| [ | Summary: In Chapter 11 bankruptcy (reorganization) after reports of 6+ month delays, $55.8M owed creditors | ] |

| [ | Related Pages: court documents, mailing list, tips, Bullion Dealer Data, 341 Meeting | ] |

| [ | Contact:

| ] |

This page is for OLDER NWT Mint information

Please go to our main NWT Mint page for the latest updates, and assistance if you were affected by the NWT Mint bankruptcy.I will be occasionally "pruning" the main NWTM page, moving posts over here, so the main page does not get too large.

New Request to Destroy Records

March 23, 2018 7:30AMYesterday afternoon, Chapter 11 Trustee Mark Calvert filed a motion to abandon or destroy company records prior to around 2012. Last May, he had requested to destroy or give away records dating before 2009, but that motion was apparently denied.

It is unclear what he would do with the records if they were abandoned, rather than destroyed. In a bankruptcy, property that is abandoned goes back to the debtor. Would they go back to Ross Hansen?

And of course, there is what appears to be a glaring error. The motion starts by "requesting authority to abandon and destroy business records of NWTM from before 2012", but the proposed order states "The Trustee is authorized to destroy all business records of NWTM that pre-date the year 2013." Remember, 2012 is a whole year, so you have to phrase things properly. You cannot say both "get rid of records before 2012" and "keep records after 2012". The poor records from 2012 get lost if you do that.

This is also interesting because Calvert declares that he is "unaware of any litigation or other bankruptcy estate matters for which such records could become relevant." However, documents from 2009 were 2012 were pulled from NWTM's records for a hearing just 1 week ago.

WARN Class Action Lawsuit Dismissed

March 21, 2018 8:15PMThe WARN class action lawsuit, which alleged that the Trustee violated the WARN Act (which typically requires 60 days notice before mass layoffs and/or plant closings for companies with over 100 employees), has been dismissed without prejudice. This was done with a joint stipulation, meaning that both parties agreed to it. The "without prejudice" means that the same case may be brought again.

I do not have any further information as to whether this was because there was evidence clearly showing that the WARN Act was not violated (so the plaintiff would not have an incentive to continue the case), or if the case is going to be re-opened in some other way (such as in a different court), or if there is some other reason. I will update this if I hear more.

FBI Investigation Started ~October, 2015

March 21, 2018 2:00PMI have recently reviewed information showing that Mark Calvert stated that Ross Hansen had been under FBI investigation since around early October, 2015.

The FBI interviewed at least one former high level NWTM employee in December, 2015, who mentioned the interview to another high level employee working at NWTM at that time.

Sell to the Lowest Bidder?

March 20, 2018 3:50PMI have obtained the audio to the March 16, 2018 hearing. It mentions that at the March 9, 2018 hearing, the Judge re-opened bidding (which the Trustee's attorney Mr. Gearin forgot, so he was telling Mr. May that they would not re-open the bidding, even though Mr. May's attorney pointed out that the Judge ordered the re-opening of the bidding).

As we know, Medalcraft put in an initial 'stalking horse' bid of $700,000. At the auction (before the March 9 hearing, between Medalcraft and Mr. May), the bids went up to $810,000 for Medalcraft and $825,000 for Mr. May. Then, the Trustee was concerned about Mr. May's credentials (despite him having been qualified to bid), so the Trustee declared Medalcraft as the successful bidder. Then, according to Mr. Gearin, Mr. May made an unsolicited bid for $900,000. The Trustee then called Jerry Moran of Medalcraft to explain that while his $810K bid won, Mr. May later made an unsolicited bid for $900,000 -- at which point Mr. Moran offered to increase his bid to $910,000 "if that would make a difference." Huh? If I won something in an auction for $810K, I wouldn't volunteer to pay $910K.

In any case, court documents show that the $910K counter-offer (which appears to have been completely solicited by the Trustee) was somehow relayed to Mr. May's attorney (at which point I would assume it was a valid bid). Mr. May's attorney then countered with a $950,000 bid on March 14. And then on March 15, Mr. May's attorney raised his bid to $1,250,000 (presumably to make up for what Mr. Gearin may have considered drawbacks with Mr. May's offer).

So both parties have increased their bid (at least 3 times total) without needing to. That makes little sense to me.

And then in court, Mr. Gearin said that the Trustee was willing to accept the original $700,000 bid (a bit more than half the highest offer) "if that is what we need to do to get the sale to go through." Is Calvert trying to sell to the lowest bidder?

And no mention was made of an offer made by a different party in February, complete with a deposit, that included the Medallic name (which this auction is selling). How can you hold a deposit for a bidder and then sell some of the items out from under him that he is bidding on?

Potential Bidder Diverted Business

March 20, 2018 9:15AMIt looks like I didn't read the August, 2017 monthly financial report carefully enough. It says:

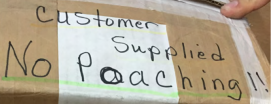

"One former sales employee has taken a position with a direct competitor who had executed a nondisclosure and nonsolicitation agreement with the estate in connection with its expression of interest in acquiring the estate’s business. The former employee appears to be contacting customers of the estate and attempting to divert business to the competitor. The competitor’s violation of its nonsolicitation agreement with the estate may adversely impact operational results and give rise to actionableeeds.ges [sic] claims."

I believe that I know who both the employee and the competitor are, and if I am correct, this is not the same employee whose E-mail I recently quoted. It is not known from what is written if this company put in a bid we do not know about, put in a bid that was never accepted, or a bid that is still being considered. But what appears certain, from "actionableeeds.ges claims", is that whoever wrote this is a lawyer that has a pet cat that sometimes walks on the keyboard.

Any Company Can Use Chinese Dies?

March 20, 2018 8:20AMI received an anonymous tip that "Another company can use the NWTMINT dies if they are the ones from China. As long as the owners are on board."

It isn't as simple as that. This issue combines U.S. and Chinese laws, as well as the policies of a company in China. There are issues of who owns the physical dies, who owns the artwork, and who can use the dies. And the big issue of how to contact customers.

Ross Hansen stated at the Creditors' Meeting that NWTM owns 10,000s of dies in China. If NWTM is the legal owner of the dies (which Mark Calvert presumably believes, as he believes NWTM owns the dies in the U.S., and has not stated otherwise regarding the Chinese dies), it is unclear how another company could use them. Next, if NWTM owns the copyright to the artwork (which may depend on whether they designed the entire image, whether they worked on a crude drawing from a customer, or whether the Chinese artists created them), another company should not be able to use them.

But perhaps the biggest issue is that it would be very difficult to generate business this way legally. Sure, you could say "Hey, if you did business with NWTM and had medals made in China and know the die numbers, we can work with you!". But that isn't going to get you far quickly. You're going to need to contact NWTM customers, and know the die numbers, for best results. But the NWTM customer list is the property of the NWTM estate. As far as I know, it would be illegal to use the customer list without permission.

Judge Denies Motion to Sell to Medalcraft

March 19, 2018 8:35PMA few hours ago, Judge Alston filed an order denying Chapter 11 Trustee Mark Calvert's request to sell the Medallic assets to Medalcraft.

This comes after such strange things as Mr. Calvert apparently putting the interest of customers over creditors, and a report of Mr. Calvert ignoring a company attempting to make an offer in 2017.

Medalcraft has stated that they have no connection or relation to NWTM or Ross Hansen, and negotiations were free from any fraud, collusion or bad faith.

NWTM Lost Domain Names

March 19, 2018 8:25PMNWTM has many domain names, ranging from nwtmint.com to bikercoins.com to silverbars.us (and like the dies, they don't seem to appear in any court documents). However, I found out today that NWTM had some domain names that it was actively using, that it lost after the bankruptcy.

Apparently, there was an NWTM employee who sold custom medals. At some point, either before or after he started working at NWTM, he registered some domains that NWTM used. It is unclear whether NWTM thought that NWTM owned the domains, or whether there was some sort of arrangement allowing NWTM to use them (which is very rare). In any case, these were domains that for many years let people see NWTM inventory, and displayed the contact information for NWTM, and had an NWTM copyright notice.

However, at some point well after the bankruptcy -- around July, 2017 -- the domains were sold to another company that produces medals, which now provides their own contact information on them. Therefore, anyone who had been going to these sites will likely start using this other company, rather than NWTM, for their medals.

Since the company that bought the domain names appears to have done nothing wrong, I am not going to mention the company or the specific domain names.

UPDATE March 20, 2018 7:20AM: I have found out that the employee owned the domains before working for NWTM, and rented them to NTWM. NWTM stopped paying at some point before the bankruptcy, so from the looks of it, it appears that the old management dropped the ball on this.

NWTM Designs With New Company?

March 19, 2018 10:40AMA former NWTM employee (terminated at the end of December, 2017) recently sent out an E-mail, suggesting that she has access to NWTM designs with a new company.

It is unclear how this is happening. A Chapter 11 Reorganization Plan couldn't slip by under the radar. Could Chapter 11 Trustee Mark Calvert have decided to operate under a different name (and would that even be considered a new company?)? If it is part of NWTM, why not use the old E-mail address? Did NWTM get court approval to sell major assets that slipped past me? How else can a new company have access to NWTM designs, and a list of E-mail addresses to send to?

The E-mail is as follows (the copy I received did not include the headers or E-mail address it was sent from).

Good afternoon,To be clear, I do not have any indication that this is related to any businesses that I have previously posted about.

[Name] here with your custom coins! Happy New Year!

Long story short, Northwest Territorial Mint filed for bankruptcy in April 2016 and has since then not been able to work its way out, this is all public knowledge on the internet. Unfortunately, Northwest Territorial Mint shut down on 12/29, doors are closed and all systems are shut down; THE GREAT NEWS is your designs are still on file and you have the ability to continue to work with me under a new company that has all the same capabilities, quality and even faster turnaround times! I would be happy to continue working with you if you’d like, please call or email me at anytime if there is anything I can do for you. PLEASE BE SURE TO EMAIL ME AT THIS EMAIL ADDRESS, THE PREVIOUS EMAIL HAS BEEN SHUT DOWN AND DEACTIVATED.

Same contact # [Phone]

[Name] [Phone]

UPDATE March 20, 2018 8:15AM: I have found out that a copy of this E-mail was sent to a group that had some medals made in 2015. The E-mail was sent "out of the blue" from their old contact at NWTM. I also received an anonymous tip that "Another company can use the NWTMINT dies if they are the ones from China. As long as the owners are on board." If NWTM actually owns the Chinese dies, as has been claimed, the legality of doing that would be questionable.

Another Offer on the Table

March 19, 2018 9:25AMI have heard that there is another offer on the table, for the Medallic name and the historic dies. This offer was made about a month ago, along with a deposit. The company would resurrect the Medallic Art Name, creating new medals building on the peak days of creativity and high quality design (while of course not infringing on intellectual property rights).

I expect that the details of the offer should become public within the next few weeks.

Trustee Objects to Rodger May Bid

March 19, 2018 9:00AMThe Chapter 11 Trustee, Mark Calvert, filed a declaration last week. In it, he states "I can not entertain Mr. May as a viable bidder. At the hearing on March 16th I intend to renew my request that the Court approve the sale of the assets to Medalcraft Mint, Inc." Mr. May's attorney wrote "We no longer trust this process to be fair."

There is some irony here. The Trustee's attorney, Mr. Gearin, E-mailed Rodger May's attorney after the March 9 hearing, stating "the Trustee expressed his concerns regarding Mr. May's ability to protect customer interests in light of the fact that Mr. May does not have experience in the minting business." The irony is that the Trustee (and his accounting company), as we all know, had less experience in minting or bullion (so little, in fact, they weighed precious metal using bathroom (avoirdupois) scales -- something I'm sure Mr. May would never have done, as he is involved in mining companies).

Mr. Gearin also stated concern that NWTM owner Ross Hansen might be involved, saying "the Trustee will not be party to allowing customers and creditors to be mistreated again as they have been in prior business enterprises run by Mr. Hansen." It is quite a relief to know that Mr. Calvert is so strongly aligned with creditors, although I'm not sure how creditors could be harmed by a higher offer (even if the resulting business was unsuccessful). And while it is noble of him to be aligned with customers, he has a fiduciary duty to creditors, and no obligation to customers (that are not creditors) as far as I know. It was disclosed that Mr. Hansen did bring the auction to Mr. May's attention, but Mr. Hansen's role would "never be more than that of a consultant".

In order for the Trustee to entertain offers by Mr. May, he expects to know things like how Mr. May will ensure timely orders and and what management team will be involved (which Mr. May provided, but not to the Trustee's satisfaction). This seems quite ironic for a dead company -- one that died under Mr. Calvert's watch. I urge you to download the declaration and read "Responses to Questions" (pp 40-41) to make your own opinion on whether Mr. May's responses suggest that his bids should be accepted or not.

Perhaps the Trustee is mistaking this sale for a plan of reorganization (where creditors could benefit after the sale), and not an asset sale (where the benefit to creditors is normally limited to the cash at closing)? Or maybe I am simply missing something (yes, it does happen!). It's nice to ensure future customers will be treated well (and very important to ensure that dies are not mis-used), but I'm not sure why a higher offer would trump a lower offer based on the future expectations of the company (which again brings irony: Calvert seemed convinced he would be able to make NWTM succeed, but with hindsight we now know the outcome).

There seems to be no question that Medalcraft is better suited to quickly take over the Medallic assets, and has the least risk of the assets going to waste somehow. However, it is also important to make sure that Mr. Calvert isn't turning down a better offer for reasons that do not relate to the interested parties.

February Financial Report

March 17, 2018 11:10AMThe Trustee has filed the February, 2018 monthly financial report.

In it, it shows that the skeleton crew was reduced from 22 employees to 10 employees.

The "Significant Events and Case Progress" section, which usually is the most information (a narrative of what went on during the month) has no new information from what I could tell. There is what appears to be a line regarding either the Medallic sale to Medalcraft or the sale of older dies to the ANA, but I cannot fully comprehend it ("The Trustee also has confirmed for the dies available for sale which is anticipated to be confirmed in March and April.").

How Did Rodger May Get Involved?

March 16, 2018 8:35AMRodger May provided a higher cash bid for the Medallic assets, outbidding the Medalcraft "Stalking Horse" bid.

According to a filing I will be discussing in depth later today, Rodger May hopes to buy the Medallic assets to run a business (e.g. providing medals to customers), with one of his partners taking the lead role. Mr. May's attorney states that Mr. May found out about the current auction from Ross Hansen, but that his partner originally tried contacting Chapter 11 Trustee Mark Calvert in 2017 (the implication being that Ross Hansen was not involved in the original inquiry).

Further, Mr. May's attorney states "Mr. Hansen's role in the company going forward has not been determined, but it would never be more than that of a consultant." Traditionally, a consultant provides advice, but cannot make any actual decisions on their own. For example, a consultant might say "Hiring Mr. Jones would benefit the company, and $55K/year is a reasonable salary" but someone else would need to actually make the decision to hire Mr. Jones and how much to offer him for a salary.

The Trustee's attorney stated that Ross had contacted ex-NWTM employees and stated that he is "back in business" and representing that he would be "running the mint within the week."

Trustee Reportedly Ignored an Offer

March 16, 2018 8:20AMIn a filing I will be discussing in depth later today, on page 40 an attorney for Rodger May (who recently placed a bid for the Medallic assets), asserts "The Trustee refused to return communications from Fred Holabird in 2017. Mr. Holabird is a shareholder, as well as manager, of Gold Leaf Placer, LLC -- Mr. May's gold placer mining company that owns the leases in Nome, Alaska."

The Trustee's attorney responded that "The Trustee has no recollection of Mr. Holabird or any communication with him in which he expressed interest in purchasing the estate's assets."

He said, she said, I guess.

NWTM Asset Sale Approved

March 15, 2018 6:10PMYesterday, Judge Alston approved the sale of the NWTM industrial assets, for $1.95M, to Industrial Assets Corp. (BidItUp) and Maynards Industries USA LLC. They are buying "(a) all the machinery and equipment, autos and trucks as specifically set forth on Exhibit “A”, attached hereto, (b) related tooling, attachments, parts, accessories, manuals, and (c) office furniture, in, around and/or about the Premises) located at 80 East Airpark Vista Boulevard, Dayton, NV 89403 and 1718 Velp Avenue, Building #D, Green Bay, WI 54303 (“the Premises”)." It appears that they were authorized to start removing items as of the moment the order was entered (yesterday around 1:15PM Pacific time).

One catch is that they are buying 1 "Group of (70) sections of heavy duty adjustable shelf units w/(21) sections of die bins." The photo appears to show the shelving that the Medallic dies are located in. It is not clear where those dies will go, or even if the purchaser is aware that they need to be saved.

$22M Offer Turned Down?

March 13, 2018 4:55PMAs with much of what I write (or wish to write), it is often difficult with zero information from the Trustee, and a lot of the best information hiding in hearings (obtaining the audio requires having someone drive to the courthouse, and transcripts usually are very costly).

In this case, I have heard from a reliable source that "legitimate offers as high as $22 million for the assets of NWTM have been turned down by the management of the company and the Trustee."

There could be good reasons for this, but it may be time for someone to ask Mark Calvert "Hey, what offers have you received, and why did you turn them down?"

UPDATE March 13, 2018 8:50PM: I have been unable to confirm that such an offer existed, and have heard from some other sources that this offer just does not seem like it was realistic. I will have to assume that there was no such offer, unless I get more information.

Trustee Untrustworthy?

March 13, 2018 10:05AMAs creditors know, Chapter 11 Trustee Mark Calvert has had almost no communications with creditors.

However, things are worse than that. He has failed to act in a number of cases where he should have. For example:

- The bankruptcy schedules on May 10, 2016 stated "Debtor stored personal property for certain customers, Trustee has commenced a detailed storage inventory which will be provided to creditors when completed." No storage inventory was provided.

- Calvert wrote that he confirmed that certain dies belonged to a specific customer, and asked for permission to return them. The Judge's order stated that "The Trustee may return the Coining Dies purchased by [customer]". A year and a half later, he had not returned them, requiring the customer to write to the Judge.

- After a lot of debate between the Trustee and the landlord over what repairs NWTM needed to make to the Dayton facility, the Judge ordered the Trustee to "promptly" make many repairs (a list of 21 was provided). The landlord of the Dayton facility claimed on February 20, 2018 that there was "no progress in any repairs or other compliance with the Court’s September 1, 2017 Cure Order."

The more serious problem here is for people like me that are acting as watchdogs that trust that the Trustee is doing what he says and is told to do. If the Trustee doesn't do things he says he will do, and doesn't do things he is told by the Judge to do, it's like dealing with a small child. I simply cannot trust Mr. Calvert (it has gone from "trust, but verify" to just "verify"). Now I have to go back and look at all the things that he promised to do, or was ordered to do, and see if I need to check if they really were done. I assume, for example, that all the storage customers that still had metal at NWTM (that wasn't stolen) got their metal -- but now I have to wonder if there are some who did not.

Tips Wanted...

March 12, 2018 2:35PMI have heard quite a few rumors of potential and/or actual wrongdoing at NWTM in the months leading up to (and after) it shut down in December, 2017. I have also heard that a number of employees are afraid to speak up given threats (real, perceived, or otherwise).

If you would like to supply me information anonymously, you can do so on the anonymous tips page. My E-mail address is also there (I do not publish information given to me via E-mail unless you give me permission, and in the rare cases where I publish the names of my sources I never do so unless I have explicit permission).

Chinese Business

March 12, 2018 2:15PMWe know a lot about NWTM. But one little known aspect is the Chinese business: orders for medals (such as challenge coins) that NWTM would have a company in China (such as Yong Tuo Emblem Company and Kunshan Top Tree Decoration Company) create and package, at a significant cost savings over what it would take to create high quality product with NWTM employees. This involved millions of dollars of business annually, at a high profit margin (due to cheap labor costs). Ross Hansen claimed that there were $2M-$4M worth of dies in China. That figure could be exagerrated, and it may be nearly impossible to access the dies, but I have not seen those numbers disputed in court documents.

As far as I know, nearly no mention has been made in court documents regarding the Chinese business and dies. It is not mentioned in the recently filed budget.

Further, I have heard that an NWTM employee has bragged that nobody cares about the Chinese business, and that he will be able to take it over himself. Since the dies are "invisible" (nobody has gone or will go to China to investigate them, as far as I can tell), they could easily get transferred to a new owner "under the radar."

UPDATE March 12, 2018 4:45PM: Someone mentioned to me that the Chinese dies use a numbering format with a "Q" followed by a letter indicating the salesperson followed by 4 digits. This information, combined with the die numbers found in the inventory list, suggest somewhere in the order of 15,000 30,000 Chinese dies (2 dies per number; obverse and reverse). It appears that some of the dies are destroyed after a number of years if they are not used.

More on Die Values

March 12, 2018 8:50AMSince Chapter 11 Trustee Mark Calvert has apparently not provided any information on the value of the dies, it's pretty much been up to me to figure that out (with a lot of help from a few other people) and disseminate that information.

Over the years, NWTM has acquired many dies not created by NWTM (e.g. through the acquisition of companies). The majority of the dies appear to be from the Balfour Company, which are relatively tiny dies for things like jewelry and pins, and therefore would not have much scrap value. There are also a lot of dies for tokens, which are also fairly small, and therefore would have little scrap value. Next comes the Medallic dies, which are large, heavy, and have historical value (such as the die for a coin that was given to the captain of the ship that picked up 700 Titanic survivors... a die that some NWTM employees are very familiar with). Finally there are the dies that NWTM themselves created, and ones that the Chinese companies created.

The photos I posted are of the Medallic Art dies. It seems that there are somewhere around 25,000-40,000 Medallic Art dies. I have not seen any estimate of how many NWTM dies there are (which is ironic, as those should have been the most likely to have been inventoried and/or referenced in court documents).

So what about the value? Much of the value is historic: the ability to hold a die used to create a famous medal, or the ability to restrike old coins for the companies that originally had them made. But the scrap value is an important reference point.

From what I have heard, a good guess would be that about 350,000 dies are small, and would have a scrap value of perhaps $.20 each, or roughly $70,000. Then there should be roughly 40,000 Medallic dies, weighing about 20 pounds each, with a total scrap value of roughly $150,000. Medallic had had around 15,000 copper die shells and 5,000 galvanos, with about 250,000 pounds of copper/lead, which would likely have a scrap value of over $500,000. That's a total of over $700,000 of scrap value, above and beyond any historical value or value for customer reorders.

Of course, we have no idea how many dies still exist, or who would get what dies.

UPDATE March 19, 2018 9:20AM: I have heard from another source that about 250,000 of the dies are essentially "junk" -- small dies, typically for jewelry, that have almost no scrap value. The source suggests that the total scrap value of all the dies and galvanos is under $100,000.

NWTM Budget Filed

March 10, 2018 7:30PMNWTM has filed a budget with the court, for the next few months. Among other things, it shows:

- NWTM has at least $87,000 of precious metals left that have not been returned to customers or sold.

- NWTM is planning to receive $420,000 for "Older Dies" from the New York Numismatic Association.

- NWTM has finished paying terminated employees ("Payroll Liability from last wk of 2017")

- NWTM "skeleton crew" payroll is currently about $50,000/mo, and should go down to $30,000/mo by mid-April.

Medalcraft Outbid for Medallic Assets

March 8, 2018 8:20PMI have heard that Medalcraft was outbid for the Medallic Art Company assets, and that Rodger May of Seattle has placed a higher bid.

How Much are 400,000 Dies Worth?

March 8, 2018 8:15PMSo we know that NWTM has somewhere in the neighborhood of 400,000 dies. So how much are these worth?

I have heard that these dies are made of steel (as is normal for coining dies these days), and are quite heavy. One person has told me that the dies alone are worth millions of dollars.

UPDATE March 9, 2018 10:45AM: I have heard from two sources, one that says that management said the dies were worth $50 each for scrap value, and another who believes $25 each is a conservative estimate of the scrap value. That would place the value of the dies in the neighborhood of $10M-$20M. However, Calvert hasn't provided details on where these dies are, which means that many of them could be the "Chinese dies", and it is unclear if NWTM actually owns those dies, and if so, if there would be any major challenges retrieving them. He also hasn't provided any information as to which dies have been sold, destroyed, given away, or will be sold with the NWTM assets or the Medallic assets.

NWT Mint President Running a Mint

March 8, 2018 7:35PMIt doesn't sound like news, right?

I have heard from two sources that the NWTM President, Paul Wagner, has formed a new company, Sierra Mint, LLC. The paperwork for the company was filed on February 16, 2018 per Washington State records. Greg Fullington, who was NWTM corporate counsel from 2013-2017 (kept on by Mark Calvert and perhaps terminated with everyone else at the end of 2017), is acting as corporate counsel for Sierra Mint. A registered trade name "Sierra Mint" was apparently filed on March 5, 2018. Paul Wagner was part of the skeleton crew, some of whom are still working with NWTM.

UPDATE March 8, 2018 7:35PM: Paul Wagner was hired by NWTM around January, 2013. His office was very close to Ross' office. He was also in a position to know what was going on before the bankruptcy. After the bankruptcy filing, Ross Hansen hoped to work with him to save the company, and gave him a business proposal. He was making around $170,000 a year at the time of the bankruptcy filing.

UPDATE 2 March 9, 2018 2:25PM: Ross Hansen stated at the 341 hearing that silver storage and lease statements were handled by the legal department, consisting of Amelia Swan and Greg Fullington, and that they left in October, 2015 (although Mr. Fullington reportedly worked at NWTM through 2017). In 2014, Mr. Fullington was aware of at least one order where the order was not shipped as of the "drop dead" date (the date at which the Consent Decree required NWTM to immediately refund money if the order had not yet been shipped), and Mr. Fullington was aware of at least one customer who felt that NWTM was "using [his] money as float" (again, 2014). After hearing of those orders, he became the Acting Chief Financial Officer of NWTM for nearly a year. He supervised Amelia Swan, who handled at least 50 serious customer complaints, many of which involved the "drop dead" date being reached with no immediate refund being given as required by the Consent Decree.

UPDATE 3 August 27, 2018 7:45PM: I now have a page about Sierra Mint, with background information and a timeline of its formation. Mostly for my own use.

March 6 Hearing Audio

March 7, 2018 1:45PMThanks to a helpful reader, I now have the March 6, 2018 hearing audio online. And the infamously poor, but still useful, computer-generated transcript.

The hearing was about the ability of NWTM to sell dies (with actual ownership set for a separate hearing).

Calvert: "We have in excess of 400,000 dies"

March 6, 2018 6:35PMAccording to an E-mail Chapter 11 Trustee Mark Calvert sent a customer, "Just to put this in perspective we have in excess of 400,000 dies."

So Ross Hansen was correct (see my recent "How Many Dies" post below). So where are these dies? Is Medalcraft going to get 400,000 dies for $750,000?

$350 to Get Dies Back?

March 6, 2018 6:45PMAbout a year and a half ago, Judge Alston ordered that NWTM could return the dies for a customer. Apparently, they have still not done so.

The piece that is more newsworthy, though, is that Chapter 11 Trustee Mark Calvert told the customer that "Also there is a cost to research this and find your dies and ship them to you. Not sure what the cost is but my guess is that it is in excess of 250.00 maybe as high as 350. Are you prepared to pay this amount?"

The Trustee's attorney, Mike Gearin, told the customer that this was a mistake (apparently since it was already handled in a motion). This, of course, is horrendous: they have had a year and a half to ship the dies, but have not, with an imminent sale. However, the obvious implication here for other customers is that Calvert is going to try to gouge you if you request your dies back (treating this as a profit-making endeavor of some sort, rather than a return of property that does not belong to NWTM).

UPDATE March 7, 2018 9:30AM: In a recent agreement, NWTM and a customer agreed that the customer would pay $18,000 for 60 dies ($300 each). So it seems fairly clear that NWTM is willing to let customers "pay to play" to get their dies back. It is interesting that both the customer and NWTM still assert ownership of the dies.

February 9 Hearing Audio

March 5, 2018 5:55PMI have obtained a copy of the audio to the February 9, 2018 hearing.

You can download the audio (4 hours, 30MB), and/or a very imperect computer-generated transcript. The transcript is barely readable (as it was computer generated; true transcriptions are quite costly), but can be useful if you are looking for something specific.

Oops!

March 3, 2018 8:35AMYesterday, Chapter 11 Trustee Mark Calvert filed a simple motion requesting that the Medalcraft Asset Purchase Agreement (APA) be changed slightly. As a reminder, Medalcraft is the stalking horse bidder for the mostly-Medallic assets, whereas the mostly-NWTM equipment is being auctioned separately.

One of the changes is that "The third sentence of section 7.8 commencing with the word "Notwithstanding" and ending with the word "(Trust)" is deleted."

It looks innocuous. So what was removed? It removed "Notwithstanding the foregoing, Gary Anderson, Investment Trustee for RNO Financial/Eureka House of Metals (Trust) may assign all or a portion of its rights and obligations under this Agreement to any subsidiary of Gary Anderson, Investment Trustee for RNO Financial/Eureka House of Metals (Trust)." Major Oops!

From the looks of it, the attorneys (who get paid up to $900/hour) created an APA for Gary Anderson (who was supposedly buying the entire company, not just the Medallic portion, as a going concern). When Medalcraft made an offer, the attorneys then modified that APA to remove NWTM assets and have Medalcraft as the buyer, but forgot to remove the section specifically giving Gary Anderson rights to assign the contract to himself. I'm sure a court would not have allowed that, understanding that it was an error, but imagine the nightmare if the Medallic assets were sold to Medalcraft and Gary Anderson got to assign all the assets to himself?

I wonder if this will have any bearing on the class action lawsuit about the WARN Act. If Gary Anderson's name appears in a document used to "slice and dice" the NWTM assets into two categories after the company shut down, it certainly suggests that Gary Anderson may have entertained the thought of terminating employees and using the assets separately, or perhaps paring down the company to the most profitable pieces.

And yes, I'm sure the attorneys are billing to pay for their time to carefully create an amendment that doesn't mention Gary Anderson's name and clearly refer to the fact that they made a major blunder. Just like they and Calvert billed for their time fixing the major accounting errors they made with the assets being returned to customers.

Class Action Response

March 3, 2018 9:30AMChapter 11 Trustee Mark Calvert has responded to the class action lawsuit alleging that he violated the WARN act (which requires 60 days notice of mass layoffs in certain cases).

Responses to complaints in lawsuits usually do not have much useful information in them. A few pieces of information that were in there, however, include:

"Trustee denies that Defendant employed 100 or more employees (exclusive of part-time employees) 60 days prior to December 29, 2017."

"Plaintiff’s claims are barred in whole or in part by the “faltering company” exception to the WARN Act. See 29 U.S.C. § 2102(b)(1)."

"Plaintiff’s claims are barred in whole or in part by the “unforeseeable business circumstances” exception to the WARN Act. See 29 U.S.C. § 2102(b)(2)."

It will be interesting to see how NWTM did not employ 100 or more employees 60 days prior to December 29, since Mark Calvert certified (p46) under penalty of perjury that NWTM had 116 full time employees as of October 31, 2017, and that only 4 employees were added/terminated that month.

The "faltering company" exception is the one that it was expected that Calvert would use as a defense. In general, it allows companies that are looking to secure financing to forego the full 60 day notice, if providing notice would have "precluded the employer from obtaining the needed capital or business". According to this source, "courts have held that it is not available in the event of a proposed sale of the company in question". The law also states "the employer must give as much notice as is practicable."

UPDATE March 4, 2018 7:40AM: Another reference point on the number of employees is that there were 113 employees when Gary Anderson (the first potential buyer with empty pockets) threw the pizza party, 19 days before Calvert decided to shut down the company. Also, for the curious, the "100 employees" that the WARN Act refers to is the number of employees at the company (not the number of employees that are laid off).

How Many Dies?

March 2, 2018 4:50PMI have been wondering how many dies NWTM owns, owned, is holding, and was holding.

The official bankruptcy inventory that Chapter 11 Trustee Mark Calvert filed on May 10, 2016 references about 700 individual dies (some are coins referencing the die code, others may be actual dies), with a total of about 550 unique dies. The die codes are in a format "M 26 99" (a letter from A to M, followed by 2 1-2 digit numbers). This allows for roughly 30,000 dies (but likely less) coded this way (there were also a handful of dies using a dated coding system, such as "2005-186").

Ross Hansen on May 27, 2016 testified that 15,000 Medallic dies were shipped to Tomball, but the Trustee disputes that there were any Medallic dies in Tomball.

In 2009, a security agreement (p84) refers to "210 Shelves of Dies" and "2 Cabinets of Coining Dies". If the shelves held 100 dies each (this article says that a "drawer" can contain 100 small dies), that would be roughly 20,000 dies.

At the May 27, 2016 hearing, Ross Hansen also testified that Medallic had 400,000 coining dies. Mr. Hansen had previously stated that there were about 400,000 dies in Dayton in the Creditors' Meeting (341 Meeting) on May 11, 2016 (per the questioning, that should have referred to NWTM dies, but was likely referring to Medallic dies).

An image shows what appears to be 10,000s of larger dies stored on shelves (which is separate from the ones in drawers).

Ross Hansen also stated at the May 11, 2016 Creditors' Meeting that there were about $2M-$4M of dies in China, stating that there are "tens of thousands of dies" at the two companies in China.

I have not seen any court documents where Mr. Calvert has clearly stated how many dies there are (or claimed that some were missing or lost). Some dies may have been included in the Graco/Tomball sale. But what has happened to the 10,000s of dies in China, and the estimated 20,000-400,000 dies in possession of NWTM? How can creditors determine if $700,000 is a reasonable offer if they have no clue how many dies NWTM has?

UPDATE March 4, 2018 7:35AM: I have heard that the dies in the "M 26 99" format are dies that were created by NWTM (cabinet-drawer-item), whereas the dies in the "2005-186" format are dies that came from Medallic.

Monthly Financial Report

March 2, 2018 4:10PMYesterday, Mark Calvert filed the January, 2018 Monthly Financial Report.

On page 47 ("Significant Events and Case Progress"), which is usually where the most important information is found, there is little new information. The last paragraph sums it up: While the Trustee believed in the potential of the company, the deterioration in the monthly sales while in bankruptcy resulted in insufficient cash flow to remain a going concern. The Trustee did not want to close the business he was forced to do so based upon the performance of the business, no going concern buyer and inability to obtain additional advances on the DIP Financing facility.

Die Ownership Fight Update

Look for 'not shipped, archived' on receipt

March 2, 2018 2:05PMIn May, 2016, a creditor filed a motion with the court to compel the Trustee to return his dies. His basis was just that 'The invoices ... clearly and unambiguously stipulate: "Not shipped, archived @NWTM facility."' The Trustee later filed a motion to return the dies to the customer, stating that the customer included "proof of ownership" and that the "dies were purchased by [customer] and are not property of the estate." At the Trustee's request, the Judge ordered that "To the extent that the Trustee determines that there are additional coining dies that are not owned by the Debtor, the Trustee may, without further order of the Court, return them to any individuals or entities establishing an ownership interest in such coining dies;" Therefore, the Trustee seems to have set a precedent that anyone with "not shipped, archived at NWT Mint", "NOT SHIPPED, TO BE ARCHIVED @NWTM FACILITY" or similar text on the invoice is the owner of their dies, and should receive them.

Die Ownership Fight

March 2, 2018 11:05AMChapter 11 Trustee Mark Calvert is seeking court approval to sell dies along with other assets of NWTM. Calvert claims that customers do not have an intrinsic Intellectual Property interest in the dies, and that even if they do, they hold no such interest in the dies themselves. In other words, NWTM could sell the dies just as they could a poster that they do not hold a copyright to.

This is a separate issue from the question of whether dies are owned by NWTM or the customer. The answer to that question seems to vary customer-to-customer, as some customers paid extra to own the dies, while most or all paid for the creation of the dies. The NWTM/Medallic websites have stated that the dies belong to NWTM, so presumably only customers who were somehow promised ownership of the dies would get to keep the physical dies.

The New York Numismatic Club counters with a different opinion on the copyrights. They point out that the copyright law changed in 1978, which in some cases may give rights to different parties. They suggest that it may be the artists, not NWTM, that own any copyright rights in the artwork in some of the dies (and points out that NWTM has not made an attempt to contact the artists, or their heirs in the case of artists who have died since creating the works, and therefore not giving them the opportunity to object to the sale). It also points out that NWTM promised that the dies would stay in the United States (making it less likely that they would be lost or counterfeited).

February 9 Hearing

February 28, 2018 1:15PMI had someone request a transcript of the February 28, 2018 hearing.

Unfortunately, I do not have a copy of a transcript for the hearing, or audio for it. My understanding is that the Western District of Washington requires audio CDs to be picked up in person. Transcripts can be ordered, but are usually very costly if ordered within 3 months (after that, if someone has ordered a transcript, it can be obtained through PACER, much less expensively). This is especially problematic with this hearing, which I heard lasted more than 4 hours -- which means that it would be time consuming to listen to the audio, and more expensive than most transcripts.

If I do get a copy of the audio and/or transcript, I will be sure to post it here if possible.

UPDATE March 5, 2018 4:55PM: I have received a copy. You can download it here, or a very imperfect computer-generated transcript.

Inventory Error?

February 25, 2018 6:45PMAn eagle-eyed reader took a fresh look at the inventory that Mark Calvert filed in May, 2016 in the bankruptcy schedules. In it, he noticed:

| Aub Warehouse | Finished Goods | 2.75 High Relief Copper Medallion, Fully Gold Plated (3-5 Mil) - KavliFoundation Nanoscience Award | Average Cost | $666.00 |

| Aub Warehouse | Finished Goods | 2.75 High Relief Copper Medallion, Fully Gold Plated (3-5 Mil) - KavliFoundation Astrophysics Award | Average Cost | $666.00 |

| Aub Warehouse | Finished Goods | 2.75 High Relief Copper Medallion, Fully Gold Plated (3-5 Mil) - KavliFoundation Neuroscience Award | Average Cost | $666.00 |

| Aub Warehouse | Finished Goods | 2.75 High Relief Approximately 12 Troy Ounces .999 Gold Medallion - KavliFoundation Neuroscience Award | Average Cost | $1,020.00 |

| Aub Warehouse | Finished Goods | 2.75 High Relief Approximately 12 Troy Ounces .999 Gold Medallion - KavliFoundation Nanoscience Award | Average Cost | $1,020.00 |

| Aub Warehouse | Finished Goods | 2.75 High Relief Approximately 12 Troy Ounces .999 Gold Medallion - KavliFoundation Astrophysics Award | Average Cost | $1,020.00 |

The last 3 entries are for gold medals worth about $15,000 each. However, they show up as being valued at $1,020 each. The first three are for copper medals, with a melt value of nearly nothing.

My guess is that the $1,020 (and $666) is what NWTM was paid in addition to the gold (and copper), with the metal customer supplied. However, this raises the questions: were these medals in inventory (and if so, who owned them)? And if they were owned by NWTM, why were they valued at about 7% of their actual value? And if owned by the customer, how could the medals have any value as inventory?

UPDATE February 26, 2018 8:30AM: I am now guessing that the inventory was referring to the dies, not actual gold medals. That would explain why there was one of each type of prize listed. This doesn't fully make sense, of course, as Kavli has pointed out that the dies belong to them (the NWTM invoice stated "dies will become the property of Kavli Foundation upon full payment of the project"). If these were the actual Kavli medals, they would have been made with Kavli's missing gold, and would be the property of Kavli and would have been returned to them (which appears not to be the case). The latest information suggests these were actual medals, likely samples (note that it is likely there would be 4 dies: 3 unique for one side, and one common to all three medals).

UPDATE March 2, 2018 1:55PM: Docket 728 helps answer this question. In it, the Judge orders that the Trustee "may return the four (4) Coining Dies purchased by the Kavli Foundation". Therefore, I see no other possibility than the 6 inventory entries above representing actual coins that are or were in possession of NWTM.

More About the Anonymous Letter

February 25, 2018 11:10AMI have heard from a number of people regarding the anonymous letter that was apparently from an NWTM employee.

One person suggested that it was actually written by Ross Hansen. I have to admit, that thought did cross my mind when I first read the letter. However, I do not believe that he would write such a letter: if it could be proven that he wrote it, I imagine it could be very damaging to the criminal investigation.

The consensus from employees seems to be that the letter could have been written by an employee, but it differs from what the known employees experienced. I sense that the employees are trying to get the idea across that while it is possible much of the information in the letter is true, some is not, and they cannot confirm most of the allegations, and therefore the letter should be taken with a grain of salt.

Several employees have pointed out that NWTM did continue to make new products after the bankruptcy (perhaps not as many as before, but it was making products). This conflicts with the anonymous letter, which stated "under Mr. Calvert there has not been one new product added to the inventory." I often get anonymous information, and to me, when one piece of information from an anonymous source appears untrue, it always casts doubt on the rest.

So my hope is that whoever wrote the letter will contact me (via the anonymous tips page or the E-mail address above) with more details. For example, any information on bullion sold in February, 2017 would be helpful.

New Tips?

February 24, 2018 11:00AMRemember, I have a page where anyone can leave anonymous tips.

If you have any information about accounting issues, know of any accounting statements that aren't public but should be, or have any other information about any problems at NWTM, I would be happy to hear from you. You can attach files if desired. You can also E-mail me (address above at 'Contact').

$1M Accounting Error?

February 24, 2018 10:50AMIn the letter from the anonymous employee, I paid particular attention to this: "[The room that held NWTM's gold and silver online coins and some bullion products] was completely liquidated last February".

So I looked at the accounting records (those are the monthly balance sheets and income statements; details on cash receipts can be found in the monthly financial statements at the NWT Documents page). I didn't see anything that pointed to large sales of bullion in February 2017. The inventory went down $1M, but that's due to something else. The monthly financial reports show a number of payments from A-Mark Precious Metals (a bullion wholesaler), but nothing suggesting a large single purchase, aside from "Core Operating Sales" about $300K higher than normal.

But I did discover something very interesting: what appears to be a $1M accounting error. Specifically, the value of the inventory went down from $3.1M to $2.1M ($942,332). In the same month, an "Inventory Brass-Copper Adjustment" of -$938,844 appeared as a loss related to restructuring.

Apparently, there was a lot of inventory that was listed as copper, but was actually brass. Brass is a copper-zinc alloy, which one NWTM page shows as sometimes being 75% copper, 20% zinc, and 5% tin. In February, 2017, copper was about $2.75/pound, zinc was about $1.30/pound, and tin about $9.00/pound. Let's assume that the brass inventory was really a base metal and worthless. $938,844 of copper in February, 2017 would have been about 340,000 pounds, or 5,400,000 ounces. If it was truly brass, which is normally at least 50% copper, we would be dealing with over 20 million ounces of metal that was mis-classified.

What makes this even odder is that the original inventory (docket 222-3) only had about $50K of inventory with "copper" in the description. It also had about $375,000 of inventory listed with "brass" in the description.

Maybe I'm wrong, and something else caused this. But what else could cause a $942,332 reduction in inventory, while also accounting for an "Inventory Brass-Copper Adjustment" of -$938,844?

Anonymous Employee Speaks Out

"Mr. Calvert is a Dishonest Bully"

February 24, 2018 10:15AMYesterday, someone claiming to be an ex-employee of NWTM filed a letter with the court anonymously.

The employee wrote anonymously for fear that he would be sued by Mr. Calvert. It states that before the bankruptcy, NWTM would produce hundreds of new, innovative products each year, but that after the bankruptcy not a single new product was added to the inventory. It alleges that Mr. Calvert told employees that they were all guilty of running a Ponzi scheme, and that he bragged that he "fixed it" so that NWTM owner Mr. Hansen would go to jail, and that as Trustee he could order the FBI to arrest employees.

The letter goes on to allege that Mr. Calvert sold metal that "obviously belonged to [NWTM] customers," and that some coin dealers left with boxes of metal "with little or no accounting." The author claims that a room full of gold and silver coins was liquidated last February, and sold at a deep discount. This piece is especially interesting, as I do not recall seeing any mention in court documents of what ever happened to the NWTM-owned precious metals. And given that Mr. Calvert shut down the bullion portion of the business immediately, the sale of what bullion was present would be outside of normal business operations, which often requires court approval. The balance sheet shows that "Inventory" went down from $3.1M to $2.1M between February and March of 2017 (the accounting does not distinguish between regular inventory and bullion). I'll write about that in a separate post.

The author of the letter also states that he believes Mr. Calvert never intended to save the company, just to stay long enough to burn through the money. That is an opinion, of course, but one that a number of employees have shared with me.

Finally, the author alleges that Mr. Calvert has thrown away many of the recent accounting records.

Please note: It is important to remember that these allegations were written anonymously, and certainly cannot be assumed to be true. However, given the recent concerns over accounting (and the gross accounting errors I previously discovered), some of these allegations should not be easily dismissed. UPDATE February 25, 2018 11:15AM: NWTM employees have expressed concern that at least some of the information contained in the letter may not be true. Please see my post above ("More About the Anonymous Letter") for further details.

Creditors Speak Out

February 13, 2018 2:05PMTwo members of the Unsecured Creditors' Committee (UCC), one current and one former member, filed documents (separately) with the court last week, speaking out against Trustee Mark Calvert and the attorneys in the case.

This saga starts with a mysterious letter that a creditor referenced in an objection to the expense applications in September, 2017, asking the court to publish the letter and offer any comment or clarification. The Judge asked about the letter at the hearing, and Mr. Gearin (the Trustee's attorney) pooh-pooh'ed it, saying that it was just a letter drafted by NWT Mint owner Ross Hansen's attorneys, and that the UCC wanted to go ahead with a plan concocted by Ross Hansen and remove the Trustee. And that "I don't think it went anywhere." Then Mr. Northrup, the attorney who is paid to represent the UCC, said that Ross Hansen would "fill the atmosphere with allegations and claims about this case" and "this letter I think was an attempt by [Ross Hansen] through [a co-chair of the UCC, who submitted the letter to Mr. Northrup] to get an alternate plan for the case to the committee so the committee could support it."

After the Judge heard those answers from Mr. Gearin and Mr. Northrup (see the full explanations in the hearing transcript), he was satisfied. But what the attorneys neglected to say is that the co-chair of the UCC sent that letter to Mr. Northrup, requesting that he seek removal of the Trustee, and if Mr. Northrup refused, he was to file the letter with the court. The letter did not include any alternative plans that may have been "concocted by Ross Hansen". Of course, Mr. Northrup and Mr. Gearin likely have a different version of the story, but will it reconcile with what they told Judge Alston? And why did Mr. Northrup never file the letter, and how did Mr. Gearin get a copy?

Then, in a separate document filed with the court, a member of the UCC requested the ability to be able to file confidential documents provided by Chapter 11 Trustee Mark Calvert, including inventory and accounting sheets. The purpose was related to matters of accounting and accountability with respect to the immediate needs of the creditors. Reading between the lines, the implication is that the UCC member is aware of accounting issues that creditors should know about. At the hearing on February 9, however, the Judge reportedly said that he could not waive the confidentiality agreement, as it is a private contract. Given the serious accounting errors I discovered from public documents (regarding the precious metals inventory -- see my "Accounting Nightmare" posts of August 23-26, 2016), I would not be shocked if there were other serious accounting problems.

Trustee Missing Metal?

February 13, 2018 7:35AMI had someone ask me for a copy of the inventory of customer-owned precious metals. Such a simple question: Chapter 11 Trustee Mark Calvert was required to file a list of the NWTM-owned inventory (Schedule A/B Part 5), a list of customer-owned inventory (Form 207 Part 11). Between those two inventories, all precious metals physically located at NWTM as of the bankruptcy should be accounted for.

In the words of Judge Alston: "And yet."

At the Creditors' Meeting on May 11, 2016, the Trustee stated "All of the customer inventory that we've identified, we have in a specific list, by location. Here it is." (it is unclear who he showed it to). In the Trustee's recent status report, he touted "The Trustee and his staff conducted a detailed and comprehensive physical inventory of all precious metal held by the company." So it *should* be simple.

Calvert wrote in the bankruptcy schedules "Debtor stored personal property for certain customers, Trustee has commenced a detailed storage inventory which will be provided to creditors when completed." To my knowledge, this was never provided to creditors. The closest was on June 28, 2016, when the Trustee filed a motion to return stored metal that was marked as belonging to a specific customer. He included Exhibit A ("Customer Owned Inventory to Return, June 2016"). But this is not a list of all precious metals not listed in the NWTM-owned inventory. The big clue here is the date, showing that this was prepared after the original customer-owned inventory (finished May, 2016). And it is in a very different format than the NWTM-owned inventory (e.g. showing ounces of metal instead of value, showing details of metal rather than a generic description).

The problem is the missing metal: metal that should have appeared on one of the two lists, but did not. On August 7, 2017, Calvert filed a new motion to return customer metal. It identifies:

- 2 100oz Pan American silver bars that "were located during the initial inventory conducted by the Trustee, but were omitted from the Initial Stored Inventory Motion as the Trustee attempted to make contact with [the customer]." This shows that the Trustee knowingly had precious metals that were not in either the NWTM-owned inventory or the published customer-owned inventory.

- 500 1oz ASE's (a monster box), that "Subsequent to the initial inventory, the Trustee discovered a “monster box”..." So this is a monster box of ASEs that was missing from the original inventory.

- A set of ingots, that was "inventoried and secured" after being told that the area it was in belonged to Ross Hansen. Later, after Ross Hansen testified that he was broke, NWTM revisited these items. They appear to never have made it to a published inventory.

- 2 100oz silver bars which were "located during the Trustee's initial inventory" along with a receipt. No such bars appear to be in the original inventory.

So this begs the questions: How much other metal was not listed in the inventories? And why did Calvert hide the customer-owned inventory?

Hearing Today

February 9, 2018 8:35AMThere will be a hearing today at 9:30AM PST (12:30PM EST) on the highly contested motion to auction/sell NWTM's assets.

The complaints range from a number of creditors who filed invalid complaints (in response to getting notice of this motion in the mail, they wrote the same letter they would have written in response to *any* court letter, about being upset about the bankruptcy), to Ross Hansen objecting that some of the property belongs to Medallic Art Limited Partnership. There are also several creditors who are objecting to their dies being purchased by another company (NWTM's policy seems to be that NWTM owns the dies, although there appear to be a number of cases where customers either paid extra to own the dies or were promised that the dies belonged to them). And there is more. So this should be a very, very interesting hearing.

Trustee to Liquidate for $2.6M

February 9, 2018 8:25AMThe Trustee has just filed a motion saying that he has accepted "stalking horse" bids from two companies for two sets of assets. A stalking horse bid means that the company making the offer must pay that amount, unless there is a higher bidder (and in exchange for guaranteeing a sale, the stalking horse bidder may get a small amount of money if they are outbid).

In this case, Industrial Assets Corp. and Maynards Industries USA LLC would be purchasing the majority of the NWTM assets for $1.95M. Medalcraft Mint, Inc. would buy the Medallic name, website, customer lists, dies, and related items for $700K. The companies would provide a combined deposit of $295,000.

Compendium of Significant Event Reports

February 7, 2018 1:20PMGiven what has been going on, I felt it would be useful to put together the monthly "Significant Event" and "Case Progress" reports from the financial statements. The monthly financial statements are all available here, but most people don't go looking through the NWTM documents section of my site.

To make it easier, you can download the compilation of "Significant Event" and "Case Progress" reports.

December Financial Report

February 7, 2018 12:20PMThe December Financial Report was just released.

It shows (p44) that as of December 1, 2017 there were 114 full time employees, with no part time employees. It shows that at the end of the month, there were 18 full time employees left (the "skeleton crew").

The "Significant Events" page (p45) states that Chapter 11 Trustee Mark Calvert decided to shut down the company on December 26, 2017. That was the first business day in the week that employees were asked to take off (originally with pay, then using vacation time). Mr. Calvert expects to "close down" the company by the end of February.

Mr. Calvert states "While the Trustee believed in the potential of the company, the deterioration in the monthly sales while in bankruptcy resulted in insufficient cash flow to remain a going concern." Monthly sales clearly fell within 2-3 months after the bankruptcy. They started at $1.6M-$1.7M in April-May, 2016. However, June-July, 2016 sales averaged $1.06M (the 2nd half of 2016 averaged a similar $1.08M), while sales for 2017 averaged $966K (including the partial December month), just 10.6% less than the 2nd half of 2016.

I'm not an accountant, but I have trouble understanding that explanation, given that the monthly sales deteriorated within the first 3 months after the bankruptcy. If it was doomed to failure (losing money every month), why was there so much optimism in the report filed with the expense applications a few months back?

More About Christmas Week

February 2, 2018 2:25PMThe week of Christmas -- December 25, 2017 through December 29, 2017 -- was the last week that NWTM employees (except for a skeleton crew) were paid for (or will be paid for -- some are still waiting for their final paycheck). I am still trying to piece things together, but there is a lot more to that week than I had at first realized.

It goes back to sometime around December 7 to December 15, when someone in management told NWTM employees that they would get Christmas week off with pay (reports are conflicting as to who said it; I have heard the comment attributed to 3 different people). That appears to have led to the December 21, 2017 meeting Mark Calvert had in Dayton, NV. He explained that the court would not allow him to pay employees for time off without using vacation time (which certainly makes sense). He said that anyone with accrued vacation time would take the week off, and get paid using vacation time (those without enough accrued vacation time would not get paid, unless their supervisor authorized them to work that week).

It was clear that Calvert was not saying that the company would shut down before the end of the year: he reportedly ended the meeting by saying that the first day back to work would be January 2nd, and told employees that New Years' Day would be a paid holiday.

So unbeknownst to me at the time, there was just a skeleton crew working from December 26 through December 29, with most employees at home using vacation time. The first letter was apparently given to the few employees present at the Dayton office on December 28. So it sounds like many employees did not get written notice of the closing until after the company was shut down. The second letter was mailed, dated December 29, received by employees in early 2018, after the business was shut down. Interestingly, it added a phone number for a contact, which the first letter omitted (a phone number appears to be required in a WARN Act notice).

Confusing things is that NWTM is still running, despite letters said they were forced to "close the company". Confusing things even further is when people were terminated. The first letter says December 31. The second letter says December 29. One employee reportedly was told to file for unemployment retroactively to December 26. But if the employees were terminated during a week where they were instructed not to work, wouldn't the date of termination effectively be their last day of work (December 22)?

Diane's Request Denied

February 1, 2018 4:10PMOn December 8, I reported that Diane Erdmann (long-time girlfriend of NWTM owner Ross Hansen) filed a motion to receive items that had been seized from her home shortly after the bankruptcy filing.

The Judge has denied her request.

Class Action Filed re: WARN Act

February 1, 2018 1:05PMA class action lawsuit (adversary proceeding) was filed against NWTM yesterday by an employee, on behalf of all NWTM employees.

The lawsuit alleges that NWTM violated the WARN Act in firing employees at the end of December.

NWTM Professional Expenses - Now Searchable

February 1, 2018 9:50AMI have gone through the 4 expense reports filed back in September, 2017, extracted the data, and combined them into a webpage at http://about.ag/NWTExpenses1.htm (warning: this is a very large (2MB) webpage).

It is not 100% accurate, due to the many issues in converting 4 different types of expense reports (some of which the text cannot be directly extracted) into a single document. However, it should be useful for a number of purposes.

NWTM Bankruptcy Professionals

February 1, 2018 8:40AMI am in the process of going through the expense reports. I discovered that there are at least 71 professionals that have been paid for working on this case so far (many have only done a small amount of work, such as answering a question in an area that they are an expert at). I have included their position when it was clearly reported in the expense reports. Note that Mark Calvert is listed twice (one in his role as Trustee at $400/hr, one as an account for his company Cascade Capital at $350/hr). Also note that some hourly rates may have changed (e.g. due to raises). This does not include CEO Bill Atalla, whose hourly rate was roughly $200/hr (including the $100K severance).

UPDATE: To clarify: Mark Calvert presumably only bills for one of those roles for any work he does (e.g. if he does accounting work, he would bill through Cascade Capital, for typical Trustee duties he would bill as himself as Trustee). Mr. Atalla is presumably owed the $100K severance due to the contract that he and NWTM signed, that the court approved.

| Company | Name | Position | Hourly Rate |

|---|---|---|---|

| K&L Gates | J. D. Almquist | $900.00 | |

| K&L Gates | D.B. Greenswag | $870.00 | |

| K&L Gates | J. Scheuermann | $815.00 | |

| K&L Gates | S.H. Coonrod | $705.00 | |

| K&L Gates | M. S. Kelley | $650.00 | |

| K&L Gates | J. Mobley | $610.00 | |

| K&L Gates | L. L. McClellan | $595.00 | |

| K&L Gates | N. G. Spiliotis | $545.00 | |

| K&L Gates | R. M. Tausend | $540.00 | |

| K&L Gates | M.J. Gearin | $525.00 | |

| K&L Gates | J.C. Bjorkman | $520.00 | |

| MNG&D | Geoffrey Groshong | $520.00 | |

| K&L Gates | S. Megally | $515.00 | |

| K&L Gates | R.G. Masters | $495.00 | |

| MNG&D | Mark D. Northrup | $490.00 | |

| MNG&D | Teresa H Pearson | $475.00 | |

| K&L Gates | C.M. Wyant | $460.00 | |

| K&L Gates | P. E. Soskin | $450.00 | |

| K&L Gates | P. K. Jacobson | $450.00 | |

| MNG&D | John Knapp | $450.00 | |

| K&L Gates | D.C. Neu | $430.00 | |

| K&L Gates | M.S. Filipini | $425.00 | |

| Individual | Mark Calvert | Trustee | $400.00 |

| K&L Gates | L.E. Steidl | $395.00 | |

| K&L Gates | S.R. Phillips | $390.00 | |

| K&L Gates | D. P. Hurley | $385.00 | |

| K&L Gates | C. C. Smith | $380.00 | |

| K&L Gates | S.E. Selin | $350.00 | |

| Cascade Capital | Mark Calvert | Principal | $350.00 |

| Cascade Capital | Charles Green | Senior | $350.00 |

| K&L Gates | J. H. Kim | $345.00 | |

| K&L Gates | B. T. Peterson | $335.00 | |

| K&L Gates | R. W. Edmondson | $325.00 | |

| K&L Gates | R. J. Groshong | $315.00 | |

| K&L Gates | D. C. Wolf | $300.00 | |

| Cascade Capital | Christine Ulwin | Senior Staff | $300.00 |

| Cascade Capital | Tod McDonald | Senior Manager | $300.00 |

| K&L Gates | L. L. Short | $290.00 | |

| K&L Gates | A. E. Gammell | $280.00 | |

| K&L Gates | S.M. Freburg | $275.00 | |

| K&L Gates | T. S. Miller | $270.00 | |

| K&L Gates | J. M. Connor | $270.00 | |

| K&L Gates | K. Drake | $265.00 | |

| K&L Gates | M. K. Pinch | $265.00 | |

| K&L Gates | K. I. Stockert | $265.00 | |

| K&L Gates | W.J. Miller | $265.00 | |

| K&L Gates | M. C. Perez-Vargas | $260.00 | |

| K&L Gates | M. P. Clark | $260.00 | |

| MNG&D | Emily R Krisher | $260.00 | |

| K&L Gates | K. N. Tibbert | $257.14 | |

| K&L Gates | C. M. Kuffel | $235.00 | |

| K&L Gates | S. A. Smith | $235.00 | |

| K&L Gates | E. R. Whittington | $225.00 | |

| K&L Gates | R. A. Duncan | $225.00 | |

| K&L Gates | D. A. Evans | $205.00 | |

| K&L Gates | D. A. Lentz | $205.00 | |

| K&L Gates | A.M. Graf | $200.00 | |

| K&L Gates | E. Mather | $200.00 | |

| K&L Gates | L. A. Diersen | $195.00 | |

| MNG&D | Kalen N Daniels | $190.00 | |

| K&L Gates | T. M. Gracey | $180.00 | |

| K&L Gates | K. P. Wing | $180.00 | |

| K&L Gates | T. S. Milne | $175.00 | |

| K&L Gates | T. Hughes | $135.00 | |

| K&L Gates | G. Hein | $125.00 | |

| Cascade Capital | Jody Canady | Accountant | $120.00 |

| Cascade Capital | Majorie Chappel | Staff | $100.00 |

| Cascade Capital | Jessica Gilmore | Staff | $100.00 |

| K&L Gates | K. R. Slavik | $95.00 | |

| K&L Gates | M. H. Hoefer | $90.00 | |

| K&L Gates | M. Bassetti | $90.00 | |

| K&L Gates | V.I. Komar | $90.00 |

How Did NWTM Fail?

January 31, 2018 4:15PMOn April 1, 2016, when NWTM filed for bankruptcy, we knew that it was in really bad shape.

But we quickly found out that while the bullion operations had been doomed to fail for many years, the custom minting operations were vibrant. That's what was going to help make creditors whole. So what happened?

There are a number of possibilities, and it is impossible to pinpoint which one(s) were responsible. Some obvious possibilities include: the bankruptcy spooked potential buyers ("bankruptcy headwinds"), the company was mismanaged, or that an outsider (or even insider) intentionally interfered with operations. I'll be looking into this a bit to see if I can narrow down what happened.

Violation of WARN Act?

January 29, 2018 4:15PM[I need to add my note as I occasionally do: I have no formal legal training, so everything I write is intended as information only, not legal advice. If you were (or are) an NWTM employee, feel free to use this information, but please do not rely on it to make any legal decisions!]

The WARN Act requires employers with over 100 employees to give employees 60 days notice of plant closings and mass layoffs in most cases.

In August, 2016 Chapter 11 Trustee Mark Calvert's company Cascade Capital performed a liquidation analysis (see Doc 1229 p34) of a conversion to Chapter 7 that specifically set aside $1,011,377 in administrative Chapter 7 claims for "WARN Act" (of which 77% would be paid from money available after liquidating the company). It stated "The 'WARN' Act would apply in this case requiring the Trustee to pay two months in additional salary to all employees at the Dayton facility." So clearly Mr. Calvert is aware of the WARN Act. Heck, he should be: he billed over $4,000 for legal research on the WARN Act! Presumably the 2016 liquidation analysis was on the assumption that a non-liquidation buyer was sought.

So what changed that did not require 60 days notice? According to NOLO, the law covers employers with over 100 employees. There were 114 full time employees at the end of November, 2017 according to the November Financial Report. WARN covers a plant closing or mass layoff, which this should be if it would have been in the 2016 analysis.

Exceptions to WARN include No Notice (temporary employees or strikes, neither of which apply here) or Shorter Notice (natural disasters, faltering company, or unforeseeable business circumstances). The business circumstances were definitely foreseeable (e.g. the September, 2017 financial report and the October, 2017 financial report both stated "If the tight cash flow issues cannot be resolved, the Trustee will need to close the business"). That leaves a faltering company (which applies to plant closings, not mass layoffs): NOLO says "If a company is struggling financially, it can give less notice." But to use that, the company has to be "actively seeking business or money ... that it reasonably believed, in good faith, that giving 60 days’ notice would have precluded it from obtaining the necessary business or money." But why would that not have applied in 2016, but apply now? Would warning employees of a potential layoff have prevented the GoFundMe campaign from collecting the $500,000 deposit?

There is also an rare exception (see 54 FR 16042) that allows liquidating bankruptcy fiduciaries to be exempt from WARN, but that doesn't seem to apply here (it only applies to those liquidating a company, not operating a company, which the Trustee was trying to do).

Were Employees Paid for Final Week?

January 29, 2018 1:40PMI strive to find the truth, and try to be very careful to report the truth, making it clear when I am unsure as to what is true, regardless of how I feel about the facts.

I received an anonymous tip today suggesting (stating) that some of the information I had previously reported (on January 17, 2018) may have been in error. Specifically, it stated "The employees did receive funds for Christmas week, and the employees were informed when it was coming. Also HR did not send anyone to Cascade Capital, but did allow people to contact Mark Calvert to ask questions."

I heard from three sources (two known reliable sources and one anonymous source) that NWT Mint employees did not get paid for the final week (12/25 through 12/29) on January 12, 2018 as they should have. The part about being referred to Cascade Capital may have come from a high level NWTM employee not in HR, but I was given the name of a Cascade Capital employee (not Mark Calvert) that an employee had been referred to.

If anyone has any information that can confirm or deny whether (and/or when) employees got paid for the last week (12/25 through 12/29), and/or whether they were informed when they would get paid for that week, I would appreciate it (the anonymous tips page also has a link to E-mail me directly if you like).

UPDATE 1: The letters given to employees on December 28 and December 29 stated that employees would be paid for the final week "consistent with NWTM's normal payroll procedures". Unless employees were paid January 12, that appears to have been a lie. Further, Nevada law states "Whenever an employer discharges an employee, the wages and compensation earned and unpaid at the time of such discharge shall become due and payable immediately." That compares with an employee who quits, who must be paid within 7 days, so presumably employees should absolutely have been paid by January 5th for NWT Mint to be compliant with the law.

UPDATE 2: I heard from an employee who did receive payment for the final week, several weeks after the January 12 payroll.

UPDATE 3: I heard from a second employee who said that he was told that he could use his vacation time for the last week and get paid for it, but did not.

UPDATE 4: The general consensus is that: [1] All NWTM employees did or will get paid (not all have been paid as I write this), [2] It looks like none got paid in the time required by law, [3] It seems that most/all got paid AFTER the normal pay period when NWTM told them they would get paid, [4] It seems that vacation time used in the final week likely was treated the same as regular pay (e.g. employees have been or soon will be paid).

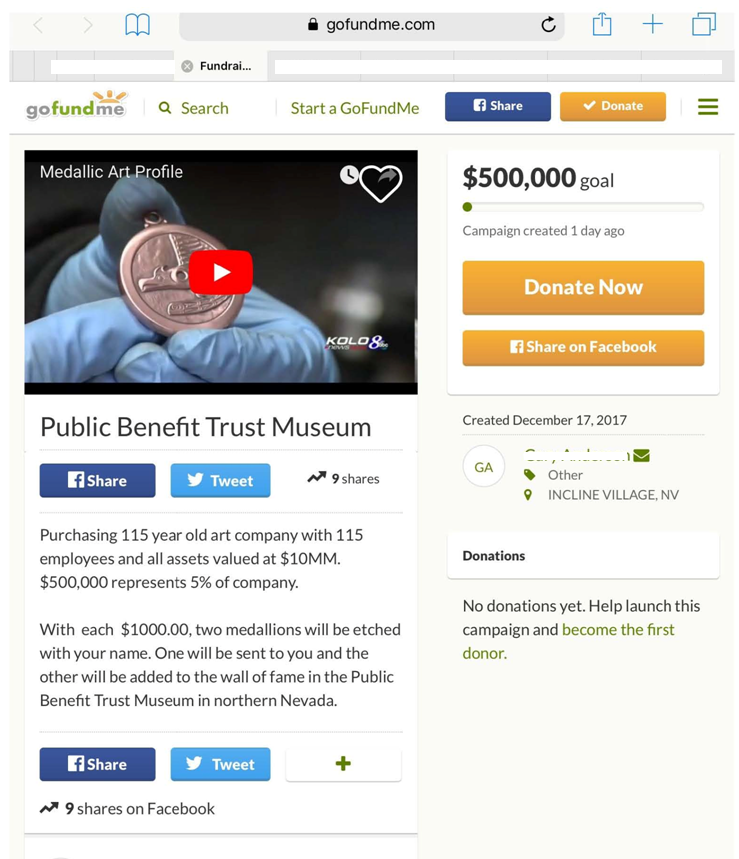

The GoFundMe Campaign to Buy NWT Mint

January 28, 2018 7:10PMI had mentioned in a December 30, 2017 post that there was a GoFundMe campaign by the company that was planning to buy NWT Mint for $10M. Here is a (slightly redacted) screenshot:

|