| Latest Status | |

| # Complaints (as of 14 Mar 2014) | 685 |

| Average Order: | $43,250.19 |

| Average Delay: | ~13 weeks |

| Longest Delay: | Over 10 months |

| Est. verified Complaint Amount: (as of 03 Mar 2014) | $21,711,595.92 |

| Outstanding Orders: | ~$42.5M (or ~$500M per Tulving claims) |

| Orders Not Delivered In Legal Timeframe: | Up to $500M |

| # Lawsuits: | At least 8 |

California commodities law requires The Tulving Company to ship within 28 days.

This page is for OLDER Tulving information

Please go to our main Tulving page for the latest updates, and assistance if you were affected by Tulving's bankruptcy.This is the page that was being updated as the Tulving problem started becoming known, and has later information as it gets taken off the primary page.

On Friday, February 28, 2014, we stated that they were effectively out of business, and about 8 business hours later, they had shut down.

Again, for most recent details, you can go to about.ag/Tulving.htm.

Plea Agreement Filed

July 27, 2015 6:55PM ESTThe plea agreement has been filed with the court, in the charge of wire fraud against Hannes Tulving Jr. and The Tulving Company. The plea agreement is not a public document, so I cannot get a copy.

NWT Issues

July 15, 2015 9:30PM ESTSomeone just alerted me (thank you!) that within the past few days the BBB closed 16 complaints against Northwest Territorial Mint (NWT) that were classified "The business failed to respond to the dispute" (usually 30+ days).

This is highly unusual, because [1] They did not respond, and [2] 12 were closed on the same day, which suggests 12 complaints in a single day (which does not seem right). I will be looking further into this tomorrow.

This is very disturbing, but at this point could *possibly* be a mistake.

UPDATE #1 17 Jul 2015 8:50PM: I tried contacting the BBB and NWT. The BBB never responded, but did remove the 12 complaints that had closed that day. I'm not sure what happened, but either the complaints weren't supposed to be there in the first place, or the BBB really messed up!

UPDATE #2 18 Jul 2015 7:30AM: It appears that the BBB branch decided to 'unclose' the exact 12 cases I asked them about, without informing me, and is allowing the company to respond ('The business is in the process of responding to previously closed complaints.').

UPDATE #3 30 Jul 2015 7:00PM: Given the poor reporting by the local BBB, it is hard to determine a pattern here. I will continue to monitor the situation.

Trustee Report #6

July 7, 2015 1:05PM ESTR. Todd Neilson, the Chapter 7 Trustee, yesterday released the Trustee Report #6.

I see little, if any, useful information besides what I have previously covered here. However, I encourage all creditors to read the report, as it comes straight from the official Tulving bankruptcy website.

The Trustee has also updated the Claims Register, although it appears the changes are minor (e.g. changing the dates that claims were filed). You can find the Claims Register by going to the official bankruptcy website (URL above), clicking on 'Claims', and clicking the "Please click here" link in the second-to-last paragraph

Bullion Direct Out of Business

July 7, 2015 1:00PM ESTJust a quick note that the popular business Bullion Direct has suspended operations, after many complaints of people not receiving orders.

I *hope* no Tulving customers have money or metal tied up with Bullion Direct as well. If you do, however, I have a webpage set up covering what is going on there.

Class Action Update

June 19, 2015 2:15PM ESTI had previously reported that the class action lawsuit against Hannes Tulving, Jr. personally was terminated.

I just heard that this may have been done with Hannes signing a tolling agreement, which would allow a suit to be refiled against him later. This cuts down expenses for both sides, while allowing the lawsuit to continued later if needed.

Tulving's Partner

June 15, 2015 1:45PM ESTIt feels like we are in an intermission, with no visible activity in the bankruptcy since mid-March when the professionals got approval to be paid, with the notable exception of the filing of the criminal case, which I stumbled across last week. Given that Hannes chose to sign a plea agreement, and the class action lawsuit against him was dropped (which a number of creditors were disappointed by), I feel this to be an appropriate time to provide further details on some information I previously published.

I felt it best not to publish all the information I had received for several reasons; one of which was that I was concerned that publishing the information could interfere with justice being served. However, at this point, releasing as much of the information as possible feels appropriate. This information comes from various sources, and I have confirmed much of the information, but cannot confirm it all (e.g. without access to documents that the Trustee has, that I do not).

In around 2011, Hannes signed a partnership agreement with an individual he knew. A friend of this partner signed documents (millions of dollars worth) without being authorized to, and without the knowledge of Hannes. Some of the documents were for products/services that were supplied (but with "padded" expenses), others were completely bogus (e.g. for goods/services given away to the partners' friends).

The partner gave The Tulving Company a $4M line of credit, which was certainly helpful. But he and another friend of his were also on The Tulving Company payroll with $300,000/year salaries during part of 2011. My understanding is that there is no record of what work, if any, his friend may have done for The Tulving Company. Yet another friend of the partner worked part-time for Tulving during part of 2013.

As of June, 2013, The Tulving Company no longer had access to the $4M line of credit from the partner. The partner's friend who signed the documents also made mistakes involving millions of dollars, including accidentally paying bills of another company the partner was involved in using The Tulving Company's money.

Oddly, I saw no mention of this partner in the criminal filing against Hannes Tulving, Jr.

Class Action Lawsuit Closed

June 14, 2015 7:20AM ESTOn June 8, 2015, the attorney representing the class action lawsuit against Hannes Tulving, Jr. and The Tulving Company filed a Notice of Dismissal. This provides notice that the plaintiff voluntarily dismisses without prejudice all claims against all defendants. The court reports the case as closed as of June 10, 2015.

I do not have any further information regarding this.

As a reminder, the class action lawsuit was essentially against Hannes Tulving, Jr. personally (since the bankruptcy stayed any legal action against The Tulving Company). The lawsuit had been paused in September, because of the criminal investigation.

Criminal Case Update

June 9, 2015 10:00AM ESTThe U.S. Attorney opened a criminal case against Hannes Tulving, Jr. and The Tulving Company, Inc. on May 8, 2015, charging them with wire fraud. There was nothing in the bill of information that really surprised me (except that it states that some wire transfers were made by customers directly to Hannes Tulving, rather than The Tulving Company). The case documents show that Hannes Tulving, Jr. and The Tulving Company signed a Plea Agreement, although the details are not public.

On June 4, a consent motion document was filed with a proposal for the courts to approve, that would allow the coins seized by the Secret Service to be transferred to R. Todd Neilson, the Chapter 7 Trustee. He would propose a plan for liquidating the coins. This is because the Government believes that the Trustee is in a more advantageous position than the Government to efficiently and promptly liquidate the seized items and distribute the funds. It also includes the inventory of seized items, in more detail than we have previously seen (but very generic, e.g. '8832 "Penny" coins in plastic sleeves').

So what does this mean? That the wheels are slowly turning, and the coins will likely get turned over to the bankruptcy proceedings as Mr. Neilson had hoped.

Quiet

May 6, 2015 8:55AM ESTThere has been no news of any type since mid-March. No docket reports have been filed, and no real changes on the offical Tulving bankruptcy website (tulvingbankruptcy.com).

I am simply posting this so people will be aware that I haven't disappeared. If you are ever worried about that, you can check the Tulving Documents page, where I post the legal documents. I try to update that at least once a week now, and report how current the page is.

Kitco Pool Safety

April 1, 2015 5:15PM ESTAlthough this is not related to Tulving, I thought it was important enough to share, as it is likely that a number of Tulving creditors have some money in the Kitco Pool.

I have discovered that the Kitco Pool -- once touted as being a much improved version of unallocated metal accounts -- has new safety issues. It is no longer 100% backed by physical precious metals, as Kitco led people to believe, and $25M of Kitco Pool was seized a few years back by Revenue Quebec the day before Kitco filed for bankruptcy (CCAA).

I am starting a page about the Kitco Pool, similar to this one, where I will add updates. If you have money in the Kitco Pool, I strongly urge you to read more and determine if the pool is still safe for you.

$600K A/R Compromise

March 18, 2015 9:05AM ESTR. Todd Neilson, the Chapter 7 Trustee, has filed a motion with the court to approve a settlement agreement with the trade creditor that shows up in Tulving's accounts receivable as owing $600K. This was briefly mentioned in the Trustee Report #5.

It shows $593,434.00 as being owed. It confirms that $18,000 has been paid so far, with another $8,000 that presumably has been paid since the payment schedule was printed. It shows payments of $5,000 a month, with 2 extra $15,000 payments a year, and a few extra smaller payments through May, 2015. It shows the final amount due on June 30, 2021 if all payments are made on time. Interest accrues only if payments are not made on time (which would extend the time until the loan is repaid). There is also an incentive for paying down the loan or paying it off completely; any extra payments will reduce the ending principal balance by an additional 10% of the payment received.

Taxes

February 27, 2015 2:10PM ESTA lot of people have been asking me about taxes.

I have put together a page covering taxes.

The summary (remember, I have no accounting, legal, or other similar background): you should be able to deduct the calculated loss on your 2014 tax return, either as a capital loss (the safe way) or as a theft loss (a better deduction and likely OK to take, but high audit potential). The amount to deduct can either be your loss minus the amount expected to be recovered as of December 31, 2014, or your loss minus the amount currently expected to be recovered (if more). I do not feel qualified to make a determination as to those numbers; the Chapter 7 Trustee would likely be in the best position to do so.

tulving.com moving...

February 24, 2015 1:25PM ESTAfter nearly a year, last Friday the tulving.com domain name finally started its way to GreatCollections Coin Auctions.

It is still legally registered to The Tulving Company, but the registry that handles the domain name is reporting that GreatCollections Coin Auctions is now an administrative and technical contact for the domain. That means that at any point they want to, they should have the ability to put the tulving.com website and E-mail back online.

Basic Analysis of Professional Fees

February 24, 2015 10:20AM ESTI have now gone over much of the fees that have been reported over the past few days (a total of a bit over $542,000, including expenses). I put all of the expenses in a table on a webpage allowing me to easily search it (if anyone would find access to the page helpful, please let me know). The fees provide great transparency into the operations of the bankruptcy (and occasionally provide information that some would likely prefer kept confidential, which is why I am not publicly releasing that page).

The main concern of creditors has typically been that the professional fees would be much higher than they could be. To summarize, I see no sign of fees for services that did not occur, nor do I see any sign of fees for services that seem out of line (such as work that was done primarily to increase billable hours).

So from my point of view, the reasonableness of the fees really hinges on whether the hourly rates (which seem astromical compared to what typical Tulving creditors get paid) are justified. In other words, we know people could have been hired at a much lower rate -- but if they got paid half as much, and it took twice as long, the fees would be nearly identical.

In all, I calculate 1,057.3 billable hours (from all the professionals combined) over the course of 11 months, or $512/hour average. That works out to about 22 hours per week, about the number of hours one half-time employee might put in. With over 200 dockets filed, analyzing several years of transactions, the two auctions, proof of claim work, that seems quite efficient to me.

There has also been a lot of "behind the scenes" work going on that has not been previously disclosed. For example, it shows that the Trustee contacted several well-known experts regarding the value of the seized coins (one of whom I believe knows the Tulving operations well).

Some of the applications state that some time was expended but not billed for and written off. For example, I also noticed a number of phone calls where one of the professionals did not bill for the calls. Also, I noted that one professional billed for 2.4 hours for meetings with the CFTC in Washington, DC. That involves about 9 hours of flight time, plus a couple hours of waiting at the airport, which the Tulving estate was not billed for.

Hopefully this will give you a better idea of the professional fees. $542,000 is a huge amount of money, but on the other hand, a lot of work was accomplished in the 1,057.3 billable hours.

Document

February 23, 2015 6:55PM ESTSomeone requested that I post a copy of a document if I have it -- unfortunately, I do not (it is one that would be very useful to me, too -- if I do get a copy, I likely will be able to post it here).

BRG and Trustee Expenses

February 20, 2015 4:35PM EST - Updated February 21, 2015 10:00AM EST (to add PSZ&J info)Yesterday, court filings showed that BRG and R. Todd Neilson, the Chapter 7 Trustee, have submitted their fee/expense applications.

By my calculations, BRG is requesting $200,203.19, and Mr. Neilson is requesting $97,347.39. These include both fees and expenses, from both before and after the transition from a Chapter 11 bankruptcy to a Chapter 7 bankruptcy. The total for both comes to $297,550.58 (for a total of 697.8 hours of work). Not all of the payments are being requested now.

The application from PSZ&J will likely be available shortly. PSZ&J is requesting $245,394.31 (again, including fees and expenses, since the beginning of the bankruptcy).

There is a *lot* of information in the applications, and it will take some time for me to go through them. However, they do show that coins that were not seized by the Secret Service that may belong to the Tulving estate (which was reported a few weeks ago) may be worth approximately $4M. It also shows $427,298 in funds were disbursed under the Chapter 11 bankruptcy, which closely matches the total in the bank accounts at the time, leading me to believe that is the amount transferred to the Chapter 7 bankruptcy.

The applications can be downloaded here:

BRG March, 2014 through May, 2014,

BRG May, 2014 through January, 2015,

Trustee March, 2014 through May, 2014,

Trustee May, 2014 through January, 2015,

PSZ&J March, 2014 through May, 2015,

PSZ&J May, 2014 through January, 2015.

I will likely go through the applications and report some information from them.

Trustee Report #5 Released - Good News, Bad News

January 27, 2015 5:15PM ESTMr. Neilson today released the Trustee Report #5 (also available at the official Tulving bankruptcy website).

The bad news is that it is clear that the bankruptcy will likely take at least a number of years to recover all the assets. The good news is that the seized coins, appraised by the Department of Justice at $3M, may be worth quite a bit more.

- Mr. Neilson had the opportunity to meet with Hannes Tulving, Jr. on December 8, 2014 (with some conditions). Hannes expressed a desire to cooperate and assist Mr. Neilson. I want to take a moment to thank Hannes for doing this, in case he happens to read this. Whatever your motivation may be, your cooperation is certainly beneficial to creditors.

- The Department of Justice and Secret Service had seized some coins, which the DoJ had appraised at $3M. Mr. Tulving's legal counsel engaged an expert who valued the coins at $11,384,000. Mr. Neilson makes it clear that high valuations should be taken lightly, and points out that it would likely take several years of careful work to realize higher values.

- The Tulving Company may have had "a number of additional coins" that were not seized by the government. There are no further details at this time (e.g. their worth, where they were, etc.), but Mr. Neilson hopes to have more details in the next report.

- The $600K accounts receivable comes primarily or all from one single "trade creditor." Apparently a $300K check bounced in addition to a $300K order being sent. Discussions are in place which may lead to recovering the money over a 5-year time period.

- The sale of the intellectual property closed on January 12, 2015 in a "rather tortuous process." It was sold to Great Collections (which someone pointed out to me is run by a person who used to work with the CEO of A-Mark), and the money has been transferred. Mr. Neilson contacted a number of other potentially interested parties; none provided a bid.

- About $1.2B flowed in and out of The Tulving Company over the 3 years prior to the bankruptcy.

- Mr. Neilson conducted a Rule 2004 exam of A-Mark Precious Metals, and received a significant amount of accounting records on December 30, 2014.

- Mr. Neilson hopes to provide information regarding the relationship between A-Mark and Tulving, and is also looking at other financial relationships between other parties and Tulving.

- They are hoping to carefully balance the costs of untanging the mess with recovering money (e.g. making decisions on whether to pursue possible assets based on how much it would cost to collect them).

- Mr. Neilson beleives that they were able to inform the vast majority of claimants (creditors).

- The Tulving records were quite accurate when compared to the proofs of claim, and he believes they capture almost all of the possible claims (there were about 100 creditors who chose not to file a claim, the amount of which was not large compared to total claims).

- On March 12, 2015 there will be a hearing for professionals to present fee applications to the Bankruptcy Court.

Two Theories Ruled Out

January 21, 2015 2:15PM ESTMy original theory had been that The Tulving Company had been speculating in the commodities market (e.g. going long in futures or options, well beyond what would have been needed for hedging). From information I have since received, this theory has been proven wrong.

Another similar theory that had been spreading on the Internet is that The Tulving Company's losses were caused by improperly calculated hedging. For example, waiting too long to hedge an order (with a price swing in the meantime), or hedging for much more/less metal than is needed (which can happen with futures contracts, which are usually 100oz for gold and 5,000oz for silver). While the choice of hedging strategy may have played a role, the improperly calculated hedge theory can pretty much be ruled out as well (those who may think that I am wrong, feel free to come up with a hedging scenario that would result in loss as metals prices go down).

Right now, it sounds like it may really boil down to high expenses (with the possibility of a significant amount of those expenses unnecessary for various reasons). It is also likely that to some extent expenses added up over the course of years. For example, at a sales level of $350M/year, you could absorb a $2M expense simply by delaying orders an extra 2 days, which could go unnoticed. In that case, as sales volume goes down, the delays would get longer.

High expenses, however, still do not answer the question of what happened around mid-April, 2013 (which -- perhaps coincidentally, perhaps not -- was when metals prices had one of their worst one-week drops). To the best of my knowledge, all orders placed before mid-April, 2013 were delivered (and while there were some reports of delays then, there were not many). The complaints started increasing significantly for orders placed around or after mid-April, 2013. The invoice numbers suggest that there was heavy ordering at that time, likely due to the lower metals prices. So something changed around mid-April, 2013, but I have yet been unable to identify exactly what.

A-Mark: Je Suis Charlie

January 13, 2015 5:05PM ESTFacts6:

- Hannes Tulving, Jr. stated in court records that the reason for the bankruptcy was that The Tulving Company "could not pay its daily operating expenses, including high-interest payments on inventory that was collateralized for operating expenses."

- My source stated that Tulving had a repurchase agreement (or hedged bullion account) with A-Mark. A-Mark denied that it was called a hedged bullion account, but A-Mark neither confirmed nor denied that it was a repurchase agreement, and the description they provided about the arrangement to me matches exactly what A-Mark calls a "repurchase agreement" (or arrangement).

- A-Mark has documents that refer to inventory used in repurchase agreements as "collateral."

- Although A-Mark disputes that Tulving paid them any interest ("no interest was ever paid by Tulving to A-Mark"), they do admit that Tulving paid a fee for this service, and A-Mark's documentation also shows cases where they refer to fees paid for repurchase agreements as interest. A-Mark's refusal to state their preferred term to categorize a payment ("interest" or "fee") does not entitle them to quash the truth.

- The bankruptcy Trustee mentioned A-Mark by name, in the context of signficant money having been paid to A-Mark by Tulving. Although some of the facts in and behind the statement are either disputed or not known, A-Mark was the only company named in this context.

- I have received credible information that Tulving paid A-Mark interest and/or fees of about $75,000 per month (A-Mark confirmed fees were paid, and did not deny the amount),

- I have received credible information that the inventory A-Mark held for Tulving's possible repurchase was worth approximately $10M (A-Mark confirmed the inventory, and did not deny the amount),

- I have received credible information that the The Tulving Company paid A-Mark over $5M in interest and fees unrelated to any outright trades (A-Mark confirmed fees were paid, and did not deny the amount).

- I see no evidence that Tulving had any collateralized inventory other than with A-Mark (or their subsidiary CFC).

- My source has information about Tulving's interactions with A-Mark that I have not seen published anywhere, which A-Mark has confirmed as accurate. My source also knows an internal term used by A-Mark that appears nowhere on their website. This, along with other information (unrelated to A-Mark), leads me to find my source credible.

- On about February 28, 2014, the inventory A-Mark held (reportedly valued at $10M) was liquidated in a manner than resulted in an approximately $130,000 wire transfer to The Tulving Company.

- According to my source, the transaction on March 3, 2014 factored in a ~$75,000 interest/fee payment (I.E. A-Mark got paid after The Tulving Company stopped taking orders), and a ~$1,000 payment to CFC.

Reminder: Tips Wanted

January 6, 2015 7:05PM ESTJust a reminder -- if you have any tips regarding Tulving, you can send them anonymously on the tip form.

Customer List Sold for $150,000

January 13, 2015 6:55PM ESTCourt records show that Tulving's customer list and associated intellectual property (e.g. phone number and domain name) were sold for $150,000 in December to the only bidder, Greatcollections.com LLC d/b/a Great Collections.

Tulving's Account With A-Mark

January 9, 2015 9:25PM ESTI had been trying unsuccessfully for a while to determine the specific type of account/agreement The Tulving Company had with A-Mark (beyond outright trades), and just got a document that has the exact information I was looking for. A-Mark refers to it as a repurchase agreement (or just "Repo" for short in some of their internal documents).

With a repurchase agreement, A-Mark would purchase metal from The Tulving Company (e.g. sent in from Tulving's customers), and The Tulving Company would have the option to repurchase the metal for fair market value at a later date. My understanding is that the amount subject to repurchase was around $10M at the time The Tulving Company shut down (and at times much higher), and that the fees (at least towards the end) were approximately $75,000 a month. With some repurchase arrangements similar to this, the fees would be appropriately classified as interest.

ADDED: A coin dealer could consider this is a type of hedging. They have easy access to metal (which they consider their inventory), yet are minimally effected if the price of metal goes up or down.

Update on Chapter 11 Theory

January 9, 2015 1:55PM ESTYesterday, I posted a theory that there may have been a plan in place for The Tulving Company to continue operations via the Chapter 11 bankruptcy, with the goal of getting metal orders from creditors sent out.

As I am not a Tulving creditor, it is easy for me to overlook the perspective of someone who has had to deal with the bankruptcy. I understand that many, if not most, Tulving creditors hold Hannes Tulving, Jr. in a very negative light. And this is certainly understandable (I have even heard stories of how difficult this was on people who actually did end up getting their orders). I hope the theory I posted did not offend any creditors.

However, one of my goals here is to be unbiased. There are some very clear (although not court-proven) facts, among which are: The Tulving Company took money from customers with an inability to ship the orders (causing much pain for creditors), but on the other hand Hannes Tulving, Jr. did not run off to a private island with $20M as many had speculated.

Which leads me to this: I have received information that leads me to be convinced that the theory I stated was indeed correct. Specifically, that before filing for bankruptcy, The Tulving Company had at least the beginnings of a plan in place to allow the business to continue under Chapter 11, similar to what I had described (selling the coins that ended up being seized by the Secret Service, but not bullion). It would have effectively been an orderly liquidation of the company, with the goal of making customers whole (with cash). The plan was not just a thought, but involved negotiations with an organization that would help facilitate everything.

Theory on Chapter 11

January 8, 2015 8:45AM ESTWhen The Tulving Company filed for bankruptcy, I was surprised that it was done under Chapter 11. That's because Chapter 11 is for companies that plan to continue operations (as opposed to Chapter 7, where the business shuts down and its assets are liquidated). Chapter 11 works well for companies that cannot pay all their bills each month, but do not owe a huge amount of money. It is also often used to liquidate a company in a more efficient way than the bankruptcy court might be able to do (e.g. a "Going Out of Business" sale).

So why would The Tulving Company have filed Chapter 11? With nearly $20M of debt, an inability to send out metal on time, and losing its reputation for quick shipping makes Chapter 7 seem like the only option.

The answer may lie in the information I received recently that the seized coins were listed on Tulving's books for much more than the $3M that the Justice Department appraised them for. It may be that Hannes Tulving, Jr. decided to file for Chapter 11 bankruptcy, believing that these coins could be sold by The Tulving Company for more than they could be liquidated for, and bring in enough money to allow most (or all) of the existing metal orders to be shipped.

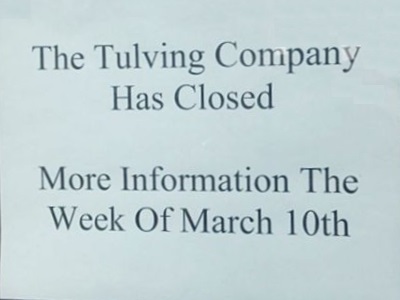

If this were the case, with Chapter 11 protection (which is overseen by the court), buyers would feel more assured that they would actually get the coins being ordered (helping overcome the reputation issue -- especially since Tulving had previously had a stellar reputation (aside from the 1990 bankruptcy). And it explains the sign on the door the day The Tulving Company shut down ("More Information The Week Of March 10th").

The original bankruptcy petition did state assets as less than $50,000, but it also had a number of similar inconsistencies (which appeared to be due to an inability to access the records that were seized, and a need to file quickly).

What we do know is that the Secret Service seized the coins on March 9, 2014, the day before the bankruptcy filing. With the coins and records seized, any chance of selling the coins and settling accounts with creditors would have been gone.

This theory, without hard evidence, would be hard to prove or disprove. However, if it turns out that the value of the coins does approach the amount of money owed creditors, it would make this a very credible theory.

Update on the Seized Coins

January 4, 2015 9:15PM ESTI have received information from an anonymous (yet proven reliable in the past) source regarding the numismatic coins that were seized by the Secret Service.

This source told me the fair market value of the coins (broken down into certified and raw coins), as listed in The Tulving Company's books, and the value is quite a bit higher than the original appraisal by the Deparment of Justice.

Again, this does come from an anonymous source, and the value could have changed since they were entered in The Tulving Company's books. I also do not know the source for the value in the books, or the method used to generate the value (e.g. based on auction/wholesale/retail prices, whether they factored in selling a large quantity of coins at one time, etc.). However, the information I received is quite promising.

Tulving Criminal Investigation Update

January 3, 2015 7:55AM ESTThis information is about a month old (as a an odd side-effect of the courts charging to search for documents). However, at the beginning of December there was some information released about the criminal investigation into Hannes Tulving, Jr.

Mr. Tulving has continued discussions with prosecutors, and as of around early December was working with prosecutors on selecting an expert to value the "significant amount of precious metals currently in the possession of the federal government". This refers to the coins that were seized by the Secret Service shortly after Tulving shut down, that were originally valued as 'worthless', but later appraised informally (I.E. without looking at all the coins) at just over $3M.

This does not provide a lot of information; however, it at least helps reiterate that Mr. Tulving has not fled to a tropical island. I personally think that auctioning the coins would be best, as it would determine the value of them. However, I assume that between the bankruptcy and criminal investigation there are restrictions preventing that from happening.

A-Mark to be Subpoenad

December 23, 2014 4:25PM ESTOn Friday, the court authorized the Trustee to subpoena A-Mark Precious Metals.

Rather than a blanket authorization of all the documents requested, the court limited the initial response to specific documents, giving A-Mark the option to object to further document requests. It also requires A-Mark to provide assistance in reviewing the documents, and requires them to submit to an oral examination under oath with 21 days written notice.

The documents required initially include monthly account statements from January 1, 2011 to the present, spreadsheets and account ledgers setting forth the details behind the transactions during that time, and copies of all underlying contract documents.

These documents should give the Trustee answers to some questions that have come up about A-Mark, such as the specific type of account(s) Tulving had (sucn as outright trades, deferred delivery, forward purchases/sales, spot deferred transactions, options, or more esoteric transactions). It should also provide details on the transaction on the day Tulving shut down, which one anonymous source with knowledge of the transaction claimed was $10M (whereas the QuickBooks entry may have just showed the $132,532.05 net amount due The Tulving Company, which would hide the nature of the transaction).

From an examination of past documents A-Mark has presented to courts, A-Mark should have no problem being able to produce documents showing exactly what was bought and sold (including product, quantity, price, vault shipping from, the A-Mark trader, etc.) every day during the time period, and outlining exactly what type of account(s) Tulving had.

Auction for Customer List - $165K Opening Bid

December 9, 2014 8:55AM ESTThe court has authorized the auction of the customer list (along with the phone numbers, web address and possibly other intellectual property). If you know of a company that would be willing to pay $165,000 or more for the customer list, please pass this information on to them (full details in Docket 197)! Bids must be submitted by December 15, 2014 at 5:00PM PST (although the actual auction is the next day at 10AM, and the court will approve the sale a few days later).

This is a combination of a sale and an auction. In other words, there is a company that has agreed to buy the customer list for $150K, unless there is a higher bid (and if there is a higher bid, they would get a fee to compensate them for the time/risk involved). The minimum bid is set at $165,000. If there are no bids, it will be sold for $150K.

Subpoena Requested to Examine A-Mark Records

December 2, 2014 9:10AM ESTThe Chapter 7 Trustee, R. Todd Neilson, has submitted a motion to the court to authorize the production of documents by A-Mark Precious Metals, Inc., and if necessary, an oral examination. This is because the records available to the Trustee are limited in detail and scope, but reveal extensive dealings between Tulving and A-Mark. The information is required to determine if the estate holds any claims or causes of action relating to such transactions.

The proposed dates and times are December 18, 2014 at 10:00AM for the production of documents, and December 28, 2014 at 10:00AM for the examination.

The documents requested include all documents relating to any transactions, transfers or business dealings between Tulving and A-Mark from January 1, 2011 to the present. It specifically includes all ledger records, purchase orders, invoices, delivery records or confirmations, cancelled checks, wire confirmations or instructions, and receipts.

You may be wondering how Tulving's records could be limited. I have heard that the Quickbooks accounting records may only show net transactions with A-Mark. Let's imagine that one day Tulving bought $200,000 of metal from A-Mark, sold them $100,000 of metal, had a monthly bill for $75,000 for the option to purchase metal, and a $5,000 loan payment. In this case, Tulving might get a detailed bill showing $180,000 due. Rather than have 4 separate entries, it might be entered in Quickbooks as just 1 entry showing Tulving paying A-Mark $180,000. If the original paper records were unavailable, it could be difficult or impossible to determine what the actual transactions were. Hence the need for the original documents.

Intangibles Sale Motion

November 12, 2014 8:20PM ESTLast Thursday, the Chapter 7 Trustee filed a motion to (among other related things) approve the sale and auction of the Tulving customer list and other intangibles (website and phone numbers). There will be hearings December 4 and December 18.

Worthy of note is that the customer list sale would be subject to an addendum addressing privacy. Also, the agreement specifies that the customer list is from January 2011 through the petition date (including customer contact information, and information about each order).

Consumer Privacy Ombudsman Report

October 25, 2014 8:00PM ESTOn Wednesday, the Consumer Privacy Ombudsman filed his report on the sale of The Tulving Company's intellectual property (the customer list, website, phone numbers, etc.).

Although there is a lot I could mention about it, the short version is this: although there is some question as to whether a privacy policy existed, and the information may not be classifiable as personally identifiable information (as bullion is typically resold, not consumed), an addendum should be made to the sale documents stating that the purchaser will abide by the privacy policy in regards to personally identifiable information. I do not believe it is iron clad, but certainly places customers in a much better position than if the addendum were not included.

More Tips Wanted

October 21, 2014 2:20PM ESTLast Updated October 24, 2014 3:15PM EST: Tulving Company financials, strikeout repo info, add 'what happened?'

I am hoping to get some more tips from people. I believe a number of people reading this may have useful information. Right now I am hoping to find out more about:

- Details on exactly what occurred early-to-mid April, 2013, that dramatically altered The Tulving Company's ability to ship orders. For orders placed through the first week of April, 2013, complaints were typically about 2-5 week delays; orders received starting the second week of April, 2013 were subjected to lengthy delays. Whatever happened then may be the key to answering "What Happened?".

- Any Tulving Company financial details, such as accounting reports/records/statements (these would not be published, but would be very helpful to back up other information I have, and to have an extra set of eyes looking for anomalies)

- Any organization that may have held inventory for The Tulving Company (in Tulving's name or otherwise),

- Any hedged (or similar) accounts that The Tulving Company may have had with wholesale bullion dealers or similar companies,

- A sample "repo" agreement with a bullion dealer (e.g. "Addendum to Trading Agreement" or similar, with information redacted if needed; it does not need to be from Tulving),

Details of how a bullion dealer might use a "repo" or "collateralized inventory" account in their normal course of business

Trustee Report #4 Released

October 20, 2014 9:25PM ESTThe Chapter 7 Trustee, R. Todd Neilson, released the Trustee Report #4 today (you can get a copy directly from the official bankruptcy site here).

For those that have been following the Tulving bankruptcy, there is not much noteworthy new information in the report, but I urge you to read it. A few pieces of information: the Trustee is looking into ways of collecting some of the accounts receivable while avoiding costly legal expenses (that do not guarantee payment), the Trustee is hopeful in selling the intellectual property for $150K as originally planned, and they are untangling the $1.2B or so of money that flowed into and out of Tulving in the 3 years prior to bankruptcy (but being careful to use resources appropriately).

The Trustee also mentioned that they plan to file a fee application later this year to approve possible payments of professional fees (reminding us that the Court assured attorneys that all fees would be properly reviewed).

Where Things Stand

October 16, 2014 1:30PM ESTLast Updated October 16, 2014 1:30PM EST: (Safe likely contains no bullion)

Claims and Money Owed:

| Total Owed at Bankruptcy Filing | $19,821,127.03 |

| Total Owed Customers at Bankruptcy Filing | $18,671,529.98 |

| Total Owed Non-Customers at Bankruptcy Filing | $1,149,597.05 |

| Number of Proof of Claim forms: | 378 |

| Total Claimed by Creditors: | $17,208,202.08 |

| Total Claimed by Customers: | $16,096,982.25 |

| Total Claimed by Non-Customers: | $1,111,219.83 |

| % of money owed that was claimed: | ~85% |

Notes: The 'owed' numbers come from Tulving's records, which may not have been accurate, especially towards the end. My original estimates were as high as $40M-$50M; this is one case where I am glad to be wrong. Claims are as of October 14, 2014. Total claims do not include about 5 duplicate claims I saw, but do include some late claims that may or may not be allowed.

Assets:

| Cash | ~$400K | Expected to be used to pay expenses, then distributed to creditors. The $400K figure comes from the end of May, 2014 (~$424K, but other expenses have almost certainly been paid since then). |

| DoJ-Seized Coins | ~$3M | This is the biggest potential source of money. It sounds like the Department of Justice wants to auction the coins, and the proceeds may or may not go to creditors. They also seized a safe, which could have some value in addition to the $3M appraisal, but I have heard that it does not contain any bullion. |

| Intangibles | ~$100K+ | Mainly the customer list, but also includes the domain name, phone number, etc. One company agreed to pay $150K, but that was before the Tulving privacy policy was known. |

| Accounts Receivable | ~$600K | My source believes this may include cases where bullion was delivered to dealers, and their checks bounced. It may be difficult and/or costly to collect this money. |

| Preference and Other Causes of Action | Unknown | The Chapter 7 Trustee is looking into payments preceding the bankruptcy, to see if recovery of some of the money may be appropriate. The Trustee has not drawn any conclusions on the recoverability of funds. |

Expenses Owed:

| Professional Fees | $97,484.33 | This includes professional fees from the bankruptcy filing through the conversion to Chapter 7. It breaks down to $39,103.78 to PSZ&J, $38,839 to BRG, and $19,541.55 to the Trustee. |

| Lease Payments | $79,200 | This includes payments for the Costa Mesa office/warehouse, $24,200 for March, 2014 (from the date of the bankruptcy filing), $33,000 for April, 2014 and $22,000 for May, 2014 through the date of the lease rejection. |

Notes: These do not include professional fees since the conversion to Chapter 7. There are also other expenses that are a bit harder to quantify. For example, there was ~$4,500 in expenses to the auctioneer, there have been storage fees, bank fees, reimbusements for postage, etc. However, these are relatively small compared to other expenses. Also, I understand that the expenses listed here need to be approved by the court before they can be paid.

$659,125 Check Mystery Solved?

October 14, 2014 8:45AM ESTI realized yesterday the most likely reason for the $659,125.00 check that was deposited in January, 2014, that was returned on March 6, and re-deposited in late March, 2014. It is a mystery because no claim was filed for it (in fact, it would have been the largest claim). Interestingly, a source of mine states that this was a personal check, not a cashier's check as it is described in court documents.

I believe it was most likely for a monster box of gold U.S. Eagles. Based on spot prices in January, 2014, Tulving was selling gold U.S. Eagles in monster box quantities for about $627,475 to $661,475 (assuming no quantity discount), so price-wise it does fit (if they ordered on or around January 24-27). The price for a monster box will always be an even dollar amount ending in 5 or 0, which also fits. And the end-of-January timeframe seems right, given the early March rejection of the check.

One possibility is that the person who sent the check got nervous, placed a stop payment order on it, and later got their metal (which would explain why they did not file a Proof of Claim). Given the amount, it would likely be an order from a bullion dealer.

The A-Mark Transaction

October 8, 2014 9:05PM ESTI have confirmed that The Tulving Company had an agreement with A-Mark Precious Metals, Inc. that went beyond 'outright trades' (immediate physical delivery at the full cash price).

The Tulving Company had at least one financial transaction with A-Mark where there was bullion stored by A-Mark in a Brinks vault in Los Angeles. A-Mark states that this bullion was owned by A-Mark, and that Tulving paid a fee for the option to purchase the bullion at market price. A-Mark has previously stated that they never engaged in futures trading, forwards contracts, or transactions involving any type of commodity derivatives with Tulving.

This metal was liquidated on March 3, 2014 (the day Tulving shut down). As a result of the transaction, A-Mark wired just over $132,000 to The Tulving Company.

To the best of my knowledge, all of the information in this post was verified by A-Mark and/or can be confirmed by public documents.

Credible Rumors, Part II - The Loan

October 8, 2014 7:35AM ESTMy source says that The Tulving Company had an unsecured $4M line of credit with an individual. The line of credit started before 2011, and ended in June, 2013.

To put June, 2013 in perspective, it was mid-April when the price of gold plummeted one week, and orders could no longer all be fulfilled. I had also heard (from another source) that the IRS may have been conducting a field audit in late April, 2013 or early May, 2013. And court documents show that The Tulving Company stopped making rent payments around June 1, 2013 (to be partially resumed about 6 months later).

Credible Rumors, Part I - Expenses

October 6, 2014 5:40PM ESTLast updated: October 6, 2014 8:25PM EST

I have been receiving a number of tips lately, many of which are credible.

I am being careful about what I disclose, for several reasons. First, in most cases, my sources do not want to be identified and/or I do not have documentation to confirm the tips (or have documentation that I cannot confirm is accurate). In other cases, disclosing too much could lead to my sources being identified, which I want to avoid at all costs. Some facts may be modified a bit for similar reasons (e.g. '415 customers' changed to 'Over 400 customers').

The information, if true (which I believe to be the case), helps outline exactly what happened to The Tulving Company. There seem to be 2 essential components, the first of which I will discuss here (some of this is from my own discoveries, some comes from tips provided by anonymous and/or confidential sources).

Financial records show some anomolies between 2010 and 2011. Towards the end of 2010, sales increased significantly (going up 80% between 2010 and 2011). And many expenses seem to have shot up, as well: insurance, personnel, and rent. But it doesn't add up.

The insurance went up 150%, which appears reasonable given the nearly doubled sales. The rent costs about tripled, as well -- but that doesn't make sense, as the company stayed in the same location it moved to in early 2009, and Hannes stayed in the same apartment he had been in for at least a couple years. And why would the office lease be renewed less than 2 years after it was originally signed (Tulving was a long-term business, that wouldn't have the need for a 1- or 2-year lease that a startup would)? And why was the lease not signed by Hannes Tulving, Jr.? Court documents show that the accountant who signed the lease started around the time the lease was signed (January 1, 2011), and list his address as 'unknown'.

But there is more to it than that. There is the cost of personnel. From what I have seen, it appears that the average salary shot up at some point in early 2011. Increased sales would not account for that. And none of the people that I have talked to that used to work at Tulving mentioned longer hours that would account for it. And later on, the average salary plummeted. By process of elimination, it seems that someone had a huge salary for a period of time. That doesn't seem like a normal occurrence to me, as I don't see any signs of Hannes Tulving, Jr. increasing his salary by a large amount during that time. And how could someone at such a company convince Hannes Tulving to pay him a huge salary (perhaps 5 times the average salary)? He took pride in explaining that a reason for low prices was not hiring expensive salespeople or coin buyers. It just doesn't add up.

The Tulving Company was known for many years for shipping within a day or two of receiving good funds, without fail. The first complaints of orders taking several weeks or longer started around March, 2011 -- at about the same time the expenses were mounting. Although it was a couple years before things got completely out of control, this seems to be the time that orders started being delayed. And we know nearly for a fact that Tulving went out of business due to delays, which were caused by using incoming customer money like a loan. So the large expenses caused a change from a well-tested businsess model (ship within a day or two) to a so-so business model (ship when you can, within a few weeks).

So it is starting to seem clearer and clearer that the events that led to Tulving's demise started at the beginning of 2011, and were related to high expenses. If you are paying more money than is coming in, you need to delay your customer orders. So where could this money have gone? That is beyond my expertise, and I feel confident will be discovered as part of the bankruptcy proceedings; the Trustee has a background perfectly suited for something like this. And even if he did not go back that many years, between the criminal investigation and other agencies investigating Tulving, if there is something to these rumors, it is sure to come up.

Still Actively Seeking Tips

October 4, 2014 7:00AM ESTI have received a number of tips lately, and any further details are certainly welcome. And I want to send a big thank you to the person(s) providing tips. You can use the tip form to send nearly anonymous tips.

Claims Update

October 3, 2014 7:05AM ESTI am showing 379 claims totalling about $17,088,983.08, of which $15,977,763.25 are claims from customers. The numbers will not match the court records, as I have taken out duplicate entries from the dollar totals, and added several Proof of Claim forms that the court received, but neglected to file.

There is also a clear issue with late claims. On October 1, the court filed at least 6 claims, which appear to have been received after the September 30, 2014 bar date. My understanding is that late claims can at times be allowed, but must meet certain strict criteria. Given the circumstances, however, I would expect the day-late claims to be allowed (it appears that none of them were on my E-mail list, so they likely did not know about the need to file a Proof of Claim until early September when the creditor list was generated).

Tulving Issues to Monitor:

October 1, 2014 7:00PM ESTI expect all claims received by the bar date should be processed by the end of the day tomorrow. I am aware of several claims that the court neglected to process; if that was done in error (as I expect), I am not sure how long that would take to correct.

At this point, I am starting to think about what happens next. I am putting together a list of answers I hope to find out, and information I hope to get. I thought there would not be much, but there are plenty of unanswered questions and information not yet known. It includes:

- What Happened? That, of course, is one of the biggest questions. This almost certainly cannot be a simple 'We ran out of money' bankruptcy; a business like this running successfully for 20 years does not shut down owing customers $18M.

- A Normal Bankruptcy?. I want to investigate a bit to see if there was any chance this was just a normal bankruptcy -- expenses exceeding assets (to the tune of $18M+). With about $5M of revenue after the bullion cost, it seems implausible. Now that we know many expenses, it should be easier to disprove that this could have been a normal bankruptcy.

- Collateralized inventory?. Was there collateralized inventory, as Hannes states, and rumors suggest? I need to investigate this more.

- Investigations. What will be the results of the Department of Justice criminal investigation, the CFTC investigation, and the class action lawsuit?

- Potential Assets

- Customer List. The customer list and other intangibles will be sold and/or auctioned, with a review of a consumer privacy ombudsman.

- Preference Actions. Will preference actions (a/k/a clawbacks) be taken against anyone? It sounds unlikely that there will be clawbacks against those who received their metal.

- $3M of DoJ-Seized Coins. The Department of Justice seized $3M of coins, that we originally assumed would be part of the bankruptcy estate. However, there is a chance that when the DoJ auctions them off, some or all of the money might not go to the bankruptcy estate. And how much money will they actually bring in?

- The DoJ-Seized Safe. The Department of Justice also seized a safe from the Tulving offices, with contents that were 'observed and photographed', yet oddly not appraised. How much are they worth?

- Accounts Receivable. Where did the accounts receivable come from, and why are the people balking at paying money for what appears to be metal they did receive?

- Expenses

- Professional Fees. Are they reasonable? So far, they appear to have been.

- High-Price Lease as Administrative Expense. The landlord is claiming $79,200 as an administrative expense of the bankruptcy for the Tulving property from the petition date until the lease was rejected by the court (claiming the estate had valuable use of it, due to the auction of propery, which yielded $23,505.15, less than 30% of the rent expense). Despite starting as Chapter 11, the business never operated after the petition was filed. However, even if excessive ($30K/mo for a $10K/mo market value), I imagine this expense is unavoidable.

- Claims

- Duplicate Claims. I see 5 duplicate claims (#32, #68, #105, #150, #350), where someone filled out 2 Proof of Claim forms for the same claim (in one case one claim had the amount billed, the other had the amount paid after factoring in the $15 wire transfer credit).

- High-Price Lease as a Claim. The largest creditor by far is the landlord, who is also claiming $921,056.84 for money owed on the leases before the bankruptcy, and damages. However, there are many issues and oddities here:

- The leases appear to be 2-3 times market value (e.g. the 6,600SF Tulving office and warehouse was renting for $30K+/mo, yet another office/warehouse space of 6,600SF in the same building is currently being offered for $10K/mo),

- The landlord and Hannes had a close business relationship (e.g. Hannes hired a relative of the landlord, bought/sold a house and mortgage with the landlord's family)

- The landlord appeared to allow Hannes to go months without paying rent without eviction,

- The apartment normally would not be rented by the business and therefore not part of the bankruptcy,

- The residential leases were 10-year leases, which is highly unusual,

- The leases were 10 year leases, yet claims are based on 10 years 2 months,

- Hannes seemed to pay everyone on time, except the landlord (who often would visit Tulving),

- The landlord knew of Tulving's financial difficulties for about 8 months before the bankruptcy,

- Hannes claimed the bankruptcy was caused by the inability to meet expenses -- yet the high-priced lease is the largest of Tulvings' known expenses (with the possible exception of massive interest payments).

- Hannes was paying $15K/month towards the Tulving office lease in the last few months, put paid the payment that would normally have been made mid-March on February 17, paying the landlord before the bankruptcy, giving him priority over other creditors,

- The landlord shows 2 $6,300 payments for the apartment in early 2014, yet the Trustee's records show 2 $5,000 payments - why the discrepancy? Was this an error, some off-the-books deal, or something else?

- The first of the 2 $5,000 payments for the apartment was actually 2 separate $2,500 checks on the same day -- presumably they were intended to be allocated as $2,500 each for the two apartment leases, but was actually applied as $5,000 towards the higher-priced lease.

- $659,125

CashiersCheck. There was a $659,125cashierscheck that Tulving deposited, which the sender tried to reverse (but did not). Who sent Tulving such a large check, why, and why did they not file a Proof of Claim? If claimed, that would have been the largest claim after the landlord.

A-Mark's Claim Comes In

September 29, 2014 9:20PM ESTA-Mark's CFC division filed a claim today for $175,600.

This claim is secured by coins that CFC should have in their possession, which R. Todd Neilson (Chapter 7 Trustee) referenced once in passing. The coins had a documented value of $375K (very close to the $350K I had estimated), but the value per the claim is now $193,114. So the sale of the coins will likely result in about as much money as is owed (in other words, having almost no effect on what customers receive from the bankruptcy).

As I had previously reported, the loan was originally made in 2008. It started with a 12% interest rate, which was quickly lowered to 8.5%. It has been renewed every 6 months since then, with the latest renewal in September, 2013. Although Hannes agreed to pay down the loan by $50,000 per month starting in January, 2009, there is no evidence suggesting that he did so (and I am sure that Hannes would not have kept renewing the loan if he had paid it off). It was treated as an interest-only loan, so the $175,600 principal value stayed the same throughout the course of the loan.

Claims Pass $15M

September 29, 2014 5:20PM ESTAs of this writing, there are 329 claims (as I have recorded them, which may different from what the court or bankruptcy trustee show) for a total of $15.1M ($14.2M of which is claims from customers). The deadline is tomorrow, but the court may take a couple of days to finish recording them.

The Last Minute Greedy Claims

September 26, 2014 8:30PM ESTOver the months, there have been some odd claims, mostly because people didn't understand the form. But overall, most seemed appropriate.

However, today there were 2 inflated claims filed. The first was from an individual who is basing the value of the metal he did not receive on the spot price a week after he ordered ($24.56 versus $23.43 the day he ordered), and at a $3.60/oz premium over spot (compared to the $1.34 Tulving charged over spot a month before he bought). The $3.60 over spot is for a vintage Johnson Matthey round, rather than new Johnson Matthey silver bars he bought. The $3.60 price over spot is for 1-19 bars, whereas there is a discount for 500+. He then wants nearly double that, due to 'California Unfair Comptetiton Law', then again for actual damages, and again for punitive damages, taking a $86,695 loss and asking for $407,197.13 (4.7 times his actual loss).

The second inflated claim was someone who paid $42,670.50. First, the attorney incorrectly claimed the creditor had paid $42,685.50 (he overlooked that she received a $15 discount for paying by bank wire). Then, he claimed $129,305 due to damages, fees and costs. Finally, the amount claimed is $1.50 short of what the numbers add up to. Egads.

The problem with these claims is that if they apply to one creditor, they should apply to all (or all in the same state, if state laws are involved). If their inflated claims are accepted, they take money away from other creditors. However, just because someone makes a claim does not mean it will necessarily be approved (and some certainly will not, such as a couple of people that filed twice, likely be mistake).

Landlord Files 11th Hour $1M Claim

September 26, 2014 3:30PM ESTYesterday, the owner of the Tulving offices and the two Tulving residences requested immediate payment of $79,200, as well as $921,056.84 as a creditor for the broken leases. The landlord is best known for buying 21 Lamborghinis worth $6M for $3M from a friend, and even once sold a scaled-down Lamborghini to child actor Gary Coleman. He has close ties to Tulving, with a family who worked there who also borrowed $900K from Hannes to buy a house that a company of Hannes' bought from another family member of the landlord in 2009. The landlord would also apparently often visit with Hannes at the office.

The $79,200 payment is for lease payments for the Tulving offices from the day of the bankruptcy through May 20, 2014, which the court determined to be the date that the lease would be rejected. My understanding is that this is considered a normal bankruptcy expense, and will be paid as soon as the court approves it (before distributions to creditors).

The $921,056.84 as a creditor is for rent money that was owed before the bankruptcy, and damages. That works out to $195,645.16, $32,935.48 and $31,154.85 unpaid rent for the Tulving offices, Home Office, and Residential Lease respectively ($259,735.49), and $454,380, $95,307, and $111,634.35 respectively for damages (total $661,321.35). This would likely be paid from the same pool of money as Tulving's customers.

There are a number of concerns here, and differences between these claims and those of customers:

- Normally, the owner of a company receives a salary and pays his own rent; had that been the case here, there would be no claim for the 2 residential leases (about $270,000 of the claims).

- The residential leases were 10-year leases, which is highly unusual. Businesses often have 10-year leases, due to the expenses of moving and the advantage of keeping the same address. The average homeowner moves every 5-7 years, and the average apartment tenant less than that.

- The landlord knew that Tulving was having financial difficulties and likely insolvent; he may in fact have been the only one who knew Tulving could not pay all his bills, and he likely knew that employees had been laid off. Hannes stopped paying the landlord days after talking with his bankruptcy attorney.

- Records show that Tulving paid nearly everyone on time (except customers). Hannes' choice not to pay the landlord was likely due to his closeness to him, and with his permission.

- A landlord normally would evict a tenant that did not pay for months on end; yet that did not happen.

- The leases started January 1, 2011 and were 10-year leases, but the landlord is claiming rent owed in January 2021 and February 2021.

- The leases state they are NNN (where the company leasing pays maintenance, insurance, and taxes), yet the lease states that the landlord pays property insurance and taxes. It is unclear who actually paid those costs. NNN is common for businesses, rare for residential.

- The residential rent may or may not have been appropriate: a quick search shows several Newport Beach houses (on the beach) renting in the $4,000 range (versus over $10,000/mo for the combined apartment and home office). 3-bedroom apartments in the area range from about $2,400 to $4,500/month. Data for 7 apartments on the next block show all of them with a rent value of less than what Tulving was paying.

- The office rent may not have been appropriate: Loopnet shows an average rent of about $19.50/SF/year for office space in 2011 when the lease was signed ($10/SF/year for industrial rent). Tulving was charged about $54/SF/year with a ~3%/year annual increase (despite average rent in the area having gone down 30% over the previous 3 years). The total rent expected over the 10-year term exceeded the assessed value of the property (Hannes could have bought the property in 2011 for the assessed value, and paid less than renting, and owned the building at the end of the term). In fact, it appears that another office/warehouse in the same building of a similar size is renting for $18.20/SF/year ($10,000/mo)!

So that $79K will get paid before customers, and the $921K owed alongside customers (all of whom are likely non-priority unsecured creditors). So are there differences between the landlord and customers? Of course. The landlord bought his investment knowing very well that there was a good chance any tenant(s) would fail to pay what was due. Customers, on the other hand, had no reason to suspect that their investment would be wiped out. The landlord's investment had at best a minimal loss of value as a result (just a diminished return), yet customers lost 100% of their investment. The landlord knew of Tulving's financial difficulties, customers did not. The landlord chose to increase his damages each month, whereas nearly all customers stopped making purchases once the first ones were not received (no customer would make purchases 6 months in a row without having received any of them). The landlord's net worth was likely nearly uneffected by the bankruptcy; some customers claim to have lost their life savings.

That's all I have to say about that.

Proof of Claim Forms Due Tuesday

September 24, 2014 8:35AM ESTAs a reminder, if Tulving owes you money (or metal), and you have not yet filed a Proof of Claim form, the deadline is Tuesday, September 30, 2014 (less than a week away).

If you could use some guidance, I have a page to help with the Proof of Claim form, or you can (I am limited as to the assistance I can provide with the form, as I cannot give out legal advice, but will do what I can to help out).

If the court does not have your Proof of Claim form by Tuesday, it should not be accepted, in which case you will not be able to receive your share of any distributions that are made. At this point, you may need to send the form via Priority Mail or overnight to get it there on time (the court does not accept claims over the Internet).

Also, I am aware of one case where the court did not record a Proof of Claim form (apparently, because the form was not filled in correctly, and they could not determine which bankruptcy it belonged to). I urge you to check the official bankruptcy site to verify that the R. Todd Neilson, the Chapter 7 Trustee, has received your claim (click the link in the second-to-last paragraph).

Hannes Sold a $900K Promissory Note Last Month

September 15, 2014 8:55AM ESTAfter hearing a rumor that Hannes Tulving, Jr. may have been buying real estate with gold, I felt obligated to do some digging.

Although I found no evidence of Hannes buying any real estate since the troubles at Tulving began, the State of California shows that he started a real estate holding company in 2006 (since suspended). Public records suggest that at the time he was associated with other real estate investors. I can only find one property that Hannes bought through the holding company, which he bought from the son of a Tulving creditor. He later sold the property to another relative of a Tulving creditor, with his company receiving a $900,000 promissory note (where the company would be paid monthly, like a bank with a mortgage).

If it was a traditional 30-year fixed-rate note, Hannes' company would be receiving about $5,000 a month from it, and it would have a balance owed of around $850,000 at this point.

I then discovered that last month Hannes sold the promissory note (for an undisclosed amount, but likely near or over $800,000). It is unknown if Hannes is the sole owner of the holding company, as he was with The Tulving Company, or whether this amount would be split with other investors (or even re-invested).

To be clear (given the rumor that led me to the information), I am not aware of any reason why this transaction should not have occurred, nor do I see anything suggesting bullion was used in the transaction at any point.

Trustee Report #3 Available

September 15, 2014 8:35PM ESTR. Todd Neilson, the Chapter 7 Trustee, has released Trustee Report #3 (you can also find it at www.tulvingbankruptcy.com, the official bankruptcy site).

It points out the the coins that the Department of Justice seized will be auctioned off by the Department of Justice, in the manner they see fit. The proceeds will hopefully go to the Tulving bankruptcy estate, but that is not certain.

It discusses the accounts receivable, but I still do not understand it. It sounds like the accounts receivable are for metal that was shipped that customers have not yet paid for (which makes sense, except that Hannes likely would not have shipped much metal without getting money first). It explains that in some cases, the payment was sent in the final days but not reflected in Tulving's records (which also makes sense). But it says that those owing the $600,000 or so of valid accounts receivable are claiming that they are unable to pay. This makes little sense; if they received the metal and never paid, how can they claim an inability to pay? Did they expect to get free gold at the expense of Tulving creditors? I think I am missing something here.

The report is about 5 pages long, so feel free to peruse it.

Customer List Ordered Sealed

September 13, 2014 7:15AM ESTAs I mentioned on September 11, R. Todd Neilson made a motion with the court to have the customer list sealed. The judge yesterday ordered the customer list to be sealed. This will be a major benefit, providing peace of mind to Tulving's customers that are choosing not to file a Proof of Claim form over concerns of privacy, as their information will not be part of the public record.

Hannes Tulving Negotiating in Criminal Investigation

September 12, 2014 2:40PM ESTAccording to court documents filed this week, Hannes Tulving, Jr. has engaged in negotiations with the United States Attorney for the District of North Carolina relating to potential criminal charges against him.

Customers Owed $18,671,529.98

September 11, 2014 12:35PM ESTYesterday, the Chapter 7 Trustee, R. Todd Neilson, filed the bankruptcy Schedules and Statement of Financial Affairs, that many have been anxiously awaiting since March.

Although there are some important questions that it does not help answer, there is still a lot of information:

- First, kudos to R. Todd Neilson, as the filings show that he has made a motion with the court to file the names of customers under seal, which means that they would not become part of the public record. Although Proof of Claim forms become part of the public record, this allows those choosing not to file a Proof of Claim to maintain their privacy.

- It suggests that roughly half of all Tulving creditors have filed Proof of Claim forms so far.

- It shows a total of $18,709,333.91 in liabilities, of which $18,671,529.98 is owed to customers. Note that these numbers could change, but I suspect the $18.6M to customers is from fairly accurate records (although a lot lower than I had anticipated). As of this morning, there were 246 claims filed adding up to $10,097,524.85.

- It again mentions Accounts Receivable ($593,434.00), but it is not clear what that could be.

- It shows misc. payments owed, such as to UPS, USPS, the phone/electric/gas companies, etc.

- It confirms that Hannes Tulving was 100% owner of The Tulving Company

- It shows that the bankruptcy attorney (Andrew Bisom) was paid March 3, 2014, the day employees were sent home. Before, we learned that Hannes first paid him in June, 2013 (when he should have filed bankruptcy).

- It shows that Hannes was drawing about $4K/month (not including his rent, and perhaps utilities, which were paid for by The Tulving Company)

- Surprisingly, there were a few checks were written several days after the business closed (such as a payment to UPS). It seems Hannes gave a very high priority to paying bills.

- It does not show payments to bullion dealers, presumably because they are not creditors (I.E. they get paid before they ship metal).

- There was a piece of information that could potentially provide a clue or lead as to Hannes' whereabouts.

- It does not provide any clues as to the $1M liability shown as being owed the landlord on the original petition.

- It does not state how many Tulving customers are owed money. Based on the average order size, which has proven to be very accurate, it would suggest roughly 425 customers in all (compared to the 'up to 1,000' I was estimating).

Mailing List

If you are looking to get important updates on The Tulving Company, you can sign up for the mailing list. This mailing list will only be used to provide important updates regarding The Tulving Company (on average about one a week). Although it is intended primarily for those who have placed orders with Tulving in the past year, anyone may join the list. If you want to contact me directly (all your information is kept confidential unless you state otherwise), feel free to .

Tips Wanted

June 23, 2014 5:10PM ESTDo you have any tips regarding Tulving that you want to be (reasonably) anonymous? I have added a tip form that you can use. Quite a few people have E-mailed me, but this extra level of anonymity may be helpful for some.

You can also E-mail me at about.ag [at] gmail.com if you wish a response, or do not mind me knowing who you are (I have never given out any of my sources, nor do I have any intent to).

Consumer Privacy Ombudsman

September 10, 2014 7:00AM ESTThe court reports that yesterday the U.S. Trustee and the Chapter 11 (sic) Trustee filed a stipulation requesting that the court direct the appointment of a Consumer Privacy Ombudsman.

You may recall that on August 7, 2014, R. Todd Neilson (the bankruptcy Trustee) filed a motion to sell the Tulving customer list, unaware at the time of Tulving's privacy policy. I reported on this, and a number of creditors became very concerned as they had believed Tulving had a privacy policy (and relied on it). Shortly afterward, the trustee ended up withdrawing the motion.

A Consumer Privacy Ombudsman is tasked with informing the court of the facts, circumstances, and conditions of a proposed sale that includes personally identifiable information. The ombudsman does not make any decisions, but instead helps the court understand the advantages and disadvantages of a sale. The Ombudsman would be appointed by the U.S. Trustee, with fees capped at $15,000.

Did You Contact Your Bank?

September 9, 2014 4:10PM ESTThere is a Tulving creditor that is looking for other creditors who contacted their bank, who then contacted Tulving's bank (or creditors who contacted Tulving's bank directly), to see how aware Tulving's bank may have been regarding what was happening.

If you did either, please , and I can pass your information on.

Have You Opened Sealed Monster Boxes?

October 13, 2014 3:00PM EST16 Oct 2014 Update: After about 3 days, I have had no similar reports (and a number of reports of people who did open their monster boxes, which contained silver). I am going to treat this was an isolated incident.

I received a report today from someone who said that he received a sealed monster box of U.S. Eagles from The Tulving Company that he opened, and it contained lead, with no silver.

Before I start a panic here, this is the only report I have received (and 6 months after the bankruptcy). I have not heard of this happening before with any company. It is possible that my source could be incorrect (note to my source who has a monster box of lead: please take no offense at that!). It is also possible that a customer tampered with and sold a few boxes, or someone did this with a few boxes between the U.S. Mint and Tulving.

In any case, if this is or was happening, this is extremely important to know more about. Many people buy sealed monster boxes without opening them (as there is often a higher premium if they are unopened), which would allow such tampering to go unnoticed for a long time.

If you have received sealed monster boxes from Tulving within the past few years and you opened them, and they contained anything but silver, could you please let me know ? Or if you purchased sealed monster boxes from another source that did not contain silver, that would be very useful information as well. Also useful would be approximately when the monster box(es) were ordered.

You can send me information via , or semi-anonymously using the tip form.

If I receive any other reports of lead-filled sealed monster boxes, I will report here.

What's Coming Up

September 5, 2014 7:15AM ESTIt has been very quiet lately, with minimal news since Hannes Tulving was seen in public.

However, that will change soon.

First, the important schedules that are normally turned in the day the bankruptcy is filed (or up to a couple weeks later) need to be filed be R. Todd Neilson (the bankruptcy trustee) by Wednesday (after several very long extensions). He is in the middle of a number of bankruptcies, several of which likely take priority over Tulving's. At the least, the schedules should produce a (possibly partial) creditor list. It may also provide some clues as to what went on.

Next, the bar date for the Proof of Claim form is September 30, 2014, less than 4 weeks away. We already know that there is one potentially large claim by a company Tulving owed money to, which is at least partially secured. And there could be a giant influx of Proof of Claim forms after the creditor list is released, depending on how well I got the word out about the bankruptcy. By the time the bar date is reached, we will have a much better idea of the total claims.

Tulving's Problems Spread to Other Dealers