting Delayed

June 11, 2019 1:55PM ESTLast week, Diane Erdmann was supposed to have her 341 Meeting, where her creditors would have a chance to ask her questions. However, she was apparently a no-show. The Trustee in the case filed an entry stating:

"Statement Adjourning 341(a) Meeting of Creditors. Section 341(a) Meeting Continued on 6/20/2019 at 11:00 AM at Courtroom J, Union Station. For debtor to appear. Debtor absent."

Avenatti's Disbarment Tie to NWTM Bankruptcy

June 5, 2019 7:15PM ESTAs I am patiently awaiting to hear something, anything, about the NWTM asset auction, I came across this.

Celebrity attorney Michael Avenatti, who Calvert used in the Meridian Mortgage bankruptcy, has recently been through a string of indictments in several states. The State Bar of California filed paperwork on Monday to disbar Avenatti. The disbarment focuses specifically on one client who received a $1.6M settlement... and while Avenatti deposited the $1.6M payment into a trust (IOLTA) bank account, Avenatti allegedly: did not give any money to his client, told his client he never received the settlement payment, and gave a fake settlement agreement to his client (with fake dates that the payments would be due).

While Calvert and his Cascade Capital have a number of ties to Avenatti, no new information came out about them. But, it turns out that the day after Avenatti received the $1.6M payment, Avenatti made 2 payments from that trust account: one a $48K payment that appears to be to help save a company Avenatti bought (Global Baristas), and a $16K payment to Miller Nash Graham & Dunn LLP. MNGD is the law firm that represents the Creditors' Committee in NWTM.

If I had to guess, it is simply that MNGD represented Global Baristas, and that MNGD had no knowledge of what Avenatti was up to. But it is interesting that with $1.6M to spend, Avenatti gave priority to MNGD.

UPDATE June 18, 2019 4:45PM EST: MNGD has not responded to my request for comment on why Avenatti was paying them with allegedly stolen funds. Also, Avenatti has now been accused of stealing $4M from a client, in a very similar way: depositing the settlement into a trust account in January, 2015, and stringing the client along saying that the payment had not yet been made (and presumably spending the $4M). It will be interesting to see if we find out what, if anything, the allegedly stolen $4M settlement was spent on...

Remaining NWTM Assets to be Auctioned Today

June 3, 2019 9:05AM ESTChapter 11 Trustee Mark Calvert sent out emails last week to a number of parties interested in the remaining NWTM assets, and will be accepting bids through today at "12 Noon PST". The assets include the store inventory (200,000+ medals, mainly ones that haven't sold well), as well as the NWTM domain name, website, customer list, trademarks, copyrights, social media accounts, art, design work, imagery, photography.

At 1:00PM PST today, Calvert will email everyone who the highest and second highest bidders are. The highest bidder will have 25 hours to wire the money. If they do not, the second highest bidder will have 24 hours to wire the money. The offer will then be presented to the court.

I do not understand why Calvert has made this auction private (it does not state that it is confidential, yet there is no sign that it was in any way made public, except through me). These are assets that he has essentially stated have nearly no value, yet several people have pointed out have a significant value.

The buyer is also required to adhere to a pre-made Asset Purchase Agreement, which among other things requires that the bidder be a Washington State LLC. This would be nearly an impossible requirement for someone who did not already have a Washington State LLC already formed (it 'normally' takes 2 business days to process an LLC formation, but also requires carefully choosing a name, preparing documents, etc.).

UPDATE June 3, 2019 4:10PM EST: No news yet. The auction deadline has passed, and Calvert has presumably sent out the results as of a few minutes ago. I will update this as soon as I hear the results (if anyone hears before I post here, please be sure to let me know!).

Diane's Bankruptcy Update

May 29, 2019 8:30AM ESTThere was a hearing yesterday in the personal bankruptcy of Diane Erdmann. Several things occurred and/or were discovered:

- The case was re-assigned to Judge Mary Jo Heston, who has "related cases" (I'm not sure what the related cases are).

- The Trustee for this bankruptcy is Michael G. Malaier, who happened to be the Trustee in Ross Hansen's 1995 bankruptcy.

- The Trustee objects to confirmation of the Chapter 13 plan, due to all possible reasons listed on the form.

- There is a 341 Creditors' Meeting on Thursday June 6, 2019 at 11:00AM in Tacoma.

- There will be a hearing on June 11, 2019 at 1:00PM regarding Calvert's motion to convert to Chapter 7, and whether to confirm the Chapter 13 plan.

- The deadline to file a proof of claim is June 27, 2019.

- The "341 Meeting of Creditors Notice" leaves blank the section "All other names used in the last 8 years", yet a court document in the NWTM case was filed by a company claiming that they did business with her under her maiden name in 2017.

Diane's Bankruptcy Schedules Sealed

May 24, 2019 11:10AM ESTDiane Erdmann has filed her bankruptcy schedules yesterday (which was the new deadline), along with a motion to seal them (the way that works is she filed a motion to seal the schedules, then filed the schedules sealed: if the judge denies the motion, she will have to re-file the schedules). So the court has them, but they are not public (yet, at least).

The intent seems good: she is "high profile and subject to having [her] personal affairs made public in online forums." Nobody wants their laundry aired in public to let others judge whether it is clean or not. And bankruptcy law does allow the court to protect information filed in a bankruptcy case under certain circumstances (in this case, "undue risk of identity theft or other unlawful injury to the individual or the individual s property"). My guess is that having bankruptcy schedules sealed is very rare, however.

The glaring irony here is that there is no doubt that 1,000s of individuals were truly injured to the tune of $25M by NWTM (whether Diane is responsible remains to be seen, as the criminal trial unfolds: she is presumed innocent), and she is looking to protect herself from a hypothetical injury that she chose to expose herself to (you don't file for bankruptcy expecting your financial details to be sealed).

In addition (remember that I have no legal background), the law seems to only protect in this case: [1] "means of identification" (18 U.S.C. 1028(d)(7)), which is a name or number (such as name, SSN, passport number, biometric data, address, routing code), and [2] "other information contained in a paper" with that data. The fact that she filed the petition means that her name, address, phone, and email are already part of the public record. So what does that leave? For example, the name of a bank account and amount in it is not a means of identification (if the account number is removed).

UPDATE May 30, 2019 1:50PM EST: The judge denied her request to seal the documents, and ordered her to file them unsealed by June 5, 2019. The judge wrote "The filing of bankruptcy schedules is one of the fundamental duties ... The information provided therein is critical for the creditors ...".

Avenatti's 3rd Indictment

May 23, 2019 2:00PM ESTYesterday, attorney Michael Avenatti (who Calvert used in a previous bankruptcy case, and referred to a bank Calvert used for a loan) was indicted for the 3rd time this year. This indictment, in New York, accuses him of fraud and aggravated identity theft of a client of his. He is accused of stealing part of an 4-part $800,000 advance on a book his client was writing; the alleged scheme fell apart in late February, 2019 when his client contacted the publisher directly, who said the payments had already been made to Avenatti. Aventatti is accused of forging his client's signature on wire transfer instructions.

Avenatti, as seems to always be the case these days, denies any wrongdoing.

Diane's Delay Allowed

May 10, 2019 2:55PM ESTThe judge in Diane's bankruptcy today allowed an extension for Diane to file her bankruptcy paperwork, simply stating that "good cause exists to allow an extension".

Given that Calvert filed a motion last night for conversion to Chapter 7, my guess is that the judge allowed the extension to give him time to allow/deny the motion to convert (there is a hearing on that scheduled for June 12, 2019).

Calvert Fights Back

May 10, 2019 9:05AM ESTIt seems clear that Diane Erdmann filed for bankruptcy to stop Calvert from selling the assets that were seized in 2016 (which she claims are mostly hers). When it was time to file the schedules, she came up with what appears to have been a delay tactic suggesting that she filed the bankruptcy hoping it would be dismissed.

Calvert, however, yesterday filed a motion to convert Diane's Chapter 13 case to Chapter 7, rather than dismiss it. This would force the bankruptcy to continue, which would allow a Trustee (not Calvert) to go after any assets Diane may have, and would also possibly allow the Trustee to pursue "avoidance actions" (in this case, trying to collect the $700,000 or so of bullion that Diane sold to pay legal bills). That would have the potential to bring in enough money to get much or all of Calvert's (NWTM's) $430K judgment against Diane paid.

The irony, of course, is that Calvert is pushing to convert Diane's bankruptcy to Chapter 7 because she is abusing the bankruptcy system -- yet Calvert is likely desparately hoping that the NWTM bankruptcy is not converted to Chapter 7 for abuse of the bankruptcy system. If Judge Alston were to do that, Calvert and Gearin would only get paid after the Chapter 7 professionals got paid.

Diane's Mystery Extension Request

May 4, 2019 9:40AM ESTDiane Erdmann recently filed for bankruptcy. Much of the information was due by a deadline of yesterday.

Diane missed the deadline for filing, but filed a letter that simply said (remember, she filed "pro se", without an attorney): "I apologize for this request, it's on advice of counsel that I require a delay. If required by the Court, I can submit more information."

The first issue is that while bankruptcy deadlines can be changed by a judge, it must be very risky to miss a deadline before an extension is granted. The second is who the counsel is: does she now have a bankruptcy attorney (in which case why isn't that attorney filing for her), or is this her public defender for the criminal case, or someone else? And what judge would grant an extension after the deadline passed without a reason given?

One possibility is that the bankruptcy was filed to prevent Calvert from selling the seized bullion she claims is her, and now that Calvert's original motion has been withdrawn because of Diane's bankruptcy, there is no problem with Diane's personal bankruptcy being dismissed.

More on the After Hours Theft/Tour

May 2, 2019 4:15PM ESTCalvert wrote a letter to the court yesterday. This was unusual, as normally all Calvert's court documents go through his attorney (Gearin did participate at least slightly, as he did file the letter via ECF). It clarifies his comment at the March 14, 2019 hearing, after Gearin explained that Calvert had thoroughly investigated examples of people pilfering from the company, that "I had Atalla come in in the middle of the night, in the middle of the night, picking up stuff. I had to chase him down." Atalla had responded explaining that he had permission, it was done at 6PM (because one of them had to wait until after he was done with work elsewhere), and he included a declaration Calvert got from the head of HR saying that employees were allowed to take 50-75 medals that they had worked on.

Calvert's letter seems to confirm everything that Atalla said about the event (Calvert said it occurred at 5:42PM, that he gave Atalla permission to retrieve his personal belongings with the instructions to coordinate with Edgar Chacon, confirmed that Atalla showed the camera the ~$35 of items he removed (and offered to return)).

Calvert also included an email he sent to Atalla afterwards saying that coming in late at night and taking the items was "not a problem."

Diane Files Chapter 13 Bankruptcy

April 18, 2019 7:20PM ESTI have just found out that Diane Erdmann has just filed for personal bankruptcy, under Chapter 13. With Chapter 13, you need a steady income to come up with a plan to repay creditors.

She lists 1-49 creditors owed $500,000 to $1M, and assets of $100,000 to $500,000.

UPDATE May 2, 2019 4:10PM EST: This move may have been done to prevent Calvert from selling the bullion in his possession that had been seized in April, 2016, that Diane claims is hers. Her bankruptcy filing was the night before the hearing on whether Calvert could sell the seized metal.

Criminal Case Update

April 17, 2019 8:55AM ESTThe criminal trial of Ross Hansen and Diane Erdmann is scheduled for October 19, 2019. A status conference is occurring today.

The government and the defense are coordinating a massive amount of documents. The defense wants to move up some timelines before the trial, which the government does not want. There is also a question of whether certain documents created by law firm Karr Tuttle (mainly emails regarding an "audit memo" prepared by Dino Vasquez) are privledged. The defense is also hoping to get any subpoenas issued to Calvert or NWTM; the government provided just the "subpoena returns" (documents that Calvert/NWTM produced), but will not provide the actual subpoenas (e.g. what was requested) without an order from the judge.